According to Thalia Petousis, portfolio manager at Allan Gray, market forecasts suggest the South African repo rate may be cut by 0.25% to 0.5% throughout 2025, with the final rate expected to be 7.25% to 7.5%.

“While 2024 began with US markets forecasting 1.75% worth of rate cuts for the year, in reality only 1.00% worth of rate cuts materialised. South Africa, by contrast to the US, only experienced 0.50% worth of rate cuts last year – taking the overnight repo rate from 8.25% to 7.75%. What is unusual about current SA inflation, which came in at 3% year-on-year in December, is how close it is to that seen in developed markets, running at only 0.1% higher than the US inflation rate,” she says.

Looking at inflation data over the 20 years to 2020, Petousis points out that South African inflation ran at 3.47% higher than US inflation on average. “Much of the current malaise in SA inflation can be attributed to weak local consumer health and low demand, in addition to a well-behaved rand exchange rate in 2024.”

Headline inflation has remained at the bottom of the inflation target band, supported by positive base effects and demand-driven pressures remaining contained. FNB economist Mamello Matikinca-Ngwenya says this trend is expected to remain intact until the second quarter of this year, when these drivers should become less favourable. For example, domestic demand was expected to improve. “Therefore, while current readings of data suggest that there is ample space to cut interest rates, a forward-looking approach still dictates that Taylor rule projections (observing one-year-ahead inflation projections) will dampen the amount of interest rate cuts,” she says.

FNB expects another 75 basis points worth of cuts delivered cumulatively over the first three meetings in the first half of the year, starting with 25bps this Thursday. However, economist Koketso Mano cautions that although optimism around medium-term growth still supports the narrative that South African growth is on an uptrend, that growth will rely heavily on structural reform implementation.

The South African Reserve Bank (SARB) maintained a cautious outlook on inflation last year, and Petousis says the Bank acted as the “canary in the coalmine warning developed markets that global inflationary trajectories were not cooling down to the degree that was anticipated”.

Read more: The rationality of public sector pay — simultaneously too high and not high enough (Part 1)

Also this week, public sector wage negotiations may come to a close, with potential above-CPI agreements. South Africa has the third-largest public sector wage bill as a proportion of GDP in the world, which at about 10.5% of GDP greatly exceeds that of countries including the US, UK, Australia and Japan.

Electricity and water tariffs

Higher water and electricity tariffs are also on the cards for this year. Eskom applied last year for a 36.15% tariff increase from 2025 – and the National Energy Regulator of South Africa’s decision to approve (or not approve) the increase is expected this Thursday.

“In the case of higher electricity tariffs, aside from just passing along the cost of non-paying municipalities to the broader consumer base, there is also a large cost building from unspent capital infrastructure. A cost-reflective tariff is just that – it is reflective of the costs being borne by the entity providing that service. As such, while Eskom spent R37-billion on maintenance in financial year 2024, going forward that cost is going to need to rise by more than 3.5x to R137-billion per year to expand generation, transmission and distribution capabilities,” Petousis says.

Read more: ‘Eskom, you are killing us’ — Gqeberha community members plead for halt to electricity tariff increases

Lullu Krugel, PWC chief economist for South Africa, says that although there is no comprehensive public data set covering tariffs set by the country’s water service authorities, Statistics South Africa data shows water prices have increased above the inflation rate since 2017. “This is a risk for 2025 as well,” she says, adding that PwC expects interest rate cuts of another 50 basis points during the first quarter of this year.

