Eskom’s repeated and persistent failure to address irregular expenditure, fruitless and wasteful expenditure as well as losses through criminal conduct are part of the reason that you, the consumer, are paying more for electricity.

This is one of the more frank admissions by the Auditor-General (AG) and its team on Tuesday as they briefed Parliament’s Standing Committee on Public Accounts (Scopa) on Eskom’s annual reports and financial statements for the 2023/24 financial year. Eskom has received a qualified audit opinion with findings for 2023/24.

EFF MP Veronica Mente asked about the possibility of “real-time audits” considering that Eskom has received a qualified audit opinion every year since 2017. She also asked for more information about the state of the utility’s finances and leadership given its desired electricity tariff increases and the mounting levels of municipal debt owed to it.

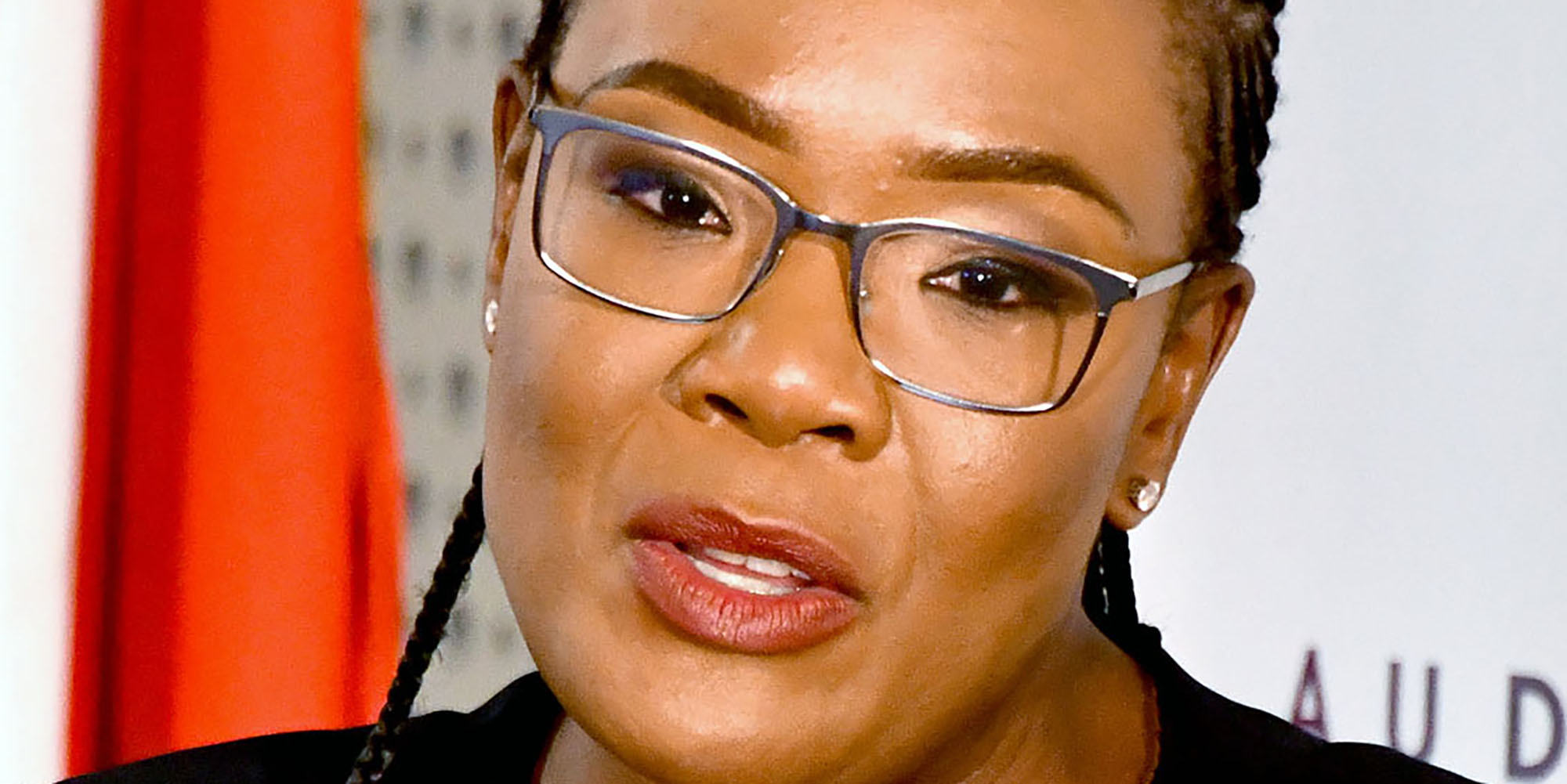

In response, the AG’s business unit leader, Madidimalo Singo, said that “what is important in the environment is that continuously what we see is lack of accountability and to a certain extent the effectiveness of the oversight over [Eskom’s] audit action plans that are put in place, and that is the area where we continuously then advise to say more needs to be done to improve accountability within the Eskom space”.

