The EFF has applied to join the legal action launched by the DA, which seeks to set aside the “fundamentally flawed” adoption of the fiscal framework by Parliament and interdict the implementation of the 0.5 percentage point VAT increase set for 1 May.

The Red Berets filed papers in the Western Cape Division of the High Court on Tuesday, 8 April to challenge what they call the “unlawful and unconstitutional” adoption of the fiscal framework by Parliament on 2 April.

In a statement on Tuesday night, EFF national spokesperson Sinawo Thambo said the party had taken this step because Parliament could not continue to “operate as a rubber stamp for the executive”.

“The court application is a necessary and principled intervention to protect the democratic character of Parliament, and to ensure that the processes that determine the use of public resources are not reduced to unlawful and illegal processes by the ruling party,” he said.

The EFF has applied to intervene in the DA’s urgent application filed in the court last week.

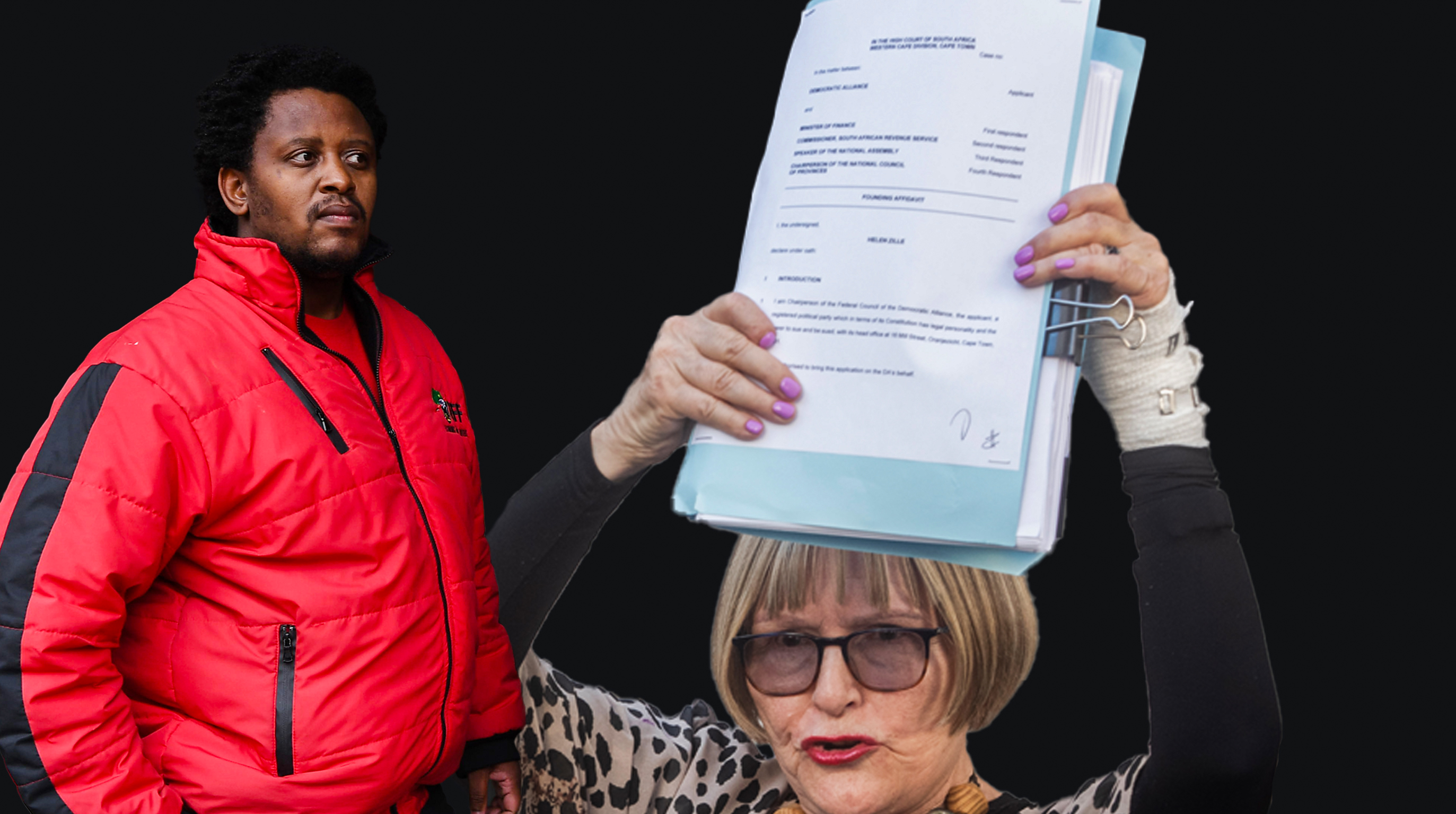

Following the adoption of the fiscal framework by the National Assembly and the National Council of Provinces (NCOP), DA federal chairperson Helen Zille filed court papers on 3 April, challenging the legality of the process taken by Parliament to adopt the framework, and Finance Minister Enoch Godongwana’s power to change the VAT rate under section 7(4) of the VAT Act, which the party says is unconstitutional.

