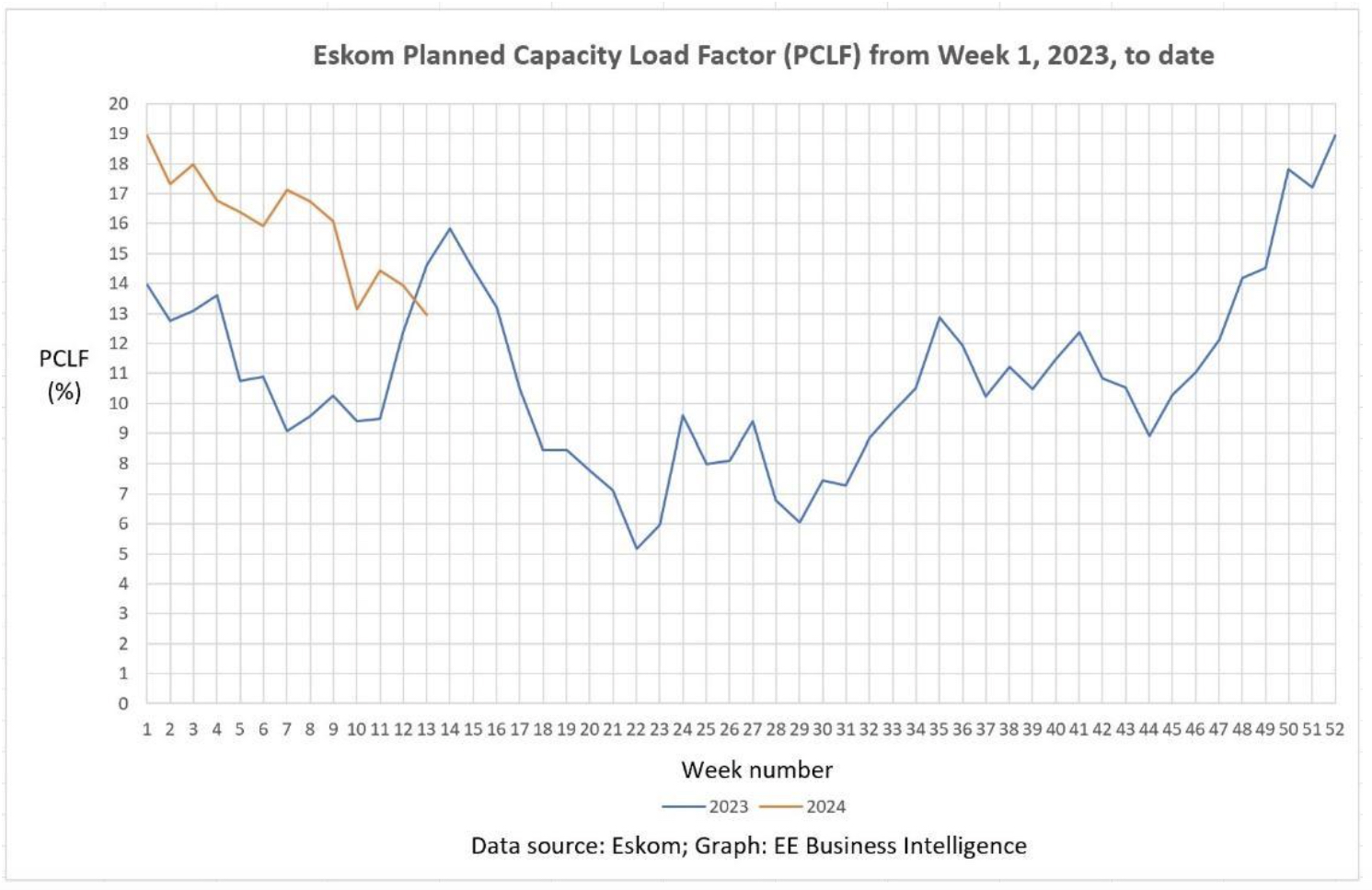

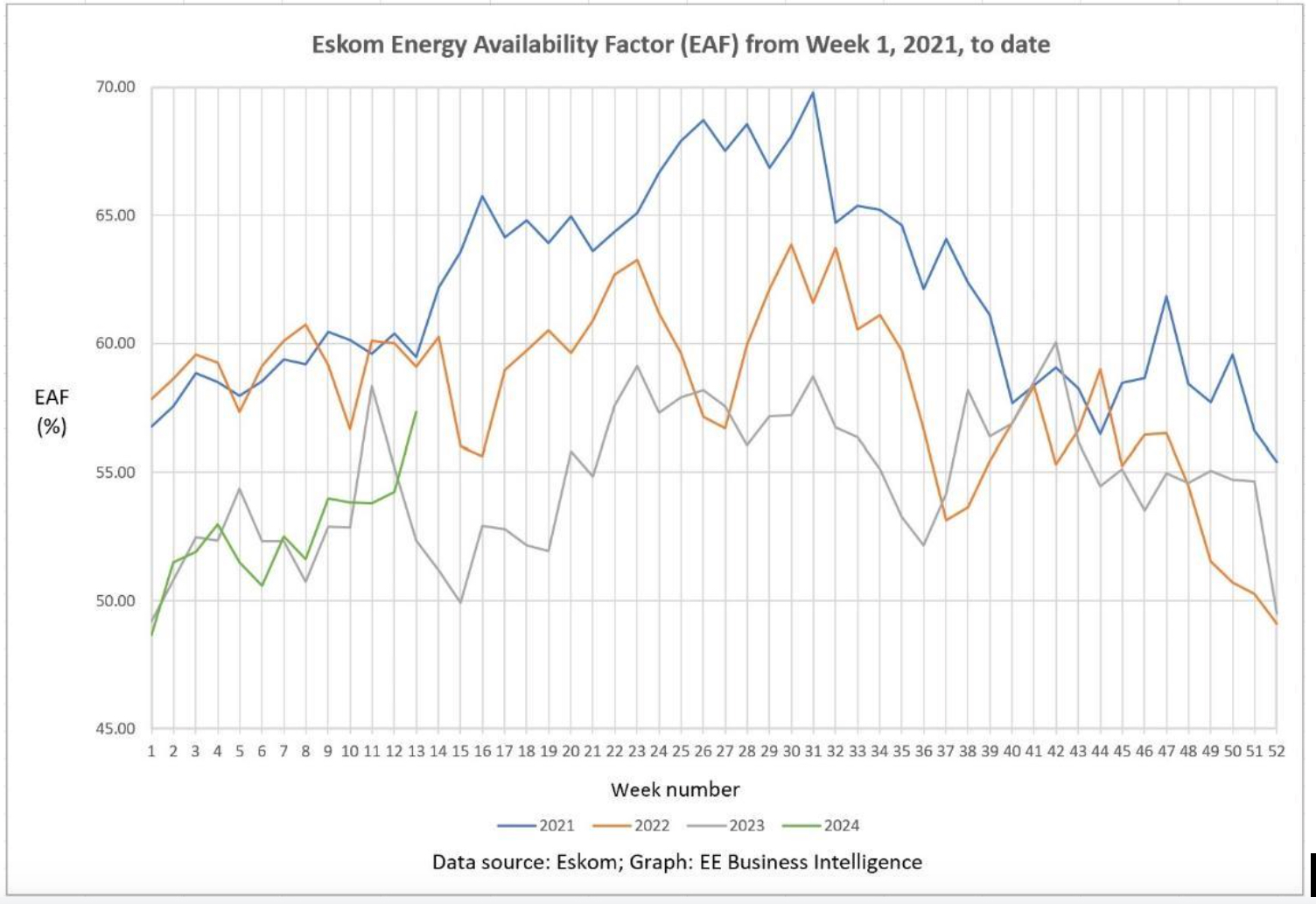

While unplanned breakdowns (UCLF) are down this year compared with the same period last year (Fig. 1), this is offset by increased planned maintenance outages (PCLF) this year, compared with the same period last year (Fig. 2). Thus, the availability of the Eskom fleet (EAF) this year is similar to that of the same period last year (Fig. 3).

So, why are we experiencing less load shedding this year compared with the same period last year?

Fig 1: Week-on-week Eskom Planned Capacity Load Factor (PCLF) from Week 1, 2023, to date.

Fig 1: Week-on-week Eskom Planned Capacity Load Factor (PCLF) from Week 1, 2023, to date.

Fig. 2: Week-on-week Eskom Unplanned Capacity Load Factor (UCLF) from Week 1, 2023, to date.

Fig. 2: Week-on-week Eskom Unplanned Capacity Load Factor (UCLF) from Week 1, 2023, to date.

