Two important articles in the news media have diametrically different approaches to fixing South Africa’s economy. They are important because they come from outside the ruling party and constitute, possibly, the start of a discussion about alternative approaches to our economic conundrum should voters decide against the ANC.

The first appeared in this publication and is a significant scoop by my colleague Ferial Haffajee on the plans of the newly formed Change Starts Now party, headed by the former banker Roger Jardine, who released his manifesto in full in Kliptown, Soweto, on Monday.

The essence of it is a huge, all-embracing Marshall Plan-style recovery, funded by an enormous R500-billion wealth and pensions tax. You could say it’s the maximal solution. The founding philosophy is rooted in a kind of Keynesian demand-push prescription which governments typically endorse after great social crises, like depressions and wars.

In Jardine’s view, the social need is so great and so immediate that SA requires an urgent injection of capital to satisfy immediate social exigencies. The country’s condition is desperate, the need is intense and we are standing, in short, on a burning bridge. Drama!

It’s hard not to notice that this is not wildly different from the prescription of the ANC. Generally, the idea is the same: gradually increase taxes and provide a growing array of social services. In the recent past particularly, the proportion of income that the ANC at local and national levels has been pulling out of the economy has expanded at a hefty clip.

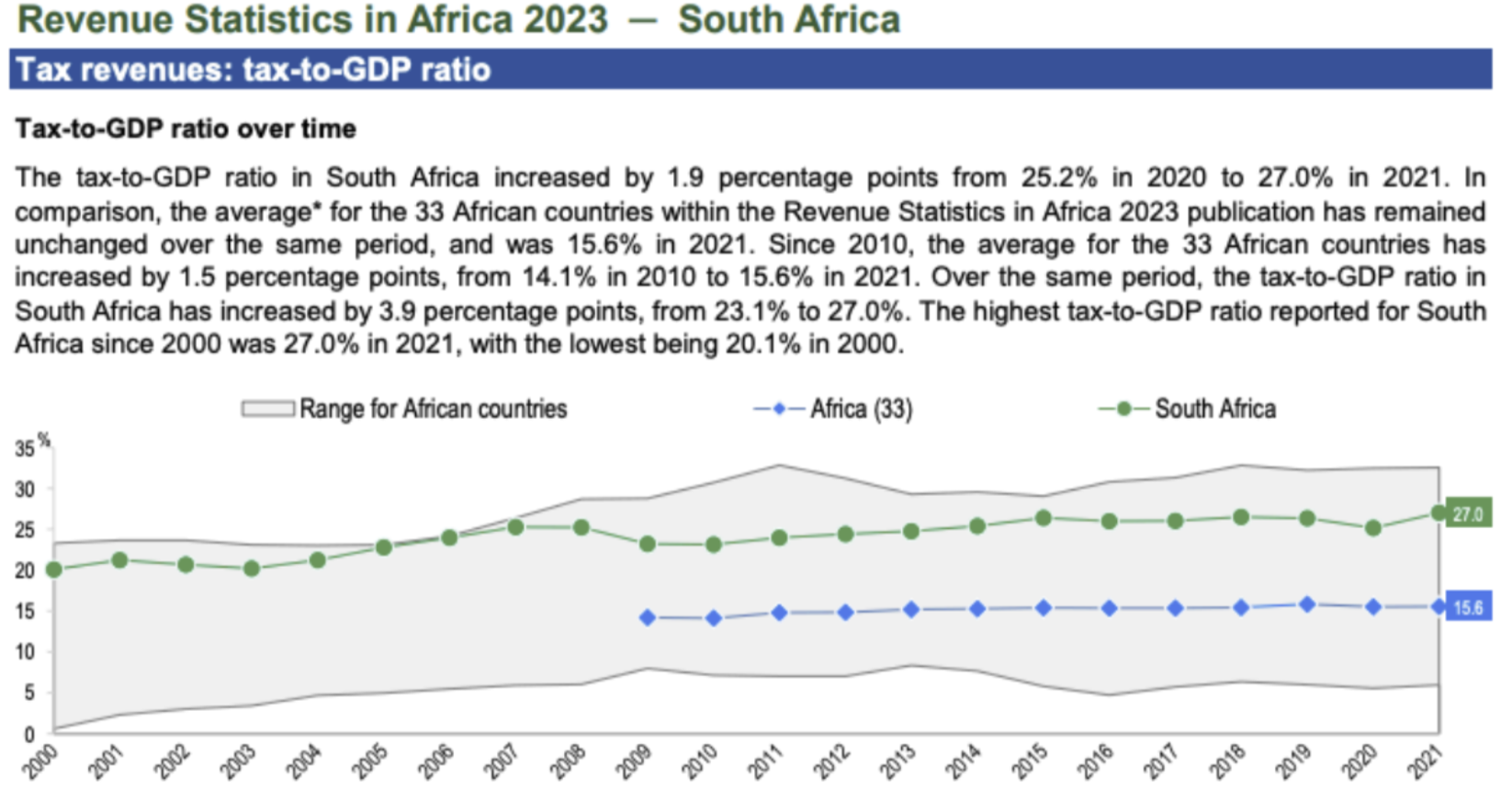

National tax as a proportion of GDP has bounced around a bit, but has been pretty steady at around 20% of GDP. However, if you throw in local government and social contributions, overall tax is now about 27% of GDP, up from 20% in 2000. And that’s before effective regulatory taxes like BEE and competition authority interventions, to name but just two. That tax rate is 70% higher than the continental average, and it’s pretty close to OECD levels.

In short, tax in SA is now extremely burdensome. The idea that the SA economy can sustain another huge hit is very controversial.

The second article is much, much more low-key. It comes from Stellenbosch University economist Johan Fourie and will be published on News24 shortly. It’s titled “Before we go BIG, let’s learn to build big — investing in infrastructure rather than paying grants is how we fix South Africa”.

Fourie points out something that I didn’t know. Nedbank recently released the Capital Expenditure Project Listing report for 2023, saying “general government” had announced R101.6-billion worth of (infrastructure) projects, 60% of which are by the City of Cape Town. That is amazing: 60% of South Africa’s public infrastructure investment is taking place in a city which consists of less than 10% of the population.

The problem, Fourie concludes, is that public services require more than just a budget allocation. “It requires capacity at the local level to design, execute and maintain infrastructure projects effectively. In short, it requires builders, not burglars.” Cute phraseology!

