It’s so nice when the government agrees with you — not that one has any illusions about a direct correlation…

In December, I suggested the government should go ahead and grab some of the Gold and Foreign Exchange Contingency Reserve Account (GFECRA) cash.

To be clear, I wasn’t alone. Most left-wing economists were vociferously in favour of the idea. But then, you know, they are generally in favour of any measure which increases the government’s ability to spend. Their approach to budgeting is similar to my approach to bacon: more!

Interestingly, most of the centrist economists were generally non-committal and I think that gave the Treasury confidence that it could go ahead without too much heat from the markets.

The issue of GFECRA sounds technical, but actually it’s very simple. The SA Reserve Bank runs a large reserve in foreign currency markets because the bank doesn’t want to be caught short if there is a sudden demand for foreign currency. If that were to happen, the rand, which already bounces around like crazy, would be even more volatile. So it’s just a method of reducing volatility risk.

This volatility became very apparent during the 1998 emerging markets crisis when there was a large and very sudden movement against the rand. At the time, the Reserve Bank tried to support the rand, a poor decision, as it turned out. The problem was not so much the choice to defend the rand but to defend the rand with so little ammunition in the pouch. As they say, only an idiot takes a knife to a gunfight.

The result was that in 2003, the SA Reserve Bank went, cap in hand one presumes, to the then finance minister Trevor Manuel and asked him — or to put it another way, the taxpayer — to square the account. The then government swallowed its pride and did so, handing over R28-billion.

So, since then, the Reserve Bank has gradually built up the reserve in part, surely, because it didn’t want to do that again. As the rand has declined in value, this reserve has grown larger and stands today at around R500-billion. In 2012, it was only R65-billion. That’s an amazing achievement, or perhaps we could say an amazing fluke. If you were a currency dealer and you turned a R65-billion fund into a R500-billion fund in a decade, you would be nipping down to the Sandton Ferrari dealership quite often.

What the Treasury and the bank have decided to do is “settle a portion of the valuation gains, after ensuring that the necessary buffer and contingency reserve are fully funded”. Don’t you love the way this is phrased: a portion is going to be “settled”, because it was so “unsettled” before; in a sense, you could say it was positively unruly, anarchic even, rebellious and mutinous! But thankfully, it’s all now “settled”.

And what “settlement” means, in my language at least, is that the Reserve Bank will fork out great gobs of dosh and put them in the pocket of the Treasury, or to put it another way, the taxpayer: R100-billion this next year, and two tranches of R25-billion after that.

The Budget Review gives us a little more detail on the state of the GFECRA, pointing out that the bank had to use the buffer during Covid, of course, which shrank the fund by around R100-billion. So if even Covid could not make more of a dent in the GFECRA, the rand is presumably pretty safe for the time being.

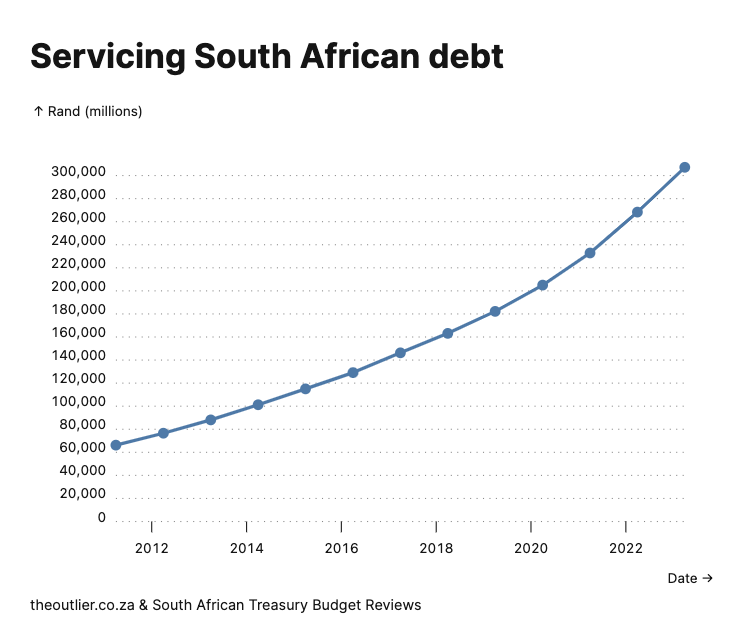

So, what will the government do with the cash? It’s simple: just reduce debt. The government’s debt requirements are now so huge that the reduction doesn’t make as big a difference as you might think. But it does mean that debt will peak at 73% of GDP, not 77%, in 2025/26, according to current calculations — if you believe the projections (I don’t).

The cost in millions of rands to service South Africa's debt which was incurred because of a shortfall in the government's revenue and its planned spending. (Treasury Budget Reviews via Outlier Insights)

The cost in millions of rands to service South Africa's debt which was incurred because of a shortfall in the government's revenue and its planned spending. (Treasury Budget Reviews via Outlier Insights)

Presumably, the Reserve Bank likes that idea because any reduction in government debt makes it less likely that it might have to use the contingency reserve. So there was a sensible meeting of minds here. In this sense, I wrongly encouraged the government to use the GFECRA for infrastructure spending.

This captures my feelings about this budget and so many others: there is a lot of fancy footwork going on to keep the numbers balanced and everything under control. But it is transparently keeping the lid on a boiling pot. And it doesn’t disguise the fundamental problem: South Africa needs to find some economic growth. It needs to find a lot of economic growth.

There was too little thinking about that topic in this budget and many others before it. What is missing here is a real growth strategy. Obvs. DM

The cost in millions of rands to service South Africa's debt which was incurred because of a shortfall in the government's revenue and its planned spending. (Treasury Budget Reviews via Outlier Insights)

The cost in millions of rands to service South Africa's debt which was incurred because of a shortfall in the government's revenue and its planned spending. (Treasury Budget Reviews via Outlier Insights)