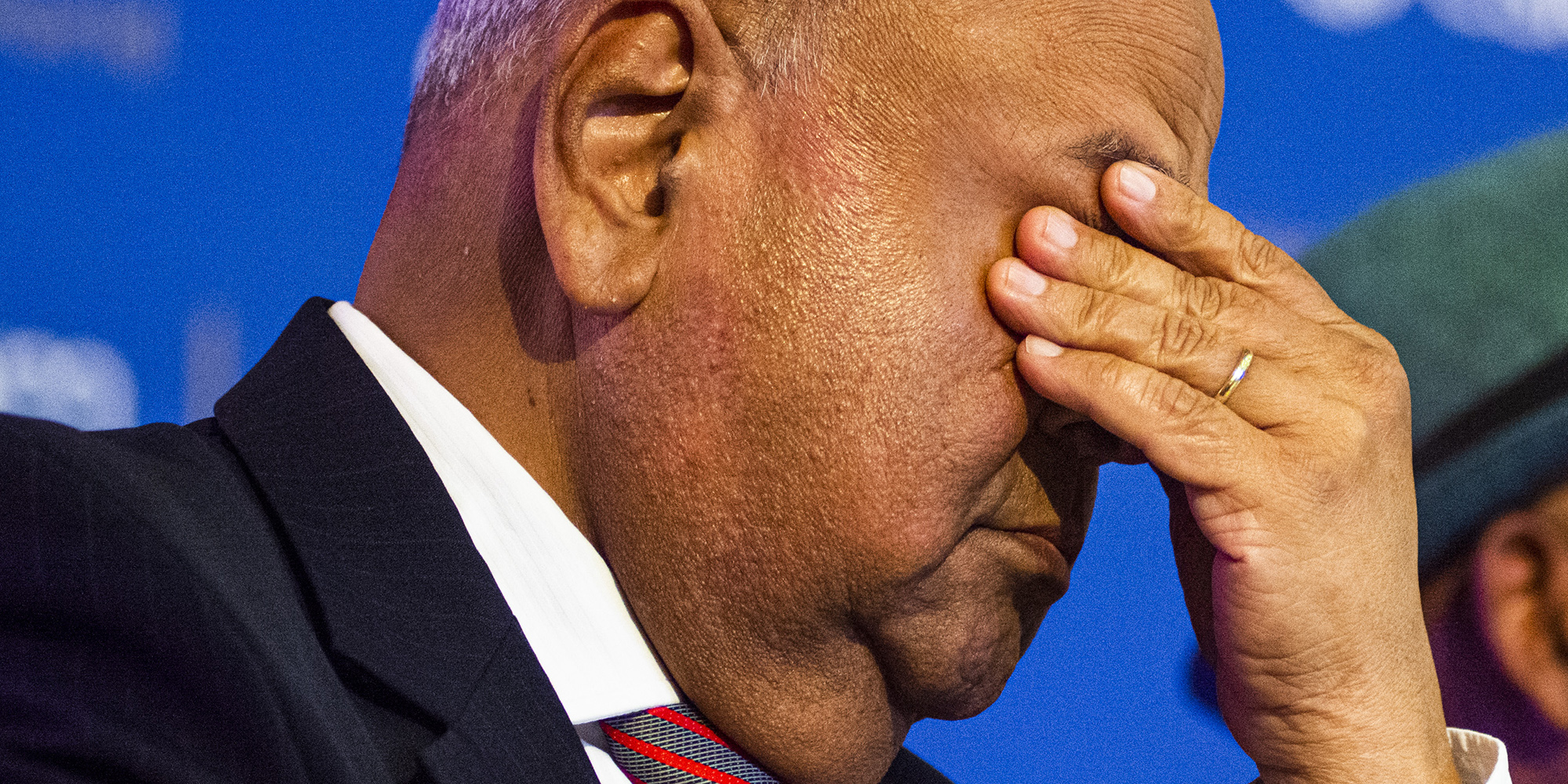

As the Minister of Public Enterprises, Pravin Gordhan has been the custodian of Eskom for four years – a period marked by unprecedented breakdowns in the power system, which has thrown South Africa deeper into darkness.

Gordhan returned to Cabinet in February 2018 when Cyril Ramaphosa was inaugurated as President to serve out the remainder of Jacob Zuma’s term.

It was a difficult period for the state-owned enterprise (SOE) universe, as taxpayer-funded entities such as Eskom and others were left broken by institutionalised State Capture corruption, incompetence and mismanagement when Zuma was at the helm of South Africa for nine years.

The legacy of this destructive period persists, with Gordhan and many South Africans blaming it (and rightly so) for the unrelenting power crisis and Eskom’s operational mess.

The return of Gordhan into office was largely celebrated because he is an anti-corruption campaigner and a veteran who brings unrivalled public sector experience and institutional knowledge.

He was seen as the right fit to lead the clean-up of SOEs, which suffered corruption damages of almost R50-billion (arguably, a conservative estimate, cited by the Zondo Commission) in sullied contracts that enriched members of the Gupta family and others.

