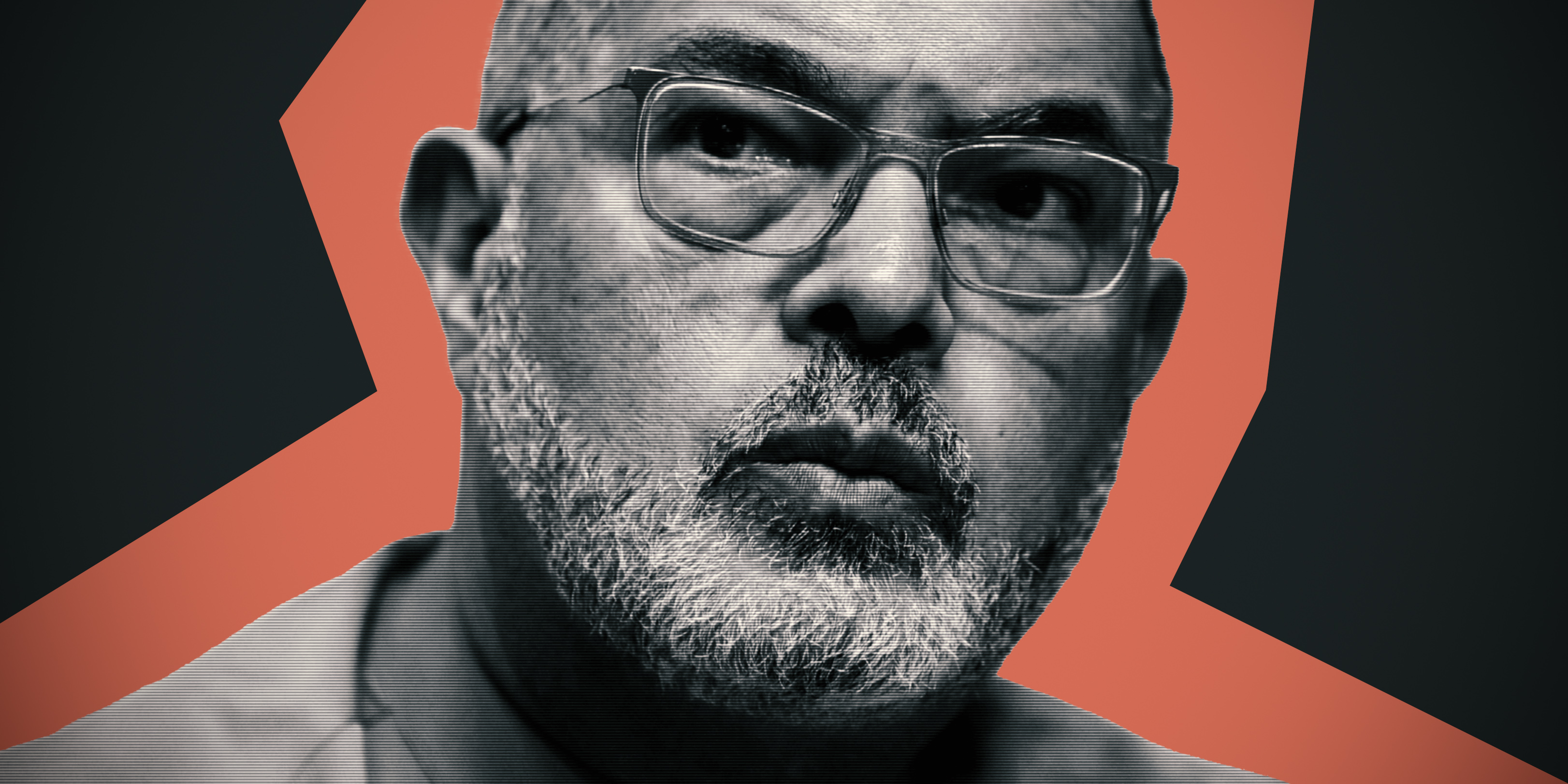

Last year, the Minister of Finance allocated R1-billion a year (over three years) to the SA Revenue Service (SARS) for its modernisation programme. SARS commissioner Edward Kieswetter says the use of AI and proactive measures have resulted in the recovery of R210-billion for the first 11 months of the current tax year.

“When the economy is doing well, people tend to more easily pay their debt due to SARS. Compliance behaviour is directly linked to the general mood within the country and particularly the economy,” he says.

“In the current environment, where we have seen millions of job losses, and inflationary pressure, people tend to close ranks and hold back on SARS payments,” Kieswetter says.

There has been an increase in SARS debt, which now stands at an undisputed R300-billion.

“The R300-billion is what is owed by people who are not denying or disputing that they owe the money. They simply don’t have the money, or they have reprioritised their spending and SARS is not very high on the list.”

Kieswetter says one of the areas where SARS uses artificial intelligence is debt propensity modelling.

“This is where we build machine learning algorithms to go through the entire textbook and to highlight instances where there is the highest propensity to recover the debt, and with minimum resources. We then focus on those entities.

“Let’s say, there are two entities, both owing us R5,000 and one entity is a profitable trading business while the other is in business rescue and no longer active or dormant. We know that we have a lower probability of recovering our money from the dormant company, so if it boils down to one call, we will call the active, profitable company,” he says.

Having said that, in the current tax year, VAT refunds have grown 12%, outstripping VAT returns which have grown by 5.5%. "So, the growth in VAT refunds is outstripping VAT collections," Kieswetter adds.

As at 31 January, SARS clawed back the R210-billion for the current financial year through the following interventions:

- R70-billion from AI/debt propensity algorithms. This resulted in the closure of almost 2.1 million cases of debt; the issue of more than 100,000 final letters of demand, and almost 24,000 civil judgements.

- R67-billion from the use of data science. SARS used data science to evaluate around 14 million income tax, VAT and company returns received by the end of January. “Only 1.5 million were flagged as high risk. We have about 550 auditors who work through those returns, engage with the taxpayers – that engagement results in a final verification,” Kieswetter says.

- R57-billion from refund risk management. This is where SARS acts to prevent refunds that are either fraudulent or not permissible. Kieswetter says the biggest culprit is VAT returns, and by the end of January this year, SARS prevented R34-billion of impermissible/fraudulent VAT returns; R13-billion of impermissible/fraudulent personal income tax returns and R10-billion of impermissible/fraudulent corporate tax returns.

- R9-billion additional taxes were recovered from potential customs fraud. This occurs when people either import illegal goods (cigarettes, narcotics, medicines) or misdeclare (understate) the value of legal goods they have imported. By the end of January, SARS stopped and seized 5,500 instances of cargo with a declared value of R5.1-billion. This process also yielded almost R8-billion in fraud detection and leakage prevention for customs.

- R5-billion was recovered from almost 850 illicit trade (tobacco and alcohol) interventions that resulted in 550 detentions and 160 seizures. DM