Fig. 3: Week-on-week Eskom Energy Availability Factor (EAF) from Week 1, 2023, to date.

Fig. 3: Week-on-week Eskom Energy Availability Factor (EAF) from Week 1, 2023, to date.

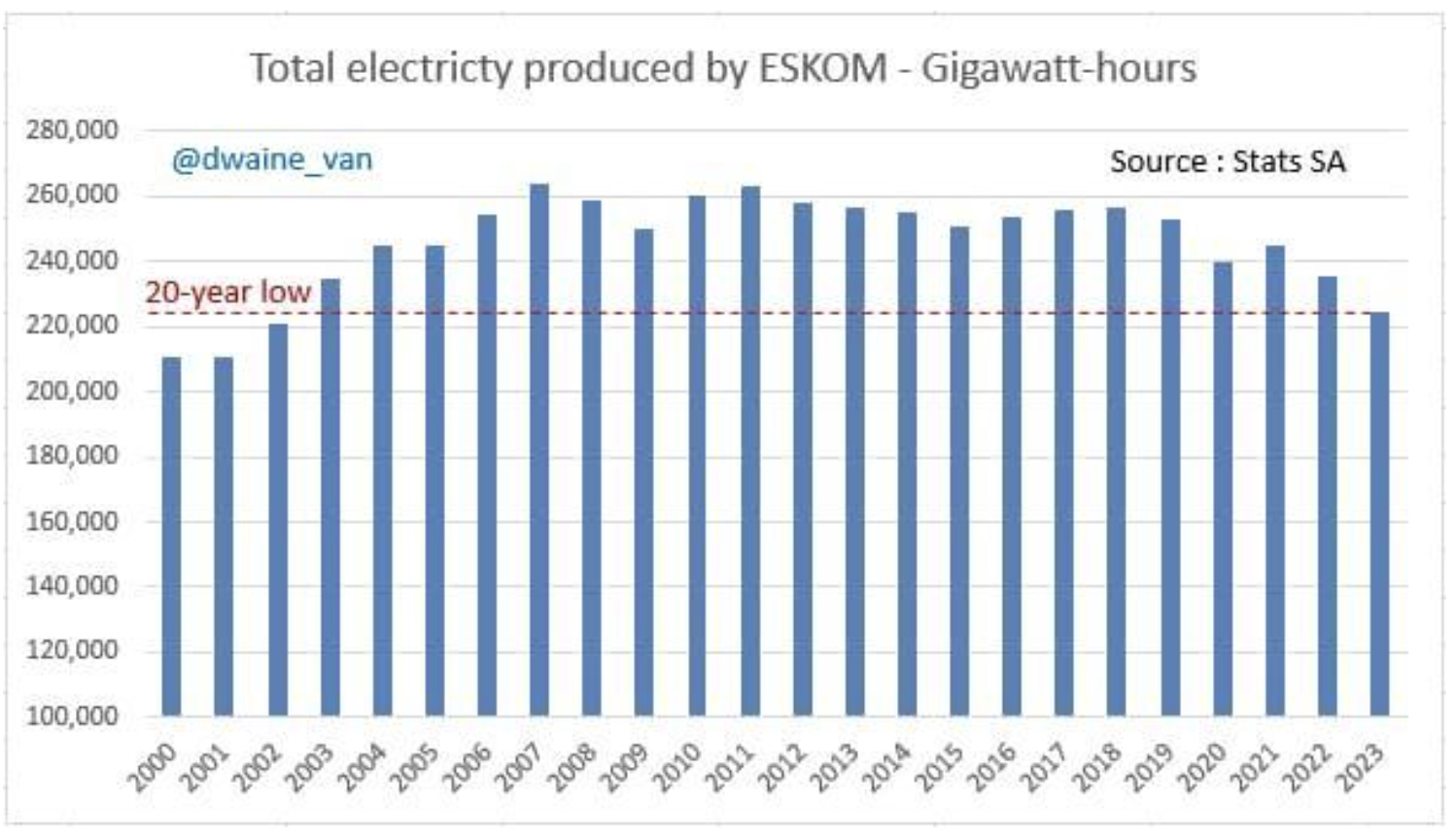

The answer is that demand for Eskom grid electricity continues to decline (Fig. 4), because of:

- The weak South African economy, and the resulting generally flat overall demand for electricity;

- The rapidly rising price of Eskom and municipal electricity of two to three times the inflation rate for many years, is dampening demand for Eskom-generated electricity;

- Load shedding and the low reliability of Eskom and municipal grid electricity, particularly over the past four years, has been negatively affecting electricity supply;

- Electricity customers are responding by moving to self-generation and alternative energy sources, including rooftop solar PV, battery energy storage, gas for cooking, solar hot water geysers, energy efficiency and a general reduction in demand for grid electricity; and

- The pipeline of big renewable energy and battery energy storage plants is now coming to the grid, and this trend is accelerating.

