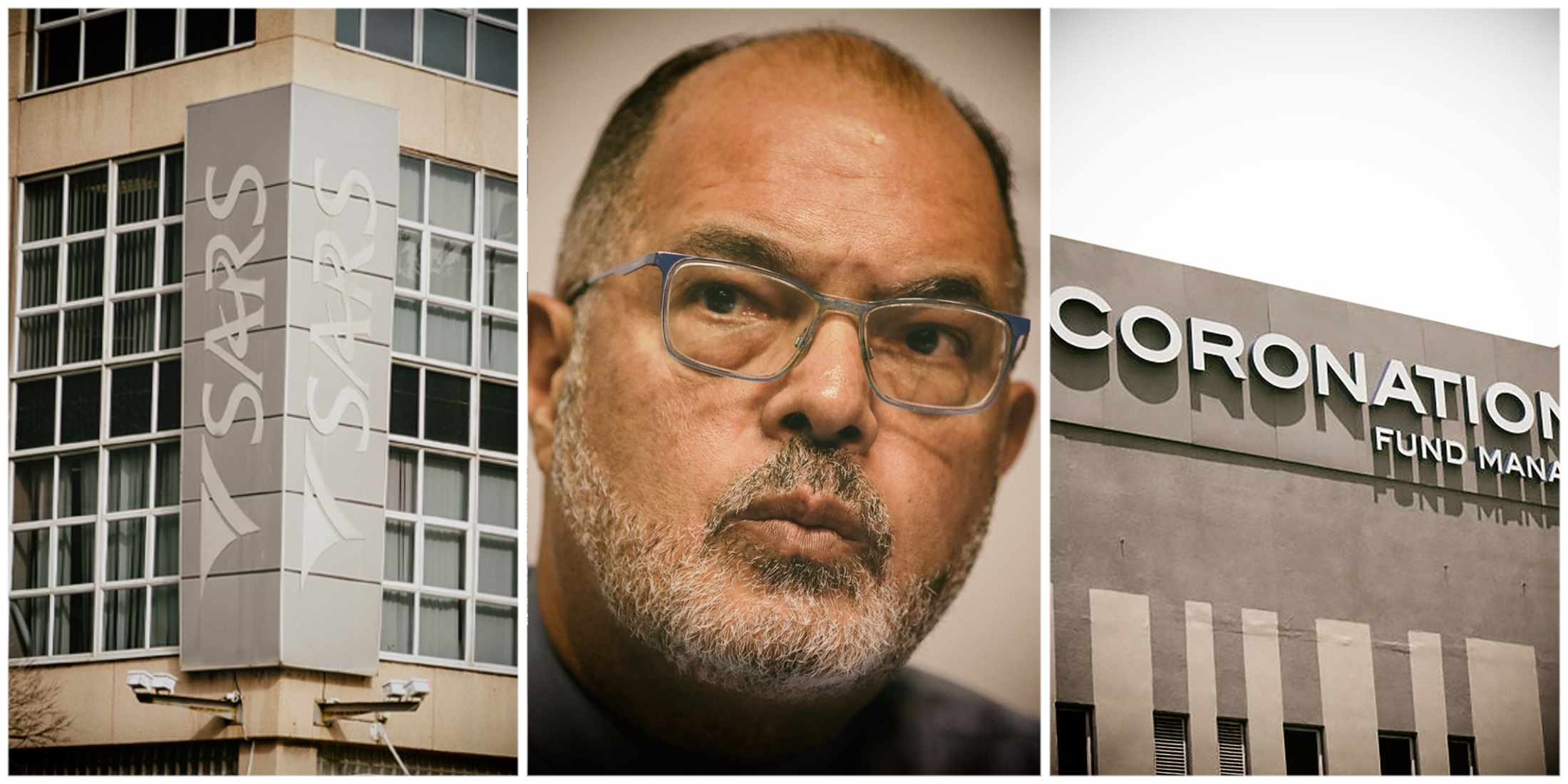

A messy tax litigation battle between asset manager Coronation Investment Managers South Africa (CIMSA) and the South African Revenue Service (SARS) has finally ended with a decisive judgment from the Constitutional Court that is unequivocally in favour of Coronation.

The market has reacted favourably, with Coronation’s share price gaining 10% in the week to Wednesday, 26 June and 15% for the year. Coronation is listed on the JSE, is based in South Africa and has several subsidiaries including Coronation Global Fund Managers (CGFM) in Ireland and Coronation International (CIL) in the UK. CGFM was established as a fund management company and delegates investment management trading activities to Coronation Asset Management and CIL.

SARS first raised the issue in 2017, when it said CGFM’s net income should have been declared as part of Coronation’s taxable income in South Africa, and slapped the asset manager with an understatement penalty.

“If it were found that the primary operations were conducted in Ireland, then (a tax) exemption would apply. CGFM had adopted an outsource business model where its investment management function was conducted by Coronation Asset Management in South Africa and Coronation International Ltd in the United Kingdom,” SARS said.

The Supreme Court of Appeal ruled in 2023 that the primary operations of CGFM’s business (and therefore the business of the controlled foreign company) was that of fund management which comprises investment management. These are not conducted in Ireland, said the court. Therefore, CGFM did not meet the requirements for the tax exemption.

Coronation indicated last week that the full impact of the tax matter as at 31 March 2024 amounted to R794-million and had been provided for in Coronation’s financial accounts.

Coronation’s chief financial officer, Mary-Anne Musekiwa, said in court papers that both PwC and Ernst & Young were comfortable that the CGFM business qualified for a foreign business entity tax exemption.

Musekiwa said any understatement that existed as a result of CIMSA claiming the exemption constituted a bona fide inadvertent error and any underestimation of provisional tax was not a result of negligence, deliberate conduct or a failure to seriously calculate the estimate.

In a scathing, unanimous judgment, the Constitutional Court said “it is fallacious to reason that, for purposes of the tax exemption, a business entity can subjectively define what constitutes the business in a narrow way so as to fall within the realm of the exemption. There would be narrow definitions of the ambit of a business – such as the provision of secretarial services to a fund manager – which would clearly lack economic substance and create too wide a discretion for companies to avoid tax liability in South Africa. SARS and a court will look objectively at the actual operations of the business to determine whether they have a commercial rationale and the business has economic substance.”

The judgment further noted that the Supreme Court ruling in 2o23 apparently lost sight of the fact that a “South African company is legally constrained to move offshore to service their investor clients who want to take up the opportunities created abroad after the relaxation of foreign exchange controls”.

“Apart from the fact that the approach adopted by the Supreme Court of Appeal is legally and factually unsustainable, it does not make commercial sense at all,” the judgment stated.

Joon Chong, a tax specialist at Webber Wentzel, said the ruling should give South African multinational companies cause to breathe a sigh of relief, although they will most likely make sure that they are more rigorous when it comes to supporting documents to prove the primary operations of their offshore businesses.

Linda Peter, an international tax director at BDO, said it was very rare to see a case going from tax court all the way to the Constitutional Court. DM

This article is more than a year old

Business Maverick

Coronation share price rebounds on back of Constitutional Court success in tax battle

The scathing, unanimous judgment concludes the dispute raised by the South African Revenue Service in 2017.