But the goodwill towards Gordhan and his efforts to reform SOEs, especially Eskom, is withering away. Gordhan’s oversight of Eskom over the past four years has come under intense criticism, with individuals from business, governance and politics saying he has failed to stop the power utility’s decline.

As the minister in charge of Eskom and also its sole shareholder representative, Gordhan is responsible for the appointment of the chief executive of Eskom, which he takes to the Cabinet for approval, as well as the board of directors. On this front, Gordhan has overseen a revolving door of leadership in Eskom’s C-suite and board, with him appointing three Eskom CEOs (Phakamani Hadebe, Jabu Mabuza - on an acting basis - and André de Ruyter) and 24 directors to the board over the past four years.

The count of directors on the Eskom board recently swelled to 24 because Gordhan replaced the board on 30 September by appointing 12 new individuals with a mix of engineering, energy policy, electricity delivery and legal skills. The new board is chaired by Mpho Makwana, who returns to the power utility after acting as CEO from 2009 to 2010.

Weak Eskom board

Critics of Gordhan have argued that, on his watch, many CEOs and directors arrived at and left Eskom after a short period, causing leadership instability. There has also been no continuity regarding the implementation and oversight of strategies to fix old power stations, which often face breakdowns that cause load shedding.

Further fuelling such criticism is that when some Eskom board members started resigning in 2018, Gordhan didn’t replace them or appoint more non-executive directors. Instead, he allowed Eskom to limp along and operate with only six directors on its board for 18 months until the end of September 2022. Having six directors is not enough to run a company the size of Eskom, which is allowed to have a maximum of 13 directors.

DM168 canvassed the views of individuals who have served on various SOE boards, who agreed that having only six directors would result in slow decision-making and debates at board level about Eskom’s operations would not be robust. They also said there wouldn’t be strong skills to help Eskom’s management navigate complex energy issues.

Iraj Abedian, the chief executive of Pan-African Investment & Research Services. Photo Supplied

Iraj Abedian, the chief executive of Pan-African Investment & Research Services. Photo Supplied

“This was a self-inflicted problem by the shareholder, which could have been easily avoided by appointing heavy hitters on the board. Eskom could have been in a better shape with a full board,” says the chief executive of Pan-African Investment & Research Services, Iraj Abedian, who also served on the Transnet board from 2004 to 2009.

Another director, who is currently serving on an SOE board and refused to be named, agreed with Abedian, saying it is “crazy” that an entity such as Eskom, which holds the economy to ransom, can be allowed to operate without a full board for a long time. “The shareholder representative was very lax about filling up board vacancies. That board was ineffective. It is astounding it was allowed to operate in that way for over a year.”

Asked when he would appoint a full Eskom board, Gordhan said that “it is out of my hands”, implying that a list of director nominees required Cabinet-wide support, which was difficult to achieve. He sidestepped the same question on 30 September when asked again during a press conference. The Department of Public Enterprises has repeatedly rejected DM168’s request for an interview with Gordhan to engage with him over Eskom-related issues.

Eskom’s operational issues that needed the attention of a full board include addressing its debt load of nearly R400-billion, which hinders its ability to borrow money from capital markets or shore up its cash flow profile to fund the maintenance of power stations. After promises over three years, a solution to the Eskom debt might finally be unveiled by Minister of Finance Enoch Godongwana on 26 October in the Medium-Term Budget Policy Statement.

Another roadblock that a full and empowered board could have removed is splitting Eskom into three parts and setting up a transmission company that would buy energy not only from Eskom but also from all producers to level the playing field. These measures are crucial for transforming the electricity supply system.

The transmission company was successfully set up in December 2021, but the appointment of its board of directors was delayed, with a list of nominees provided to Gordhan in February 2022. The process has since stalled.

Visit Daily Maverick's home page for more news, analysis and investigations

Reform efforts delayed

There is now a big drive for Eskom to recruit ex-employees to reverse skills and knowledge loss, which has contributed to the entity’s woes of not being able to keep the lights on for 15 years.

Gordhan has called on experienced engineers and artisans – who worked their entire lives at Eskom and were instrumental in maintaining the utility’s power stations but now work overseas – to return to South Africa. These veterans would mentor and train Eskom’s workers, helping to stem the downward trend in the performance of generating units. But this should have been done four years ago.

Former Eskom board chair Reuel Khoza. (Photo: Gallo Images / Sunday Times / James Oatway)

Former Eskom board chair Reuel Khoza. (Photo: Gallo Images / Sunday Times / James Oatway)

Respected businessman Reuel Khoza, who chaired the Eskom board from 1997 to 2002, led the initiative in 2018 to recruit six highly skilled ex-Eskom workers who are now working outside the country.

