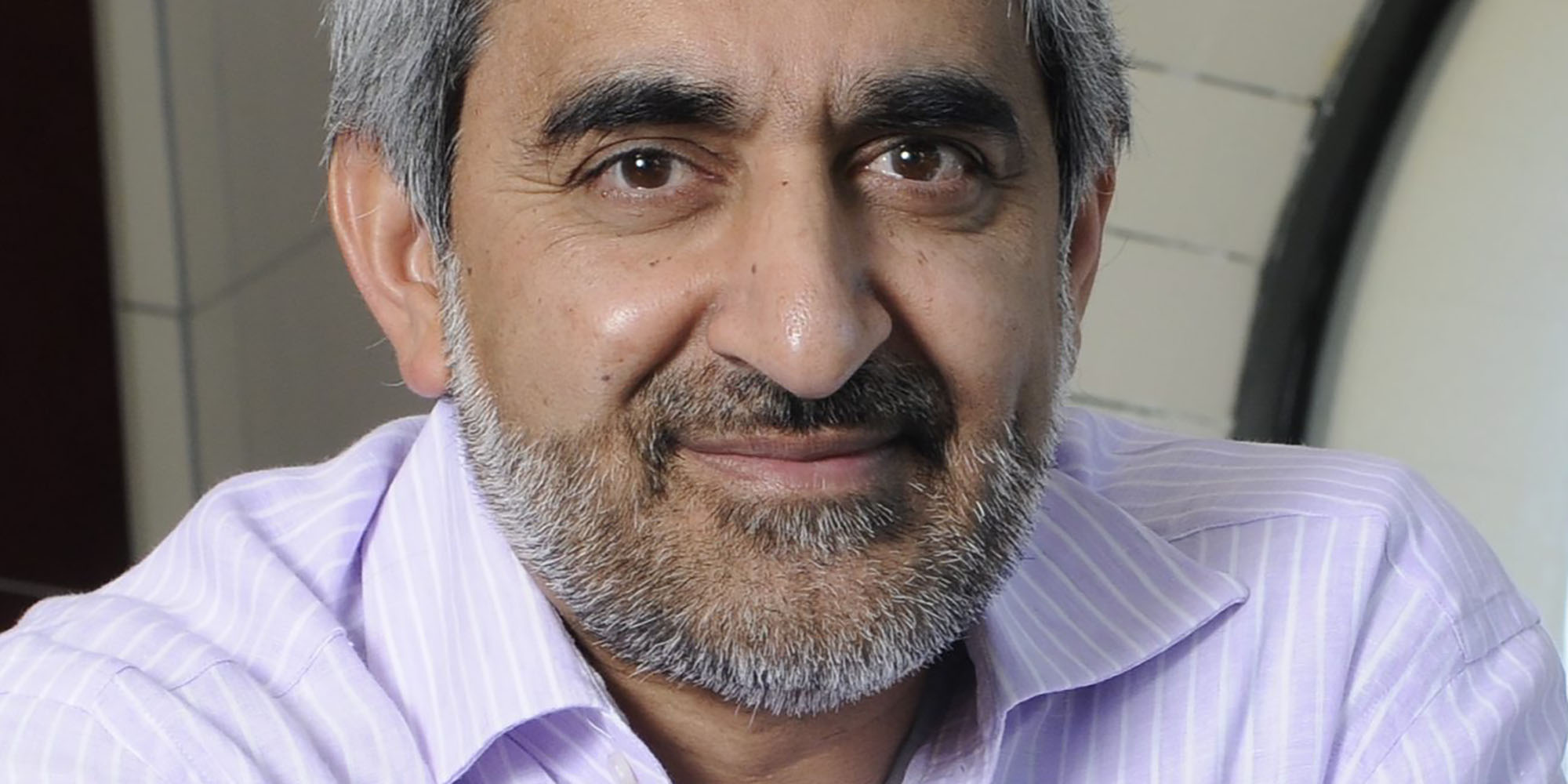

Brimstone Investments CEO Mustaq Brey says the company counts itself as fortunate to not only report a profit, but also that it was able to pay a dividend of 33c per share (up from 30c per share in 2021).

Brey said that 2022 was a “very, very tough year”.

He added: “And we are just very, very happy to report a profit of R324.5-million and the fact that we could pay a dividend of 33 cents. It’s been a difficult year. The country has some difficult economic times at the moment. The fact that our subsidiaries and our associates were also able to [turn a profit]... we are very happy.”

Not as happy as they must have been in 2021 when Brimstone reported profit of R920.9-million, declared a slightly lower dividend of 30 cents per share, and 292.3c earnings per share (as opposed to just 76.6c in 2022).

The group released its annual results on Tuesday for the year ended 31 December 2022.

