Why is Berkshire Hathaway selling down its holdings and is it right to do so? What a gazillion-dollar question. Or questions more like it, embracing as it does everything from equity valuation theory to geopolitics.

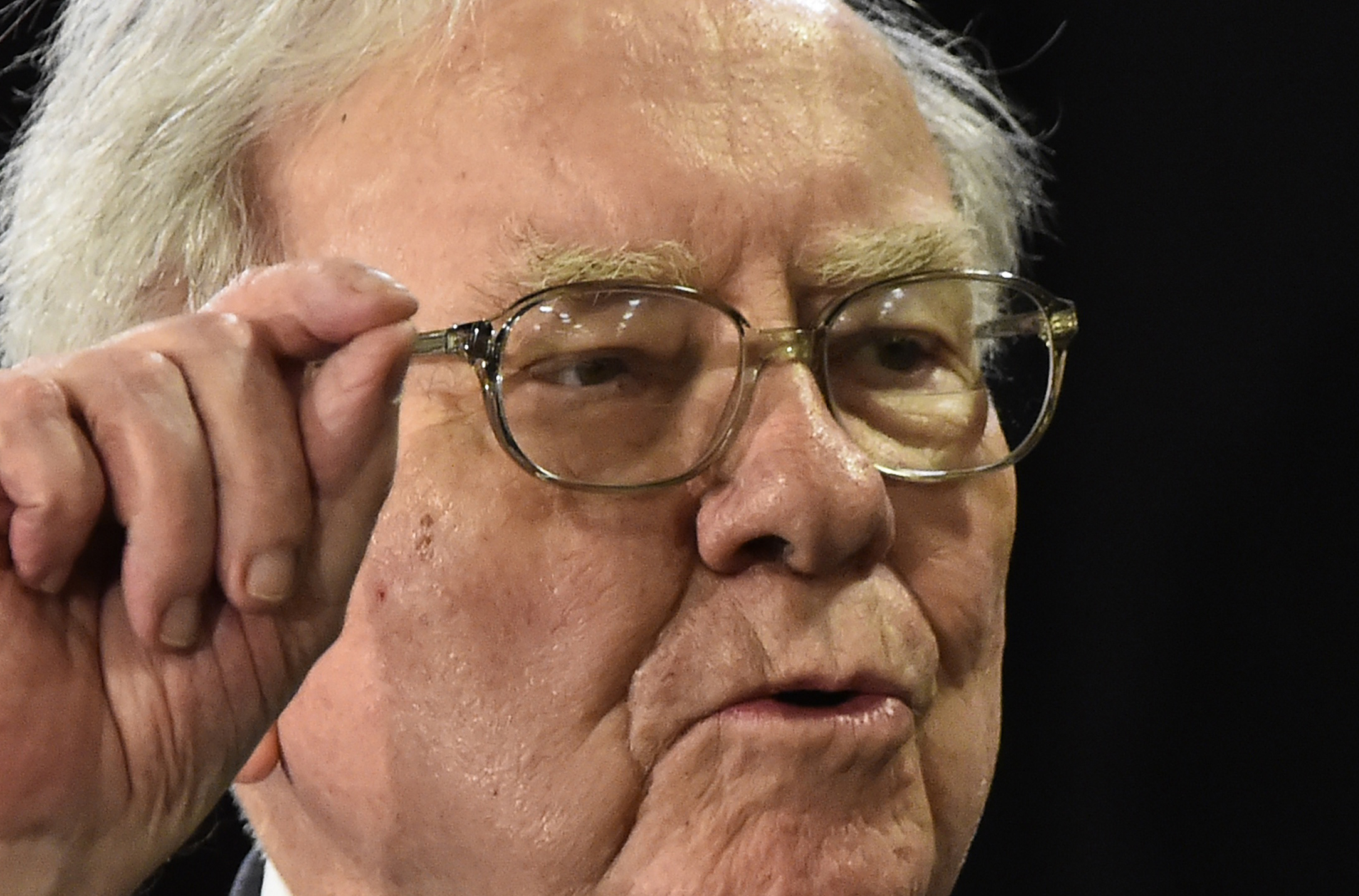

The obvious answer is that Berkshire’s investment guru Warren Buffett is, as he always has been, cautious in periods of high market exuberance and this conservative approach has always served him well, fairly obviously. But it’s a bit more complicated than that.

