There is an anonymous saying that “The difference between knowing how something is done and doing it is the difference between imagining and living”.

Other versions of this idea include Benjamin Franklin’s “Tell me and I forget, teach me and I may remember, involve me and I learn” and Aristotle’s “What we learn to do, we learn by doing”.

With this in mind, I decided to buy some $Melania. I hasten to add it was only as an experiment, of course. I don’t want to actually own any crypto linked to anyone in the new administration in the US. I just wondered how difficult it would be for someone from way-off South Africa, who doesn’t know how to buy a meme coin, to actually do it.

I was intrigued by the fact that US President Donald Trump launched his meme coin $Trump at the Crypto Inauguration Ball, which took place on the Friday before the inauguration. Trump didn’t attend in person, but announced on Truth Social during the ball that “My New Official Trump Meme is HERE” with a link to the coin. All of the blockchain bigwigs must have got a fat surprise while they were snacking on their lobster rolls and burgers.

But the word got out pretty quickly and, by Sunday, the market cap of $Trump was $5.5-billion. (This is a bit misleading - more on that later.) By Sunday, it was worth, technically, more than $50-billion.

We recognise this now as a typical Trump move, not dissimilar from selling “Trump bibles” during the election campaign; it’s extreme, craven money-grubbing. But - and this is also sadly typical - by some weird twist of fate, it seemed to work beyond anyone’s wildest expectations. Axios’ managing editor for business, Ben Berkowitz, wrote that it spoke “to the nature of the crypto industry that someone could have more than $50bn worth of something that literally did not exist 48 hours previously”.