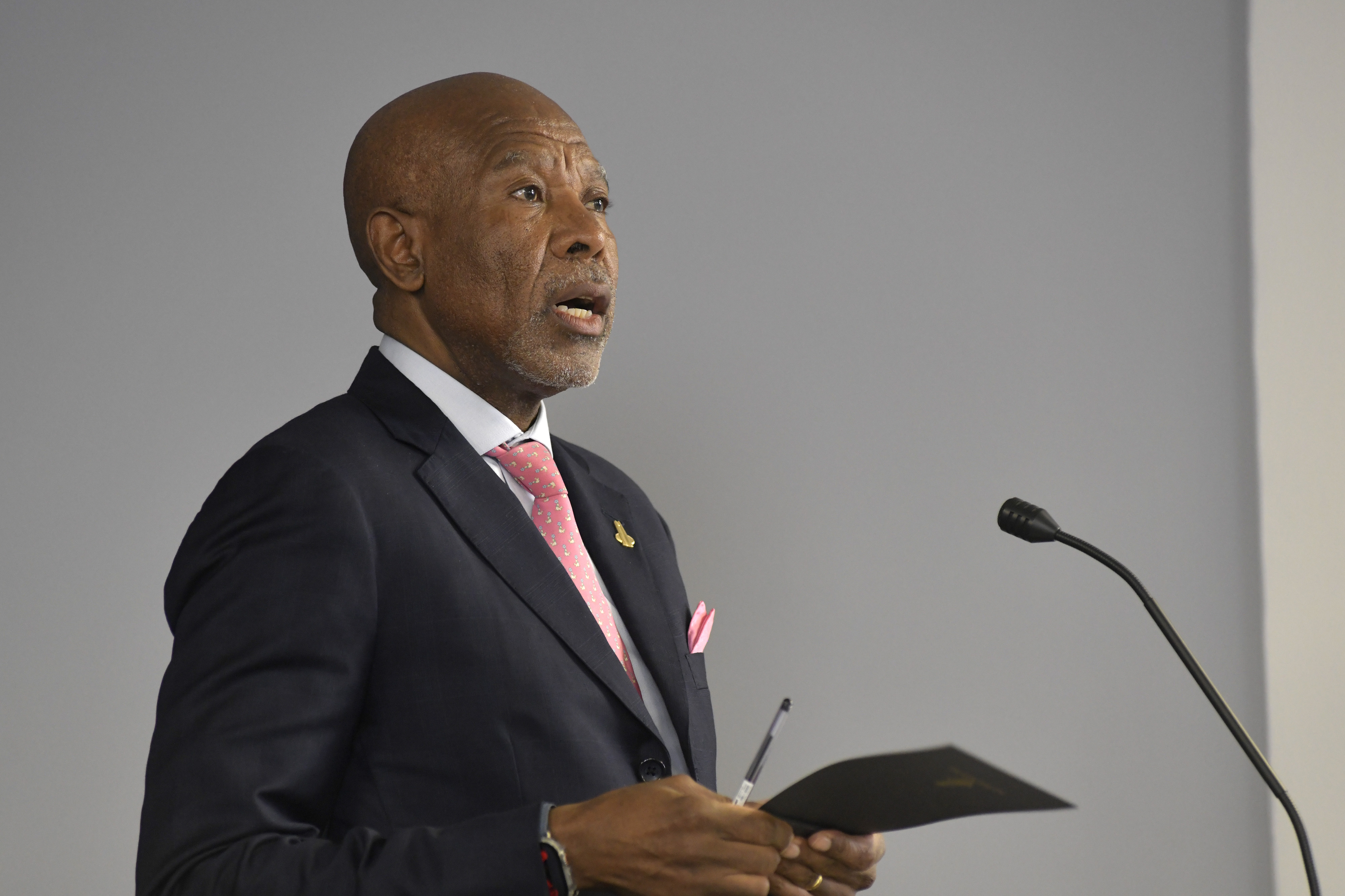

SARB governor Lesetja Kganyago said in November last year that the inflation target review being undertaken by the revenue bank and National Treasury “is coming to a conclusion”.

“While timelines are unknown, an announcement on a lowered target (potentially 3% to 5%) could be made in the short term… The best time to make this kind of adjustment to an inflation target is when inflation is low, like it is now.”

US trade tariff impact

The trade tariffs being bandied about by US President Donald Trump are having knock-on effects on markets around the globe and no less in South Africa. Petousis says the success and quantum of US tariffs have large spillover impacts for South Africa, as well as a host of markets, in the form of both export revenues and inflation.

“How these policies will unfold is still uncertain, but I am reminded of something my colleague Sandy McGregor wrote in 2022: ‘The problem is that we still do not know what the post-pandemic world is going to look like, and we are on a journey without a clear vision as to our destination.’ Perhaps the same can be said of a post-Trump world,” she notes. DM