By 2034, the European Union’s Carbon Border Adjustment Mechanism (CBAM) could impose levies exceeding 50% of the value of South African aluminium exports, a staggering cost increase that industry leaders warn could cripple the sector’s competitiveness in the country’s largest trading bloc’s market.

This alarming projection emerged during a webinar hosted by the EU Chamber of Commerce and Industry in Southern Africa and the European Delegation to South Africa, where government and business representatives debated how to mitigate the looming financial shock.

The event, moderated by Emily Tyler of Meridian Economics, featured Vicente Hurtado Roa, head of the CBAM unit at the European Commission’s Directorate-General for Taxation, alongside South African industry representatives Hendrik de Villiers from Hulamin, and Rosalind dos Santos from Mpact.

South Africa’s overwhelming reliance on coal-fired electricity from Eskom presents a major challenge for local industries subject to CBAM, which calculates carbon emissions at the point of production.

CBAM is designed to prevent “carbon leakage” where companies relocate production to countries with weaker emission regulations to avoid stricter climate policies. While the EU argues that the mechanism levels the playing field, South African industry leaders warn that it could create a serious trade disadvantage for local exporters.

Daily Maverick reported last year that South African officials contend that CBAM will cost the economy more than R2-billion a year. CBAM is currently in a transition, undergoing a trial period of monitoring and reporting that began on 1 October 2023 and will end on 1 January 2026, when the EU will begin phasing in carbon prices on the production of imported products.

Read more: EU carbon price on imports ‘violates’ WTO rules, says Patel as SA heads for clash with bloc

The Department of Trade, Industry and Competition, in a letter to the EU Commission, wrote, “Climate justice needs to be placed in the foreground of any discussions on carbon border taxes and other response measures to climate change. We must draw to your attention that around US$1.5-billion in exports of South Africa to the EU are at risk (based on 2021 data). Our Presidential Climate Commission indicates that our overall exports could decline by 4%, with the steel and aluminium sectors being particularly at risk.”

