South African platinum group metals producers got a big lift late last week when the US asked its allies in the Group of Seven to mull imposing sanctions on Russian palladium exports.

This is a big deal. While South Africa is by far the world’s biggest producer of platinum group metals as a basket, Russia is the top producer of one: palladium.

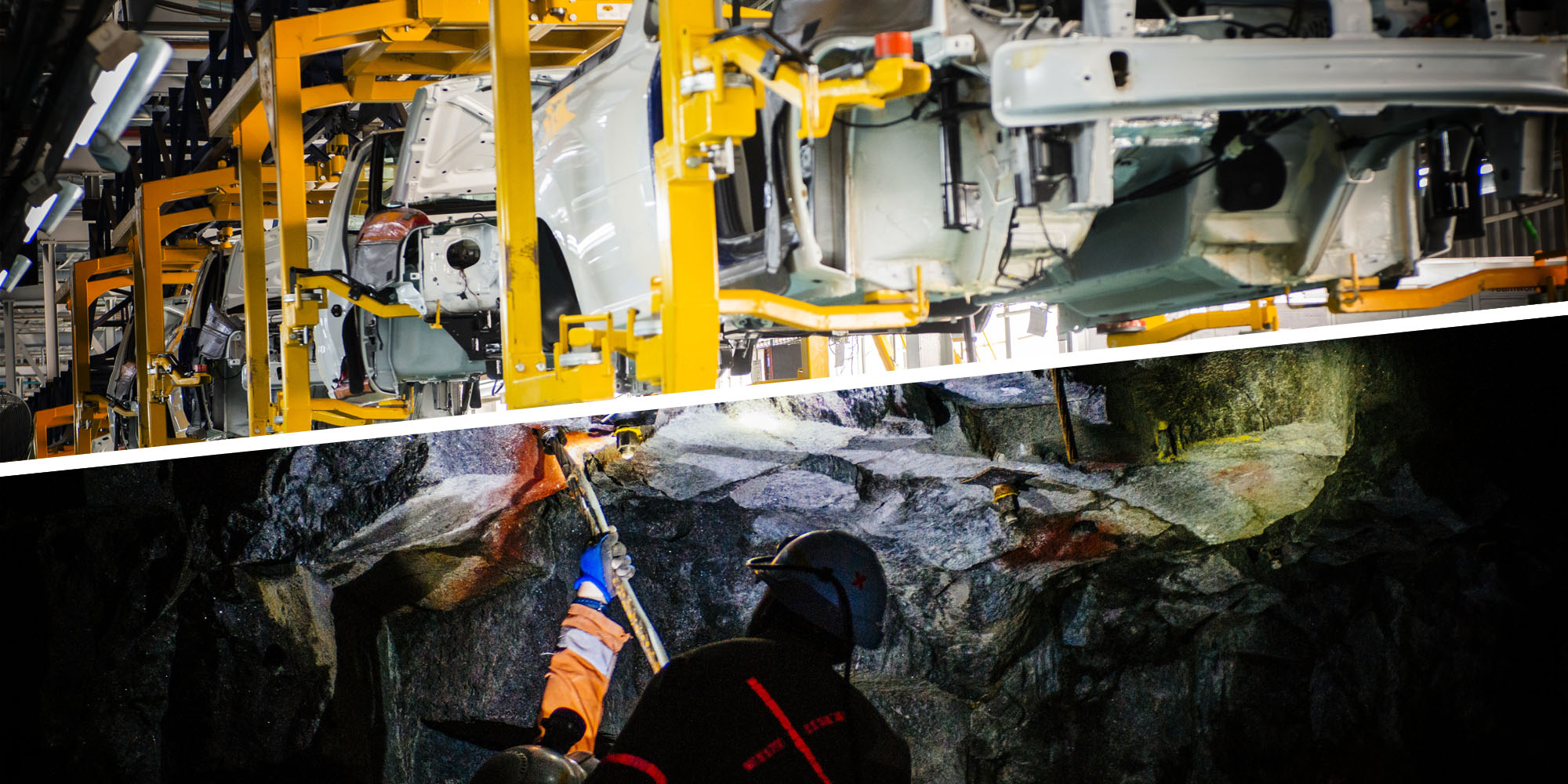

Palladium is the key autocatalyst to cap emissions in petrol engines, and supplies are tightening. Sibanye-Stillwater recently put its palladium-rich Stillwater West mine in Montana on care and maintenance, which will take about 200,000 ounces out of global production.

