BHP’s $50-billion (R868-billion) bid for Anglo American may have been a flop, but South African mining companies have been on an absolute tear when it comes to merger and acquisition transactions (M&A).

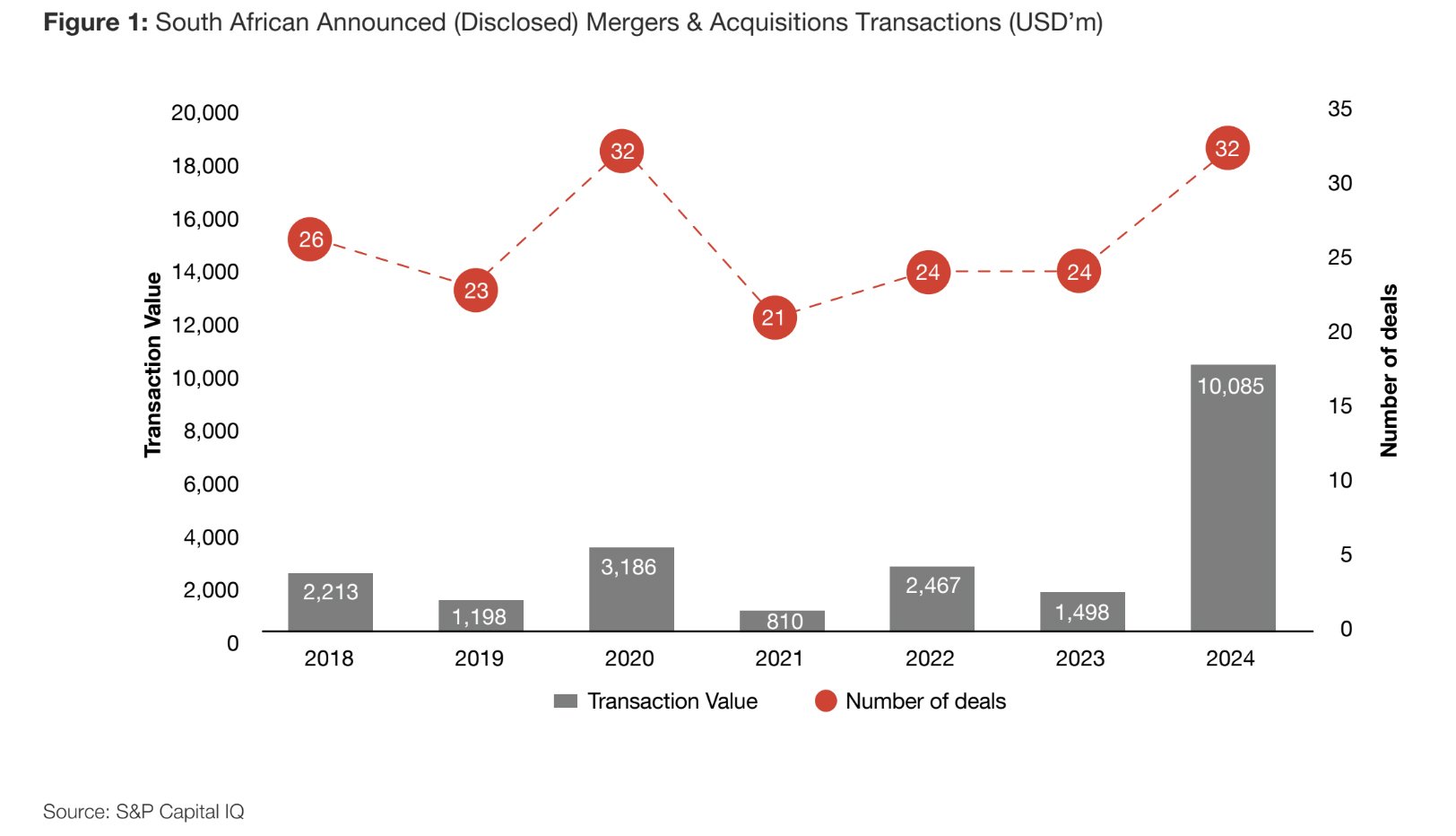

According to PwC’s annual SA Mine report for 2024, South Africa's mining sector was involved in deals that amounted to just over $10-billion in the 12 months to the end of June, dwarfing the $1.5-billion recorded for the previous 12-month period and exceeding the combined total for the previous five years.

In total, there were 32 such transactions compared with the 24 recorded in the previous 12 months.

“The South African mining sector has experienced a hive of M&A activity in the past year, driven by factors that have reshaped the industry’s dynamics and outlook,” the report, released on Tuesday, said.

“The quest for copper and other strategic minerals, broader consolidation and operational synergies, and diversification and strategic realignment to create shareholder value have been the main themes emerging from M&A transactions.”

Coveted copper was Anglo’s main attraction for BHP, a transaction that would have boosted the period’s M&A profile in dollar terms six-fold had it gone through.

But the scramble for the green metals and critical minerals needed for the global decarbonisation drive was still part of South Africa’s mining M&A story.

Among the notable transactions highlighted in the report, Ganfeng Lithium — a China-based lithium manufacturing and processing company — acquired 19.9% of South African Lithium, while Copper 360 picked up Nama Copper from Mazule Resources.

African Rainbow Minerals acquired the remaining 50% stake in its joint venture that operates the Nkomati Mine from Norilsk Nickel Africa. Nickel also has a green sheen these days because of its applications in the energy transition.

“Another key driver of M&A activity in the South African mining sector has been broader consolidation and operational synergies, as mining companies have sought to improve their efficiency, productivity and profitability amid a challenging economic climate,” PwC said.

Or in simpler terms: consolidate to cut costs when times are tough.

On the consolidation front, Impala Platinum took over neighbouring Royal Bafokeng Platinum, a transaction that the report noted “will eventually allow for optimised processing infrastructure and other synergies”.

What went down

Several other metrics, however, went south in the domestic mining sector.

“Production volumes continued to decrease in 2024. In June 2024, there was a 3.5% decrease in mining production, with gold and PGMs (platinum group metals) being the most significant contributors,” the report read.

Gold’s downward production trajectory despite record prices reflects reserve depletion and soaring costs, while the fall in PGM output was a response to depressed prices.

For the South African mining sector overall, revenue fell 10% to R582-billion in the period under review. PGM revenue was down 23% and coal experienced a 12% drop, partly because of Transnet’s woes.

But for gold, scorching prices meant revenue climbed 18% in the face of falling production.

Net profit for the sector as a whole dropped 52% to R59-billion, while total market capitalisation decreased 8% to just over R1-trillion. Gold remained the big outlier in this regard with a 19% increase because of surging prices triggered by demand from central banks seeking to diversify their holdings from the US dollar and the precious metal’s safe haven status amid rising geopolitical tensions.

Production and revenue overall in the sector may remain constrained by the global commodity cycle.

But M&A activity could stay hot in the year ahead. Anglo American is restructuring and its global copper assets are still a draw. And consolidation and the search for synergies are still high on the radar screen of boardrooms. DM