The sharp decline in profit was attributed mainly to a decrease in operating profit of R185.5-million, a decrease in fair value gains of R239.6-million, an increase in finance costs of R87.3-million, and the prior year recognition of profit from discontinued operation of R157.7-million.

Group-wide, it increased total assets by 11% to R11.7-billion from R10.5-billion.

This reporting period also saw the announcement of the Fishing Rights Allocation Process (FRAP) allocations, which he said brings certainty to its major fishing assets, and allows them to catch more this financial year.

Brimstone subsidiary, the JSE-listed Sea Harvest Group, experienced a tough year to 31 December 2022. It lost 10% in volumes from FRAP and a reduction in the total allowable catch, although revenue was well up in all segments with firm demand in all its markets and strong pricing. This demand was offset by extraordinary cost inflation, supply chain disruptions – which include those caused by blackouts – and the steep rise in freight rates.

For the year, Sea Harvest’s revenue increased by 27% to R5.88-billion (up from R4.62-billion in 2021), with earnings before interest and tax decreasing to R500-million (from R670-million).

The fair value of Brimstone’s investment in Sea Harvest at year-end was R1.9-billion.

On 11 April 2023, Brimstone expected to receive a dividend of R60.6-million from Sea Harvest, which also owns the Sea Harvest brands in South Africa and Australia, Ladismith Cheese and Viking Aquaculture.

Brey said on fuel alone, Sea Harvest spent an additional R247-million on keeping its boats running in 2022.

In a company statement, Fred Robertson, executive chairman of Brimstone, explained: “Sea Harvest experienced unprecedented cost inflation and the further impact of load shedding as it translated into higher energy costs and supply chain disruptions.

“Sea Harvest completed the acquisition of MG Kailis on 23 May 2022, with this transformative transaction representing a significant step in the execution of the group’s investment strategy of acquisitive growth in the international seafood space that focuses on businesses of scale in high-value seafood species.

“MG Kailis complements and diversifies the group’s existing business operations in Australia from a wild-caught fishing, trading, engineering and sales perspective.”

Visit Daily Maverick’s home page for more news, analysis and investigations

Brimstone holds a 25.1% stake (or 32.7 million shares), worth R2.1-billion at year-end, in Oceana. It also recognised R195.4-million as its share of profits from Oceana based on the seafood producer’s reported earnings for the year to 30 September 2022.

Obsidian Health, a medical equipment manufacturer, has come under pressure. Brimstone owns 70% of Obsidian Health, whose profits were down significantly. It contributed R5.2-million to group profit during the year under review, down from R20.7-million in the previous year – boosted by PPE and Covid tests.

“That party came to an end last year when Covid regulations were lifted during the year.” But as one door closes, another opens, because elective surgery caseloads have piled up.

“Theatres are being utilised again and we are reselling what I term our ‘body parts’ [clinical supplies] back into hospitals.” These include capital equipment and medical devices, ICU and high care, orthopaedics as well as diagnostic testing.

Brimstone’s 18% stake in reinsurance broker Aon Re Africa contributed R13.9-million to profits and delivered a dividend of R12.7-million during the year.

The South African Enterprise Development, an investment vehicle providing equity growth capital to small- and medium-sized enterprises, contributed R1.9-million.

Education’s paying off handsomely for Brimstone: higher education and training provider Milpark Education contributed R14.6-million and paid a dividend of R15.1-million. The group has also invested a further R20.4-million in Milpark to complete the acquisition of CA Connect.

Milpark has done exceptionally well, driven by CA Connect – “an absolute winner of a business” – which offers training for recent BCom graduates.

Listed higher education group STADIO, which released a trading update on Monday, has reported positive growth in student numbers for the year, with 11% more first semester students (to 38,348) as at 30 June 2022 and 8% second semester students (41,296) as at 31 December 2022.

Brimstone owns a 5.1% stake in STADIO, which was revalued upwards by R50.5-million to R213.9-million at year-end, and received a maiden dividend of R2-million.

The Cape-based FPG Property Fund, a retail convenience specialist that owns 26 convenience shopping centres locally, with an expanding footprint in the United Kingdom, is thriving. Brimstone received a dividend of R3.3-million from the fund during the year under review.

The companies they invested in have done reasonably well in the circumstances, although he stressed that last year was punishing, especially on Sea Harvest.

The fuel cost was a killer last year: Sea Harvest had budgeted for a price of about $60 per barrel; the average price was closer to $100 a barrel.

“It’s come down to about $84 a barrel again. They will be able to stabilise and then the cost of the freight is also normalising again. Some of those signs are very positive. And they’ll be able to catch more again this year.” BM/DM

This article is more than a year old

Business Maverick

Brimstone says 2022 was horrific, but it’s managed to turn a profit and declare a dividend

Interest rates, higher fuel costs, supply chain disruptions, rolling blackouts and a steep rise in international freight costs have dented profits over the past year.