Fig. 4: Total electricity (GWh) produced by Eskom per year from 2000 to 2023. (Data source: Stats SA; Graph: Stats & Facts @dwain-van on X, 5 April 2024)

Fig. 4: Total electricity (GWh) produced by Eskom per year from 2000 to 2023. (Data source: Stats SA; Graph: Stats & Facts @dwain-van on X, 5 April 2024)

All this is relieving Eskom of a burden that it has been struggling to meet over the past few years, and this is resulting in a significant reduction in the frequency and intensity of load shedding this year compared with the same period last year.

So, Eskom has been in a death spiral of rising Eskom prices and load shedding, causing customers to move to alternative energy sources, causing declining Eskom sales volumes, causing rising prices to recover fixed Eskom costs off declining sales volumes, and so on.

At the same time, the utility has also been in something of a debt spiral, which has been arrested for the time being by government bailouts from National Treasury, which has put a moratorium on significant new debt by Eskom.

The utility death and debt spirals, and Treasury, are now forcing Eskom and the whole electricity supply industry in South Africa to restructure, unbundle and increase the role of the private sector in financing, construction, operation and maintenance of electricity generation, transmission and distribution infrastructure in South Africa.

This should not be seen as the privatisation of Eskom, but rather as increasing public participation in the business of Eskom by development finance institutions, commercial banks, pension funds, other financial institutions, business, industry and the public.

In transmission, we are seeing the creation of a nominally independent, state-owned national power transmission operating company (NTCSA), an independent market operator (IMO), and an electricity market in South Africa. We will also likely see new high-voltage transmission corridors that will be financed, built, operated and maintained via public-private partnership (PPP) concessions (like toll road concessions), because Eskom does not have the resources, money or balance sheet for this.

In generation, we are seeing the emergence of a diversified and competitive power generation sector, comprising Eskom and former Eskom generators, PPP generators, municipal generators, hundreds of independent power producers (IPPs), and literally thousands of big, medium and small “prosumers” (customers who are both producers and consumers of electricity).

Instead of Eskom being the single buyer of electricity from its own generators and from IPPs, there is an increasing trend of wheeling and trading of electricity between independent power producers, generators and traders to a multitude of customers across publicly owned electricity grids in southern Africa.

Read more in Daily Maverick: Eskom news

A fundamental change is taking place in the electricity sector of South Africa as it starts to catch up with those in many other parts of the world. This change is in progress now, but is not a fait accompli yet, and it could be reversed if reactionary, backward-looking naysayers and “doolittles” in the country, with vested interests in the failed status quo, get their way politically.

But there is reason for optimism. The pace of reform in the electricity supply industry of South Africa is now gathering momentum, driven by the need for decarbonisation and security of supply, and the reality of the economic imperatives.

There is also a growing multiparty consensus in Parliament on the passage of the long-awaited Electricity Regulation Amendment Bill. Once promulgated, the new act will provide the necessary legal, policy, regulatory and planning framework for the envisaged reforms, and the future electricity supply industry in South Africa.

However, what remains to be seen are the necessary reforms in the significantly dysfunctional Eskom and municipal and electricity distribution industry. This thorny issue is still unresolved. DM

Chris Yelland is managing director, EE Business Intelligence.

© Copyright 2024 – EE Business Intelligence (Pty) Ltd. All rights reserved. This article may not be published without the written permission of EE Business Intelligence.

Fig. 4: Total electricity (GWh) produced by Eskom per year from 2000 to 2023. (Data source: Stats SA; Graph: Stats & Facts @dwain-van on X, 5 April 2024)

Fig. 4: Total electricity (GWh) produced by Eskom per year from 2000 to 2023. (Data source: Stats SA; Graph: Stats & Facts @dwain-van on X, 5 April 2024)