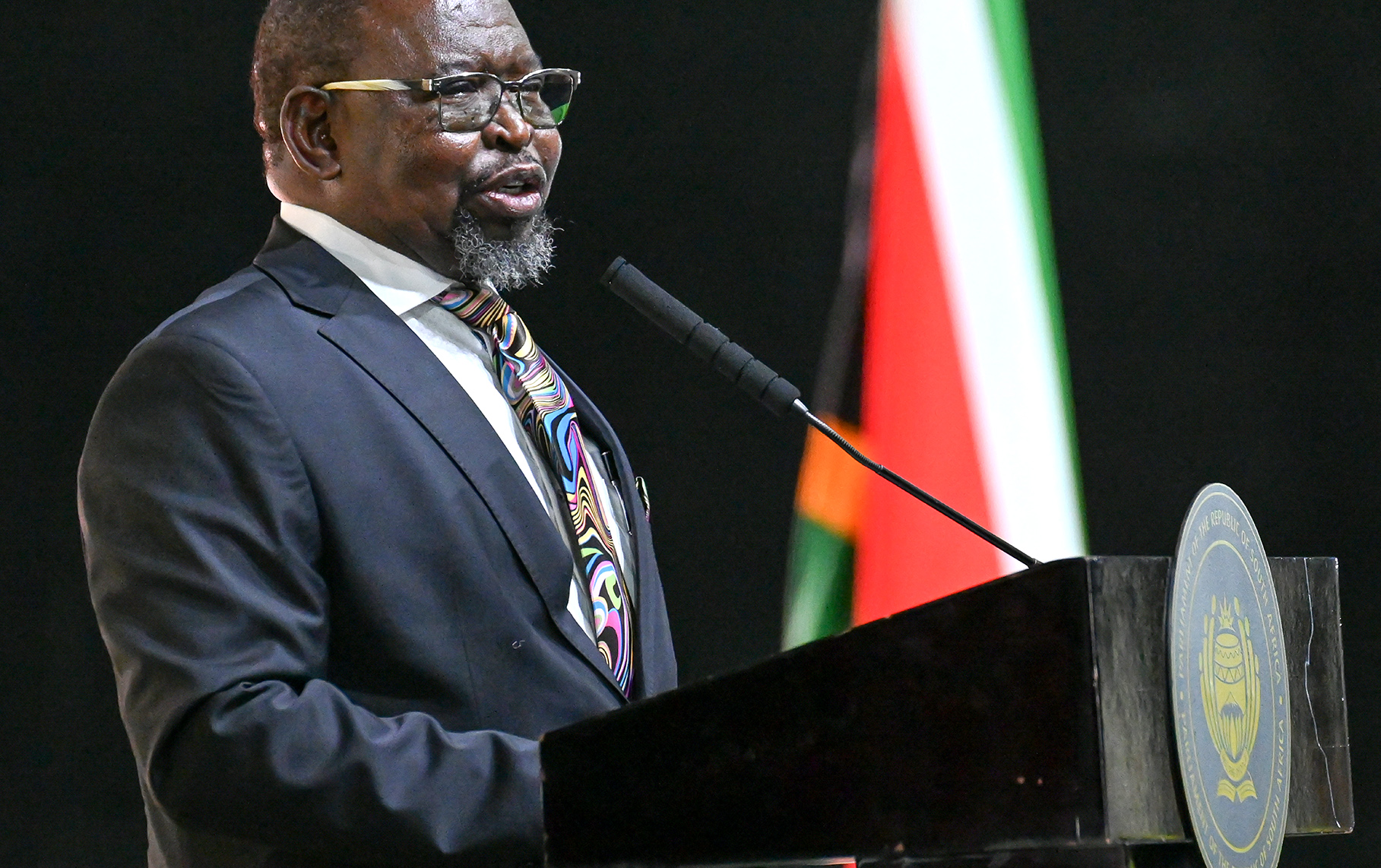

Over the medium term — meaning the next three years — there is a R75-billion question that Finance Minister Enoch Godongwana will need to answer on Wednesday, 21 May 2025, when he makes an unprecedented third attempt at tabling the Budget.