He goes on to examine the proscription of the think-tank the Institute for Economic Justice (IEJ), which has called for a basic income grant (BIG) for some time. The IEJ argues — correctly, says Fourie — that such a comprehensive grant system would reduce malnutrition and increase the opportunities for the poorest in the short run. It also argues that a BIG will stimulate spending, boosting job creation and growth, and should, therefore, be a policy priority.

Obviously, a BIG would require tax increases and there is an argument about where this tax should come from. The IEJ would like to see a wealth tax targeting the wealthiest 1%, a higher VAT on luxury goods and a graduated increase in personal tax. Jardine is arguing for a 4.2 percentage point increase in corporate income tax, a 4.5 percentage point increase in top-earner tax, and a 1% charge on retirement funds — all of this for three years.

What will the effect be of these increases, however they are made? A recent paper in the South African Journal of Economics looks into this issue. The paper, by Hylton Hollander, Roy Havemann and Daan Steenkamp, is titled “The Macroeconomics of Establishing a Basic Income Grant in South Africa”.

The conclusions are eye-popping.

Fourie says the model reveals that transitioning the Social Relief of Distress (SRD) grant into a permanent BIG would be the least costly option but would still slow economic growth, thereby increasing unemployment. A larger BIG, set at the food poverty line (as the IEJ proposes), would necessitate significant increases in public debt and taxes, crowding out consumption and investment, and ultimately resulting in severe job losses. The most extensive BIG scenario considered would lead to a substantial rise in debt, significant tax hikes and nearly a million job losses over five years.

In short, the Journal authors conclude that while a BIG would temporarily reduce poverty, it has enormous trade-offs in the current fiscal climate. The only way to afford a BIG, they argue, is to have structural economic reforms that promote growth through “increased government infrastructure investment”.

“If we want a BIG, perhaps we should first build big,” Fourie writes.

As we know, governing is about balances: short-term vs long-term; tax vs growth; education vs health, and so many others. Honestly, when I hear about these proposals to tax South Africans even more, my heart just sinks. Where have people been over the past two decades? How has that policy worked? Not very well, I’d venture.

The need is there, obviously. But while it is all very well proposing huge tax increases, please demonstrate, before you take even more money out of the economy, that you can administer that tax effectively. That’s trite, I know, but no less true because of it. Anyway, the point is that the debate about the economics of a post-ANC government has begun. The starting parameters are extremely wide, and that’s not necessarily a bad thing. DM

Business Maverick

After the Bell: Before BIG, South Africa needs to show it can build big