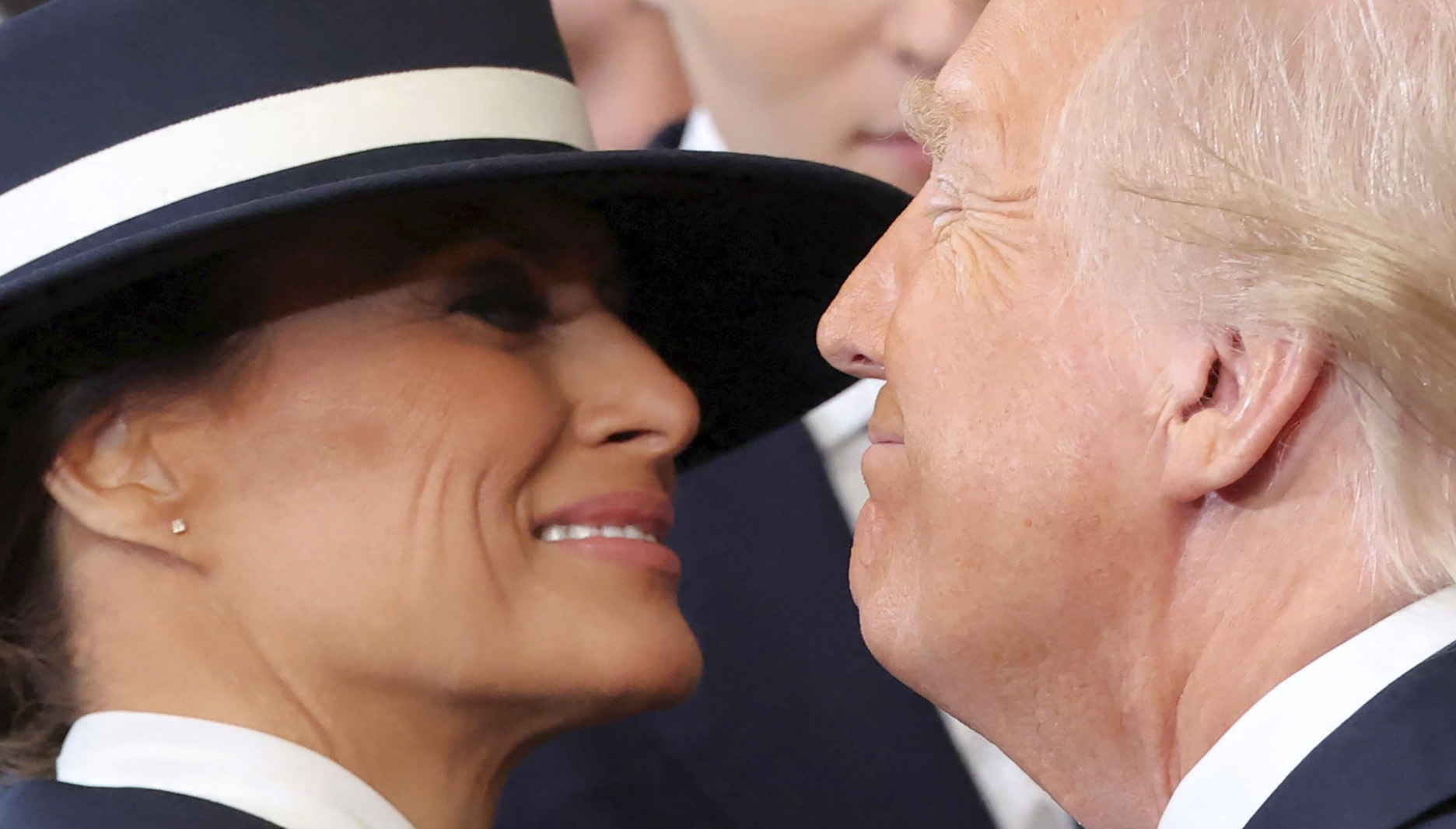

Anyway, not to be outdone, Trump’s wife Melania launched her meme coin during the week and this is when I decided to pounce. If you can’t beat ’em, join ’em, I philosophised. So, I dipped into my not-very-impressive savings and bravely decided to put R500 on the line.

How difficult could it be? Turns out, it took a whole 15 minutes to buy 11 Melanias. I won’t lie; there is a curious satisfaction in knowing that if the family of the President of the United States is going to go in for transparent market manipulation, I’ll be right there along with them.

But how do you actually do it? Well, the easiest way is to just ask ChatGPT the question: “How should a South African buy $Melania.” It’s a bit tricky. You have to load cash into your investment platform, which in my case is Luno. You then buy $Solana, the meme coin of the computing platform of the same name, which creates smart contracts. You then transfer the money into a crypto wallet that actually offers $Melania (Luno wouldn’t be caught dead offering such a dubious coin). Then you contract on an automated market maker which is built on the Solana blockchain, in my case Raydium.io, and swap your $Solana for any coin you want, in my case $Melania.

Somewhat embarrassingly, Raydium informed me that R500 was not going to cut it, so my 11 $Melanias cost me at the time a little less than R1,000. It sounds very complicated, but if you follow the directions, it’s less complicated than building a set of Ikea shelves.

So, when you are buying meme coins, there are a few things you need to remember:

Rule 1: Don’t. It sounds impressive that $Trump is “worth” $50-billion and that it was created in no time at all. It seems like magic.

But here is the key thing you need to know. The “market capitalisation” of meme coins is calculated by multiplying the current price by the total number of tokens that may ever exist. This number is stated in meme coin release documents and, in the case of $Melania (and $Trump), there are 1 billion tokens. Initially only 25% were released into circulation, but currently 90% of the tokens are sitting in a single wallet.

What that means is that one person (or institution - in this case Trump organisation affiliates CIC Digital) is in effect controlling the supply. And for holders, perhaps that’s a good thing, because it was launched at $7, and rose quickly to $12. But sadly for people who bought at, say, $4, it is now trading (at the time of writing) at $3.80.

We supporters of $Melania (the coin not the person) are not wild about supply expanding too quickly. Should supply increase, the current market cap would diminish rather quickly to, well, zero. There is a website, https://coinmarketcap.com/ which calculates the market capitalisation of memes and it puts $Melania at around $700-million. But as I say, this is conceptual.

A good example is $hawk, which was launched last year by Haliey Welch, known as the “Hawk Tuah Girl”. The token initially surged to a market capitalisation of just under $500-million, but plummeted by 95% within hours, leading to big investor losses. Court cases now allege this was a “pump and dump” scheme, because 90% of the tokens were held in a single wallet. Where have we seen that number before?

The other problem for holders of $Melania is that there is a structured vesting schedule: she can cash 35% of the coins in months two to 13 at the rate of about 2.6% of the total per month. What that means is that there is an overhang from April onwards. Not good.

The fact that America’s first “pro-crypto” president and his wife are, um, hawking tokens with no tangible utility while they prepare to overhaul the US regulatory regime has some in the crypto industry on edge. This is not a good look.

Attorney Walter Shaub told a CNN reporter, the meme coin manoeuvre suggests “the very idea of government ethics is now a smoldering crater”. CNN Business quotes Gabor Gurbacs, founder of digital asset firm Pointsville, saying “Trump needs to fire his crypto advisors, from top to bottom”.

Don’t think that’s likely. Do you? DM

Business Maverick

After the Bell: My meme coin adventures in buying $Melania