This past long weekend saw yet another precipitous decline in stock markets around the world, with the S&P 500, for example, tumbling over 2%. I think it’s worth pausing here and examining this more closely because this may be an inflection point.

The reason the market tumbled was because US President Donald Trump did something very few heads of state do these days: he openly criticised the head of the Federal Reserve, Jerome Powell, whom he appointed in his previous term, and called for his head. After months of absolutely promising that he would not fire Powell, Trump on Thursday, 17 April 2025, reversed course and said Powell’s “termination” couldn’t come soon enough. Such is the man.

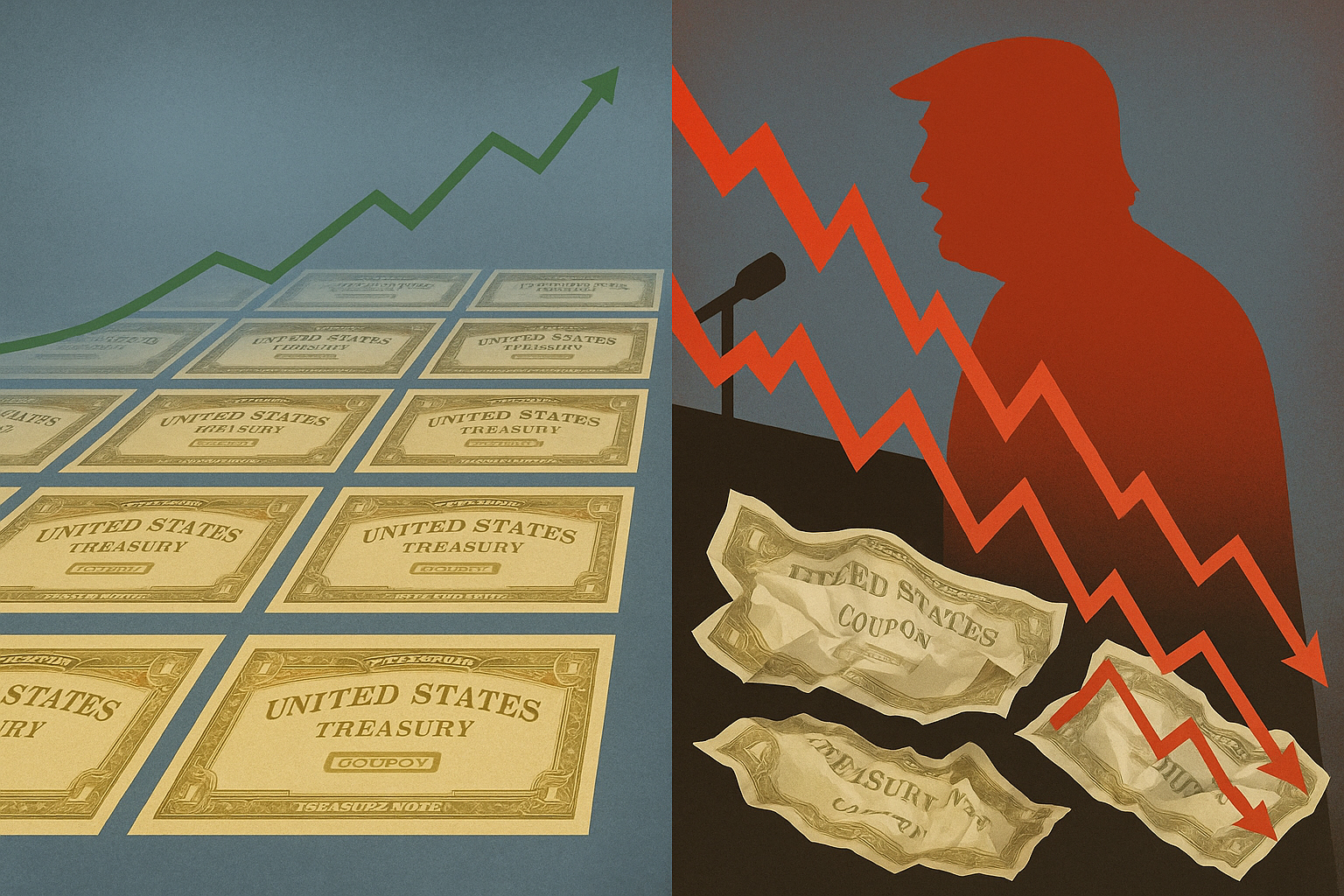

The stock market decline was bad enough, but the thing market watchers are really worried about is the bond market, and that, for the uninitiated (which includes me), requires some explanation — and understanding.