“They were willing to come back home to help. This was a substantial group of six people who are active, knowledgeable and experienced in an area of electrical engineering,” recalls Khoza, who led Eskom during its golden years, when it had minimal to no debt on its balance sheet and was revered around the world for engineering excellence. Eskom could also stand on its own without government bailouts. But Khoza’s initiative was rebuffed by the government. “We asked the government to recall these people. But we were brushed aside with gusto.”

For political analyst Dr Ralph Mathekga, the worsening energy crisis and visible failures to reform Eskom’s operations can be attributed to “policy indecisiveness and incoherence”. He also says the poor performance of Gordhan and Gwede Mantashe, the Minister of Mineral Resources and Energy and the only person in the country who has the power to procure new energy capacity, is also stunting the reform agenda.

Gordhan and Mantashe, arguably powerful figures in the energy space and economy, signed performance agreements with Ramaphosa, which run from June 2019 to April 2024. In such agreements, they have similar targets to improve Eskom’s operations and energy generation, but have, so far, performed dismally.

One target requires them to improve Eskom’s energy availability factor (EAF) –the average percentage of power stations available to dispatch energy reliably. The target is an EAF above 80% by 2024 – yet so far this year, this has declined to below 60%. A high EAF indicates that plants are well operated and maintained, making load shedding a thing of the past.

Says Mathekga: “We shouldn’t have an energy crisis in South Africa. We should be energy secure because of our natural resources. But we have two ministers who have not shown any good performance on the energy issue. Gordhan is often painted as an anti-corruption hero but is so sensitive to criticism regarding his poor performance. This is not acceptable.”

Mandate of Eskom's new board

The new Eskom board has one main job: to achieve an EAF of 75% from unacceptable levels (below 60%). As power cuts near the fourth week, the board has little time to become familiar with Eskom’s problems and quickly find ways, with the support of management, to improve the generation capacity. Gordhan believes that the 75% EAF target is realistic, even though energy experts have serious doubts. Drastic actions are required to reach the EAF target, including ramping up maintenance of power stations to impossible levels, rapidly building generation capacity and shutting down Eskom’s worst performing power stations to artificially boost the EAF.

Bonang Mohale, a businessman who has served on SOE boards. (Photo: Gallo Images / Sydney Seshibedi)

Bonang Mohale, a businessman who has served on SOE boards. (Photo: Gallo Images / Sydney Seshibedi)

Bonang Mohale, a businessman who has served on SOE boards at South African Airways, SA Express and the Airports Company South Africa, says whatever EAF improvement plans that Eskom management (with the support of the new board) come up with, the shareholder should not interfere in decision-making. And the board will have to be bold and vocal enough in pushing back against interference.

“We need to be explicit about the role of the shareholder. The role of a shareholder is to appoint a board and give it a shareholder compact that details all the targets to achieve in the next three to four years. And the most important thing that a shareholder needs to do is step away. Let the management run power stations and the board provide governance oversight,” says Mohale.

But Gordhan, who doesn’t believe in the need to pare back the degree of state ownership in the economy, is a meddler – often preferring to be involved in operational matters of SOEs. Previous Eskom board members have testified about this in Parliament.

Gordhan’s performance is not exactly stellar

Gordhan’s performance agreement targets were signed in 2020 with President Cyril Ramaphosa. The agreement runs from June 2019 to April 2024.

- Increase reserve margin to 15% by 2024 to counter load shedding.

Progress/regression on target: The reserve margin has consistently remained below 10% since 2011. This means that the health of South Africa’s electricity supply and transmission system has deteriorated. Demand for electricity has grown substantially since then, whereas energy generation to boost capacity has been in decline. The reserve margin has not increased, which will make it difficult for Gordhan to reach his target of 15% in the next two years.

- Improve energy availability factor (EAF) to ensure constant supply of electricity. Increase EAF to above 80% by 2024.

Progress/regression on target: There has been regression on this target. The EAF refers to the average percentage of power stations available to dispatch energy at any time. A higher EAF percentage would end load shedding, but the EAF is languishing at below 60%.

- Explore embedded generation options to augment Eskom’s capacity. Explore small-scale embedded generation options to augment generation capacity of Eskom by 1,000MW by 2024.

Progress/regression: There is progress on this target. Worsening load shedding this year has pushed Eskom to move faster and it has set out plans to buy 1,000MW from renewable energy players in the private sector. Eskom started power purchasing agreements in late September and additional energy might be added to the national grid from next year.

- Separation and unbundling of Eskom into three parts (generation, transmission and distribution) to eliminate cross-subsidisation and improve efficiency. Separate transmission company to be established by 2020.

Progress/regression: There has been progress on this target. Eskom has executed the separation of its transmission division, in line with a December 2021 deadline set in its restructuring plan. But details about how the division will be funded and the appointment of its board are yet to be completed. DM168

This story first appeared in our weekly Daily Maverick 168 newspaper, which is available countrywide for R25.

Newly elected president of Business Unity SA, Bonang Mohale. (Photo: Gallo Images / Sydney Seshibedi)

Newly elected president of Business Unity SA, Bonang Mohale. (Photo: Gallo Images / Sydney Seshibedi)