With the proposed VAT hikes now off the table, there is a R75-billion shortfall forecast over the next three years that needs to somehow be plugged, and the fragile South African economy has few faucets that can still be tapped.

That leaves just three options — tax hikes, spending cuts or increased borrowing.

Among economists, there is consensus that there is virtually no more scope for hikes to income or corporate tax, though the fuel tax levy could be played with to siphon some more liquidity for the Treasury.

What this means for you

If you are a taxpayer, no relief is in sight but there should be little additional pain — in the short run. In the longer run, a failure to keep the debt-to-GDP ratio from surging above current levels is needed if you want tax relief down the road. Faster levels of economic growth are also critical to reduce your future tax burden and to create jobs. At the end of the day, the Budget is about your hard-earned money and how the government spends it.

Beyond that, it comes down to belt tightening or the debt market.

“There will likely be spending cuts and increased borrowing,” Jee-A van der Linde, senior economist at Oxford Economics Africa, told Daily Maverick.

Van der Linde pointed out that ratings agencies such as S&P — which last week affirmed South Africa’s BB- credit rating with a positive outlook — forecast that the country’s gross debt to gross domestic product (GDP) ratio will reach 80% this year.

That is in sharp contrast to the Treasury’s latest projection of the debt to GDP ratio peaking at 76.2% for 2025/26.

“If you look at what the ratings agencies expect, like S&P, of an 80% debt to GDP ratio and yet they maintain a positive outlook, that tells me that the Treasury may increase borrowing. It’s already being priced in by the ratings agencies,” Van der Linde said.

Still, South Africa can no longer borrow and spend like a drunken sailor.

“The National Treasury will have a hard time finding sustainable revenue sources in the current economic environment,” Van der Linde said.

Spending

That brings into sharp focus the need for a blade to cut spending.

“We think that the Minister of Finance could announce a spending review in the October 2025 Medium Term Budget Policy Statement. We have pencilled in a net increase in spending of R30.0-billion compared to R61.6-billion in Budget 2.0 in FY25/26, consisting of a combination of infrastructure and ‘other’,” Tertia Jacobs, Investec Treasury economist, said in a pre-Budget note.

“In contrast, new spending on the frontline could be tied to a spending review or reprioritisation of existing expenditures.”

Jacobs also noted while “some fiscal slippage is expected... this may not translate into an increase in bond supply due to higher available cash balances”.

Jacobs flagged two developments since Budget 2.0 — an opening cash balance that is R20-billion higher, and an R80-billion surge in the value of the Reserve Bank’s Gold and Foreign Exchange Contingency Reserve Account because of red-hot gold prices.

Last year the Treasury announced it would draw down R150-billion from this source over the next three years, and it could conceivably be tapped again.

The R75-billion shortfall has also been questioned by some.

“To preemptively justify expenditure cuts, National Treasury has deliberately exaggerated the revenue implications of removing the originally proposed VAT increase. A reversal of VAT implies a R2.7-billion gap in the current fiscal year and a R60-billion gap over the medium term, instead of the R75-billion widely quoted,” the Institute for Economic Justice (IEJ) said.

To avoid an “austerity budget”, the institute suggests removing tax breaks linked to pensions and medical aid contributions for high-income earners, restoring the corporate income tax to 28% from 27%, and dipping back into the Reserve Bank’s Gold and Foreign Exchange Contingency Reserve Account.

Domestic and global macroeconomic outlooks have worsened

It’s also important to note that both the domestic and global macroeconomic outlooks have worsened since the withering of Budget 1.0 and Budget 2.0 on the political vines.

The Treasury’s rose-tinted forecast for economic growth of 1.9% this year is bound to be shaved. The International Monetary Fund (IMF) cut its 2025 forecast for South Africa on this front last month to 1.0% from 1.5%.

The IMF also pared down its global growth forecast for this year to 2.8% from 3.% largely because of the chaos and uncertainty triggered by US President Donald Trump’s ham-fisted tariffs and trade wars.

The bottom line is that South Africa is running out of fiscal room and that R75-billion question is the sword of Damocles hanging over Budget 3.0. DM