Let’s just get the dimensions in perspective here because they are eye-popping. At the end of 2022, Berkshire cash holdings were $128.58-billion. In 2023, that increased to $167.64-billion and, as of September 30 last year, they surged to a record $325.21-billion. That’s about a third of the company’s market value, which is a lot of money to leave on the sidelines.

And, by the way, the rest of the market is doing the opposite. The Bank of America’s monthly survey of US fund managers, which has just been released, reported that cash holdings as a percentage of portfolios fell to 3.5% in February, which it said was the lowest reading since 2010.

Buffett’s big sales over the past year were just ginormous. The biggest were selling two-thirds of its Apple shares, reducing its share in Bank of America from 13% to 8.9%, and selling down its Citigroup shares by nearly 75%. The big purchases were Constellation Brand, Domino’s Pizza and Occidental Petroleum - in other words, food, drink and petrol - the very, very defensive stocks.

Yet, according to the public record, high market valuations were not the only reasons. Selling down Apple was an attempt to reduce concentration because, at the end of 2023, Apple constituted about half of Berkshire’s equity holdings by value. Buffett himself has also pointed to company tax considerations.

Yet, overall, you have to say, Buffett is seeing dangers in this market, and when someone that experienced and successful does, you have to sit up and take notice. Personally, he won’t be worried in the least that his direction is heading in the opposite direction to everyone else’s; he would, I suspect, relish it. He is famous for saying: “Be fearful when others are greedy and greedy when others are fearful.”

And yet this time - and I say this with enormous trepidation - I can’t help wondering if he is wrong.

But first, let’s understand the root of his concern. Buffett is known for, among many other things, his measure of something called the Buffett Indicator. In his substack, The Informationist, hedge fund manager James Lavish writes with vigour: The Buffett Indicator is Flashing BRIGHT RED. What is it, by the way, about shouty capital letters; why can’t people just use bold, like After the Bell does so elegantly?

Anyway, the Buffett Indicator, says Lavish, is one of the simplest and most straightforward metrics we have out there when looking at just how overvalued or undervalued stocks have become. Named by and after Warren Buffett himself, it is simply the ratio of total stock market capitalisation to GDP.

So how is that looking? Well, pretty red-flagish. This is Lavish’s graph from Longtermtrends.net.

The point is that there was an important feedback loop involved in the decline in 2000. It was rooted in rising stock prices, which fed a flood of new IPOs, encouraging more investment, increasingly leveraged, and the crash came when corporate earnings failed to justify the valuations.

In the 2008 financial crisis, the decline was the same, but the reasons were different; it was, says Lavish, a crisis of leverage and systemic risk, primarily in the housing market and banking system. There was excess liquidity and leverage, followed by financial innovation, and then a shock event.

But in terms of the Buffett Indicator, the pre-crash period of the 2008 financial crisis was absolutely in the shade compared with the current situation, when stock value was 100% higher than GDP. Now it’s double that, roughly akin to the dotcom bubble.

What has driven the current rise was all that Covid-19 money-printing in 2020 and 2021. What’s interesting about the current situation is that the high level of the Buffett Indicator has now been holding its position for almost three years. Yes, the Buffett Indicator is flashing BRIGHT RED, but it has been flashing BRIGHT RED for ages now. What does that mean?

For people with the expectation of a dramatic increase, it means what we are lacking is a feedback loop (as in 2000), or a crisis of leverage (as in 2008). What the pessimists do have in their quiver is that the pure level of danger is extremely high.

What do the optimists have in their quiver? What they have is that there is no apparent precipitating event - or at least not yet. All the people who bought shares with the Covid-19 handouts are happily sitting on them, broadly without leverage so declines do not result in forced selling. Or, to put it another way, the historical mean is now set too low by modern standards.

What investors need to watch out for is that precipitating event and, I suspect, it will be when global GDP gets revised downwards, or the Trump trade war gets under way in earnest, or some geographic crisis happens. Or something.

Now more than ever, investors need to sleep with their pants on. DM

Business Maverick

The Buffett Indicator is flashing red, but is it broken?