The key question is this: Why did Trump change his mind and decide to criticise Powell and undertake to remove him? And why is that a bad — or at least more of a bad — thing than the other bad things? The answer lies in the fact that it’s possible for political leaders to disturb the stock market and, at a push (unusually negatively), the currency markets. Hello, Jacob Zuma.

But the one thing that has proved absolutely invulnerable to political manipulation is the bond market. Politicians can whine and bully and complain and threaten. But the bond market just carries on delivering its (usually critical) verdict with absolute impunity.

Economic reforms

This was recognised a long time ago by James Carville, a prominent political strategist and advisor to then president Bill Clinton. In the early 1990s, during the Clinton administration’s efforts to implement economic reforms, Carville remarked: “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

At the time, the Clinton administration faced significant pressure from bond investors who were concerned about federal spending and deficits. And you know what Clinton did? He buckled and reduced the deficits and has been lauded for doing so ever since. In a sense, Clinton’s success as a leader rested on understanding the power of the bond market and choosing not to fight it.

In doing so, Clinton marked himself as a leader of rare insight because plenty of other leaders have tried to bully the bond market and failed. The most spectacular has been by Turkey’s “strongman” leader Recep Erdoğan, who decided that high interest rates cause inflation, not the other way around. To satisfy his theory, he fired central bank governors who tried to raise rates, undermining the independence of Turkey’s monetary institutions. The Turkish lira lost more than 80% of its value against the dollar in the past five years, and bond yields surged.

After his re-election in 2023, Erdoğan unexpectedly appointed a technocratic economic team including Mehmet Şimşek, a respected former finance minister, and Hafize Gaye Erkan as central bank chief who promptly put up interest rates from 8.5% to 50% in just over a year. Gradually, market orthodoxy returned. Erdoğan fought the bond market, but the bond market won by attrition.

Surely, you might think, Trump knows this, so why has he decided to take on the bond market? That is what threatening to fire the head of the Federal Reserve effectively means. I think the reason is that he is getting desperate; many key economic pointers are pointing the wrong way (not all of them, by the way) and if he messes up the US economy, he is toast. When things start to look wobbly, politicians look for a quick fix, and one quick economic fix is always to decrease interest rates.

Now, you may say well, the Federal Reserve has drastically missed its inflation target over the past five years, so why are we so concerned about its hallowed and precious independence? Bloomberg columnist Matt Levine has come up with a great way to think about it: it’s like someone making an appointment for lunch or coffee and showing up late.

Read more: What Does Trump Even Get If He Fires Jerome Powell?

“If the person shows up late because the subway broke down, then I really can’t hold it against them. That’s not a broken promise. If they’re late because they got on the subway going in the wrong direction, I might think of the person as something of an unreliable flake, but it doesn’t necessarily make them a bad person. However, if they’re late because they just didn’t think it was important to show up at the time they said, then it means they don’t respect you, and probably you don’t want to be their friend any more.”

In 2022, the dollar fell hard against a basket of goods and services, but the market judged that the subway broke down, or maybe the Fed just got on the wrong train.

“It was a confusing time. They misjudged the scale of the disruption and fiscal expansion.”

But basically, every central bank around the world made the same error, so you know, you’re not going to break up with the Fed over it… letting inflation gather steam today by arbitrarily holding down rates (because that’s what the president wants) would be a different story. This would be a message to dollar holders around the world that it doesn’t take seriously its commitment to show up on time for lunch,” Levine writes.

The story of the Trump 2.0 administration has been this aggressive flouting of norms and institutions, and you can have a position on that.

But this is different. This is the bond market. DM

If you wish to comment on this issue, please send an email to letters@dailymaverick.co.za

Letters will be edited.