Read more: After the Bell: The difference between a fiscal framework and a fiscal rule

In her founding affidavit, Zille named Godongwana, South African Revenue Service (SARS) commissioner Edward Kieswetter, National Assembly Speaker Thoko Didiza and chairperson of the NCOP Refilwe Mtsweni-Tsipane as respondents in the matter.

The hearing in the case is scheduled to begin on 22 April.

What is the DA’s case about?

The DA has approached the high court in two parts.

According to Zille’s founding affidavit, in Part A of its application, the DA is seeking orders, first, setting aside the “fundamentally flawed” decisions of both Houses of Parliament to adopt the fiscal framework and sending the framework back to the standing committee on finance and select committee on finance for reconsideration; and second, suspending the implementation of Godongwana’s decision to hike VAT on 1 May pending the final determination of Part B.

To the extent necessary, it is also seeking an order interdicting the SARS commissioner from collecting VAT at the “unlawfully increased rate” come 1 May, pending the outcome of Part B of its application. But the DA believes that if it obtains a suspension from the court, it does not also require an interdict against SARS.

Read more: DA says it is ‘willing to speak to ANC to get a workable Budget on the table’

Importantly, the party is seeking final relief from the court declaring the National Assembly and NCOP’s decisions to adopt the framework invalid and set aside. But the relief sought in respect of the VAT increase is interim, pending the final determination of Part B.

In Part B, the DA is essentially challenging the constitutionality of section 7(4) of the VAT Act and Godongwana’s decision to increase the VAT rate, as announced in his Budget speech on 12 March. More on this shortly.

Why is the process of adoption ‘fundamentally flawed’?

In her affidavit, Zille argues that Parliament’s resolution to adopt the fiscal framework was “fatally irregular and unlawful”, because the “underlying reports accepted by the National Assembly and the NCOP had been unlawfully adopted by the National Assembly’s standing committee on finance and NCOP’s select committee on finance, and were themselves unlawful”.

According to Zille, the standing and select committees’ reports are unlawful for three reasons. First, the committees never voted on the final version of the report. The committees, she argues, “considered the framework clause by clause, without a final version that set out a clear statement”.

“A clear statement accepting or amending the fiscal framework and revenue proposals was never put to the committees for final adoption, and never appeared in the version of the report that the committees considered.”

Second, while the report states that the committees accepted the fiscal framework, it also suggests that changes should be made to it – such as the VAT hike – which is contradictory.

“The reports therefore do not comply with the requirements of section 8(4). The committees ought to have amended the reports themselves; not ‘accepted’ them while taking issue with a core component (the VAT increase),” Zille said.

And third, she argues, the adoption of the framework was the product of “a material error of law, and the taking into account of irrelevant considerations, in that members of the committees, and ActionSA in particular, acted under the misapprehension that recommending the reconsideration of the VAT increase would result in the VAT hike being halted”.

According to Zille, the recommendation made by ActionSA, that Godongwana should take 30 days to reconsider raising VAT and find other revenue sources, was “non-binding” and has no effect in law.

Read more: The Budget brouhaha and you — wallet pressure, service strain and the price of political paralysis

“The resolutions of the National Assembly and NCOP adopting these reports are therefore unlawful and unconstitutional. They must be declared invalid and set aside.

“This relief is urgent. If the budget process continues, it will be tainted by this illegality. South Africa’s economy cannot afford uncertainties about whether its budget was adopted lawfully or not. The matter needs to be resolved swiftly so that a lawful process may be undertaken,” she stated.

What is the ‘ministerial fiat’ that will increase VAT on 1 May?

Zille states in her founding affidavit: “If Parliament believes that the VAT hike will not happen because of its non-binding recommendations, it is mistaken. As of now, and as [a] matter of law, the VAT hike will go into effect on 1 May 2025.

“In fact, as demonstrated by the committee reports, the majority in Parliament appears dead set against a VAT hike.

“But the hike will come into effect by virtue of ministerial fiat.”

Simply put, the VAT hike will come into effect on 1 May because Godgongwana has said so, and section 7(4) of the VAT Act – which provides both for the imposition of tax as well as the rate of tax – gives him the power to change the VAT rate for one year without Parliament’s approval.

Section 7(4) of the VAT Act states:

“If the Minister makes an announcement in the national annual budget contemplated in section 27(1) of the Public Finance Management, 1999 (Act No.1 of 1999), that the VAT rate specified in this section is to be altered, that alteration will be effective from a date determined by the Minister in that announcement, and continues to apply for a period of 12 months from that date subject to Parliament passing legislation giving effect to that announcement within that period of 12 months.”

While the minister’s amendment to the VAT rate is “subject to” Parliament approving it within 12 months, Zille argues the tax increase will, as both a legal and practical matter, be irreversible because of the nature of VAT as a tax.

Part B: Why is section 7(4) ‘patently unconstitutional’?

Zille argues that section 7(4) of the VAT Act is “patently unconstitutional”.

“First, the VAT rate is set in section 7(1) itself. Section 7(4) allows the Minister to amend that provision. The power to amend legislation is a plenary power, that Parliament may not delegate to the executive.

“Second, it affords the Minister a power to impose an irreversible tax,” she said.

The crux of her argument is that because the power to amend legislation is a plenary power reserved, in terms of our Constitution, exclusively for Parliament, the power that section 7(4) gives the finance minister to amend section 7(1) is contrary to our Constitution and thus unconstitutional. DM