Addressing Mente’s question more directly, Singo said that “around the cost of electricity, and I think one of the things you would have noted… is that there are three areas we are worried about and that also contributes to the questions that Honorable Mente raised. The one is how the entity actually manages expenditures and we’ve seen that they are struggling with irregular expenditures, fruitless and wasteful expenditures as well as losses through criminal conduct.”

She emphasised that “what we have noted in the environment is that the lack of consequence management in these areas contributes to these undesirable expenditures. What we do note and in agreement with Honorable Mente is that there is an increase in the cost of electricity and you would have seen when we’re presenting that we also reflected on the issue of the primary energy cost and this is the cost to produce electricity.

“So, to the extent that the audit action plans are not effective in addressing these three undesirable expenditures, we will continue to see a rise in the primary energy cost and consequently a rise in the cost of electricity.”

Singo said the AG’s recommendations to the Eskom board, management team and audit committee have been that they have to “strengthen the internal mechanism of looking after these expenses. But secondly, you’ve got to look at consequence management. The fact that investigations take too long also contributes to and perpetuates the continued noncompliance with laws and regulations. From that perspective, one of the critical things that ought to be done in this environment is strengthening our accountability and making sure that there is effective oversight over the audit action plan, so that once you’re able to manage the cost itself, then we can see the impact in terms of the Eskom tariffs.”

Andre Dennis, a partner at Deloitte and part of the AG delegation, raised a few caveats.

“I think it’s important to take note that during the 2024 audit, we had quite a few individuals who were in acting roles and we keep on saying that decisions are not taken necessarily when people are in acting roles. So you’ve got a new permanent CEO that came in, in March of 2024. Since then quite a number of permanent individuals were appointed to positions. You’ve also got a new chairman who’s also driving that quite strongly. So I think from that perspective the acting individuals would now be replaced by permanent individuals who would have very specific responsibility for those roles. So I think that is quite important to note.”

Read more: Eskom news

Read more: Eskom Intelligence Files

ActionSA MP Alan David Beesley also referred to the primary energy costs, arguing that the announced closure of ArcelorMittal’s long steel operations was due in part to rising energy costs.

“Three and a half thousand people are losing their jobs. More than probably 100,000 in total will be impacted. So there are real consequences to corruption and incompetence,” he said. So, he asked, who is ultimately responsible for consequence management?

“So, the responsibility for ensuring that there is an effective internal control environment and that the institution has appropriate policies and procedures, lies with the board. Equally, when there is noncompliance with the law, when there is noncompliance with those specific policies and procedures, the responsibility for consequence management ultimately rests with the board.”

The news follows the National Energy Regulator of South Africa’s recent rejection of Eskom’s request for a steeper tariff increase, citing concerns over affordability for consumers.

Daily Maverick reported that Eskom had requested R445-billion, R495-billion and R536-billion for the 2025/26, 2026/27 and 2027/28 financial years, respectively. Based on Eskom’s application, the proposed standard tariff increases were projected at 36.15%, 11.81% and 9.1% for the three years.

The approved tariffs are:

- 2025/26 financial year: Revenues of R385-billion, which translates into a 12.74% increase;

- 2026/27: Revenues of R410-billion, a 5.36% increase; and

- 2027/28: Revenues of R437-billion, a 6.19% increase.

Read more: Eskom issues urgent load shedding alert as tariff increase rejection sparks concerns

Soon thereafter Eskom issued an urgent load shedding alert at the end of January, citing breakdowns and “the use of all our emergency reserves, which now need to be replenished”.

Daily Maverick also reported that in December 2024, at the Eskom results presentation, board chairperson Mteto Nyati said it was “the last time” the power utility would unveil a horror show of numbers after reporting a loss of R55-billion for the year ending 31 March 2024. Eskom is now forecasting a profit of more than R10-billion for its current financial year, which runs until March 2025. Despite this, the Auditor-General’s findings suggest that underlying structural weaknesses persist. DM