Worst-case scenario

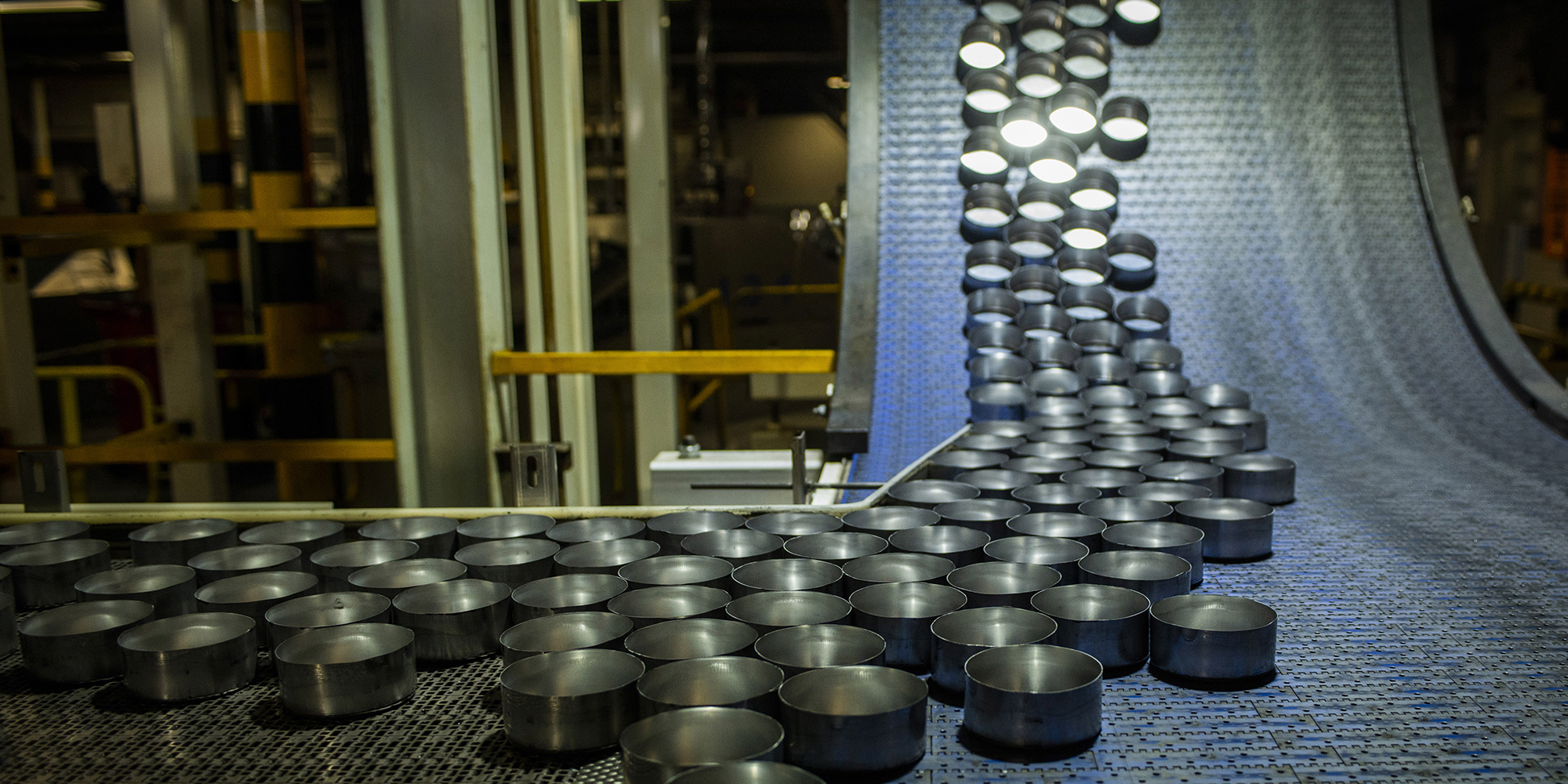

According to Hendrik de Villiers, head of environmental sustainability at Hulamin, an aluminium supplier and exporter, the South African aluminium industry faces one of the highest embedded carbon footprints globally and is at great risk.

“Giving you a feel for the type of industry we’re in, the complexity that there is in our facilities: So we start by putting metal of different forms into our melting furnaces and I have to stand still on this topic a little bit because this is where a big portion of what eventually gets to our customers gets determined already.

“Virgin aluminium refers to the iron ore that’s been refined and smelted at the smelter … it’s very electricity-intensive… In South Africa … our grid … has a very high carbon footprint … and there’s nothing we can do about it, so we are dependent on our supply chain for making any changes there.”

De Villiers warned that by 2034, CBAM levies on South African aluminium exports could exceed 50% of the product’s value — a cost burden that threatens industry competitiveness in the EU market.

“The scenario I’m sketching for you now is the 2034 scenario with certain assumptions. Using the assumptions and the publicly available data, they have been translated into a percentage of the aluminium price and I’m using €2,500 per tonne as the LME [London Metal Exchange price] for aluminium and then by 2034 it says levies on aluminium products of SA origin will reach more than 50% of the value of unprocessed aluminium and that is the shocker.

“So, this is for a given CBAM price, it’s the worst-case scenario where Hulamin has not taken any mitigation actions to compensate for this.”

‘An environmental measure’

EU official Vicente Hurtado Roa defended CBAM, rejecting claims that it functions as a protectionist trade measure. He described it as an environmental mechanism designed to mirror the EU’s carbon pricing system rather than a tariff.

“CBAM is not a tax, it is not a tariff. It is an environmental measure which is going to mirror the carbon price that we apply in the European Union, also to imported goods in the same way in an even-handed manner as the goods which are produced in the EU,” said Roa.

“The idea is that we realise that the efforts to decarbonise have to be global because the problem with climate change is also a global problem and the fact that the industry in one country could be in the European Union as it could be in South Africa will be completely watered down or upset or undermined by the fact that other industries in other countries are not decarbonising their goods and other countries are not introducing carbon pricing.

“We are not introducing CBAM to protect the competitiveness of our industry or as a trade measure. It’s purely an environmental measure,” he said.

Mitigation strategies

Rob Davies, former minister of trade and industry, an honorary professor at the Nelson Mandela School of Public Governance, and a member of the AfCFTA Trade and Industrial Development Advisory Council, wrote in Daily Maverick that a study commissioned by the African Climate Foundation measured the potential impact based on different scenarios for EU Emissions Trading System carbon price per tonne and product coverage.

That study found that even in the “lightest” scenario with the most limited impact, “Africa’s economy will be negatively affected by the CBAM, with exports to the EU declining by 4%; that Africa will be worse affected than any of the other major economies analysed”; and that “even at €40 per tonne, the CBAM will raise EU import tariff revenue substantially, but have little impact on global CO2 emissions”.

With carbon levies on South African exports set to escalate, the speakers outlined three major mitigation strategies:

- Increasing recycled aluminium content to lower embedded emissions;

- Scaling up renewable energy and decarbonising the national grid to reduce indirect emissions;

- Strengthening South Africa’s carbon tax framework to keep revenue within the country rather than paying it to the EU under CBAM.

While some of these projections involve worst-case scenarios or estimates based on specific assumptions, they highlight significant challenges facing industries like aluminium due to their high embedded emissions under current production conditions in South Africa.

As CBAM moves toward full implementation in 2026, South African exporters face a tight window to adapt. Businesses that fail to decarbonise their supply chains risk losing market share in the EU or absorbing unsustainable cost increases. DM

https://youtu.be/REeWvTRUpMk