From time to time, I’ve found myself in a position in which someone has nudged me and said, “Gosh, you have big shoes to fill.” I’m sure this has happened to you at several points during your life, whether it was taking over as a CEO, head prefect or simply having to take over your street WhatsApp group after someone had been managing dustbins for a long time.

As a reader of this newsletter, you already know I’m going through one of those phases right now. Former Business Maverick editor Tim Cohen is someone I’ve known for many, many years, and always looked up to.

To try to take his place in your afternoon is no easy task.

But it reminded me of how often it happens that someone finds themselves with very big shoes to fill. Just a few short months ago, I had to take over from Bruce Whitfield who, like Tim, had created something immense from nothing.

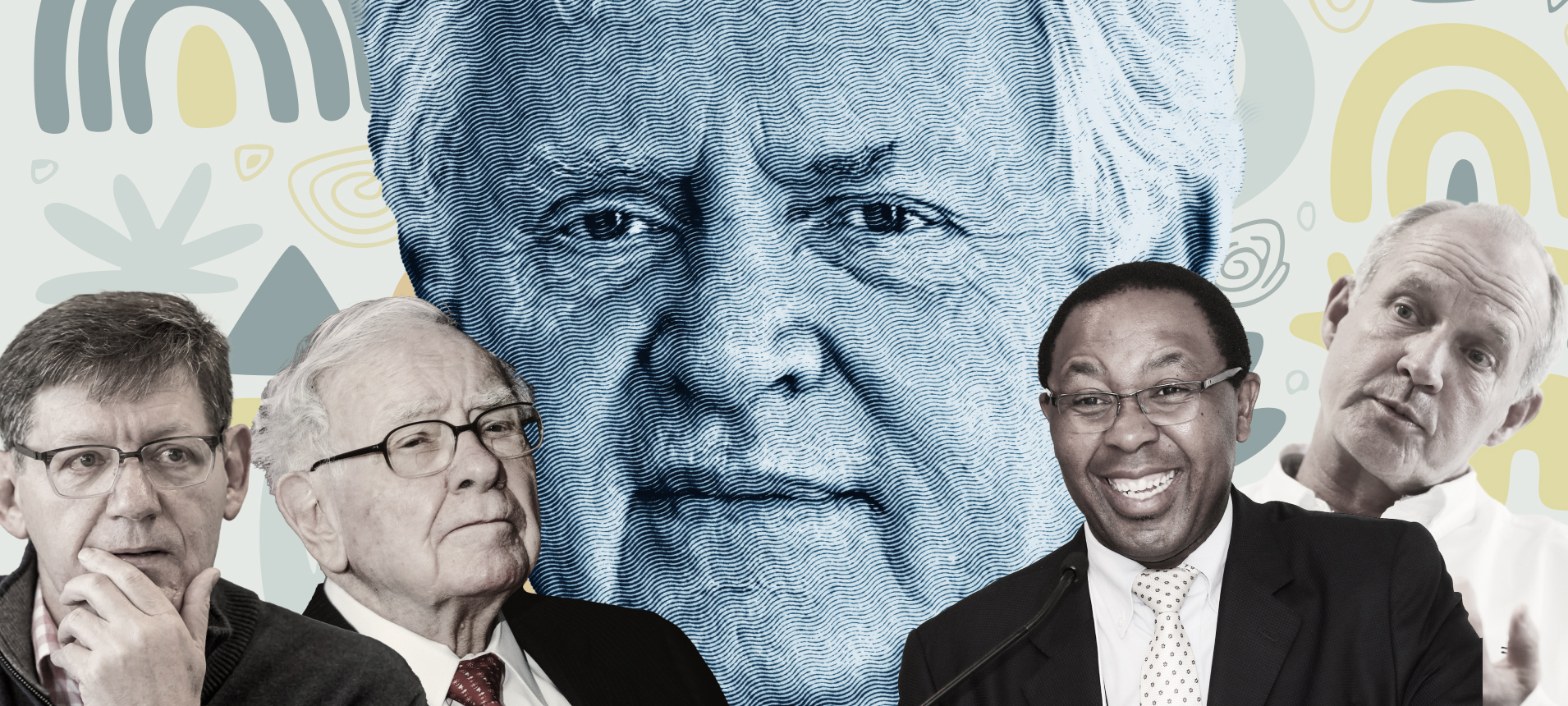

But at least I’m not taking over from Warren Buffett, someone who has probably made more money for more people through investments than anyone else in history. And yet this is the position in which Greg Abel now finds himself.

Secret

Usually, you know that something like this is coming; it appears Abel didn’t. While he had been preparing to take over for four years, the actual announcement was kept secret.

But in keeping that secret, Buffett did show he has a human side. The two people he did tell in advance were his children (both of whom are directors at Berkshire Hathaway).

Imagine being Abel; the person you are taking over from announces his retirement, and shares fall by about 5%. It’s the best possible indication of how much work you have ahead of you. And of how difficult it might be to prove that you are your own person, that you have the ability to run the business as well as Buffett did.

I think the first thing is: don’t panic; don’t try too hard; just do the job. No one can be another Buffett, but no rational investor would expect him to be. Always respect the person who came before you, respect what they’ve created but make sure you have space to do your own thing.

And because Abel has been a part of it for a long time, he won’t find it that hard.

The same applies to a person taking over a very important job in our banking sector in July.

In the history of banking in South Africa, it is probably true that no institution has grown as big as quickly as Capitec. For the past 25 years of that growth, pretty much since it was founded, Gerrie Fourie has been playing a huge role.

But he decided to retire early (God knows, he earned it) and Graham Lee will take over.

In many ways he has an easy (ish!) job.

Momentum

Capitec has built up so much momentum that it is really about fine-tuning things and managing the future very carefully. Perhaps the biggest part of the job is to spot problems as early as possible and to deal with them effectively.

This means that while Lee lives under the shadow of Fourie, he also has space to manage things.

The incoming CEO at Absa, Kenny Fihla, may well be wishing he had such a shadow to live under.

He is superbly experienced and qualified. Absa was lucky to be able to draw him away from Standard Bank.

But look at the job he now faces. Absa’s share price has lagged behind the other banks for years and it has been embroiled in what looks like (from the outside at least) so many difficulties over transformation.

On Monday morning, News24 reported that it appeared the bank had asked law firm ENS to investigate the leaking of information that led to its former CEO Arrie Rautenbach leaving in haste.

One of the problems that Fihla may have is that all of these problems have been brewing for a long time. And as a newcomer, it may take a while for him to know who is with who and how to unscramble it.

And it might also be a long time before anyone can see progress. That means he has to live with the perception of these problems for quite some time.

Outsider

While having an insider taking over is a good thing for Capitec and Berkshire Hathaway, it’s probably best that an outsider is taking over in Absa’s case.

Because he’s not tarnished with anything that went before, he might find it easier to create trust and thus legitimacy.

This might give him a much better shot at fixing Absa’s problems than any possible insider could have.

So, as you move from your afternoon into your evening, it might be worth asking what kind of situation you are leaving for the person who might one day take over from you. Are you fixing the problems at your company? Is everyone on your street bringing out their bins on time?

That might tell you something about how your productive life is really going. DM

Stephen Grootes is an associate editor at Daily Maverick and hosts The Money Show on 702 and CapeTalk.

(And we are beyond thrilled to have him on After the Bell – Business Maverick editor Neesa Moodley)