Read more: Sibanye puts Montana mine on care and maintenance — H1 earnings sink, shares soar as rights issue ‘muted’

News of the sanctions suggestion last Wednesday by the Biden administration has sent the palladium price soaring. It has gained more than 12% since, climbing to $1,220 (about R19,850) an ounce, its highest levels in 10 months.

This in turn has lifted the share prices of South African platinum group metals producers.

As of midday Monday, Anglo American Platinum’s (Amplats) share price was up more than 12% since Wednesday last week, Sibanye’s had gained close to 12%, Impala Platinum’s was almost 10% higher, and Northam Platinum’s had jumped over 10%.

A miner holds a piece of platinum-rich ore. (Photo: Waldo Swiegers / Bloomberg via Getty Images)

A miner holds a piece of platinum-rich ore. (Photo: Waldo Swiegers / Bloomberg via Getty Images)

Platinum group metals prices have been waylaid by a range of factors, including the still relatively fragile global economic recovery and the hype around electric vehicles, which don’t use the precious metals except in hybrid form.

This has been eating into the profits of South African platinum group metals producers, undermining their share prices and raising questions about the viability of many shafts.

But platinum group metals have many industrial uses and their application to the emerging hydrogen economy amid perceptions that obituaries of the internal combustion engine are premature are seen underpinning prices in the longer run.

Read more: Hope springs eternal on the platinum group metals front — with reason

And now talk of sanctions on Russian palladium has triggered a rally. Russia has been supplying China, where metal movements are opaque. But the US pointedly kept palladium off the sanctions lift, a signal that the world’s biggest economy needs the metal and it did not want supplies being disrupted.

That is, until now.

This raises the stakes dramatically for South African platinum group metals producers in next week’s US presidential election, which remains a nail-biting toss-up between Democratic nominee Vice-President Kamala Harris and former president Donald Trump, the Republican candidate.

A Harris administration would presumably keep the prospects of palladium sanctions on Russia in play. This would further support palladium prices, which remain about a third of the record peaks of close to $3,000 an ounce scaled 3½ years ago.

Mined platinum-rich rock sits inside a freight wagon in a mine shaft during a media tour of the Sibanye-Stillwater Khuseleka platinum mine, operated by Sibanye Gold, outside Rustenburg, South Africa. (Photo: Waldo Swiegers / Bloomberg via Getty Images)

Mined platinum-rich rock sits inside a freight wagon in a mine shaft during a media tour of the Sibanye-Stillwater Khuseleka platinum mine, operated by Sibanye Gold, outside Rustenburg, South Africa. (Photo: Waldo Swiegers / Bloomberg via Getty Images)

On the other hand, a Trump administration is unlikely to be as tough on Russia — it will certainly abandon Ukraine — and might not pursue such sanctions.

Increasingly unhinged, incoherent, and racist — in fact, downright fascist — Trump is regarded by many as a Kremlin asset.

It must also be noted that Putin himself in September floated the idea of restricting Russian metals exports in retaliation for Western sanctions.

Putin mentioned uranium, titanium and nickel — not palladium — but it conceivably could be thrown into the mix as well. One suspects that a Harris administration with its support for Ukraine could trigger such a move by Moscow.

On the platinum group metals political front, Trump has long denigrated electric vehicles and wants to drill for oil and gas wherever it may be found in the US. By that reckoning, some platinum group metals executives might hold the view that a Trump administration would be better for their product than a Harris White House.

Shameless grifter

But Trump has recently embraced electric vehicles — albeit in a lukewarm kind of way — purely because he’s a shameless grifter and is being enthusiastically backed by Tesla CEO Elon Musk, the richest person on Earth.

And Trump, who has no basic grasp of economics, would pursue economic policies such as massive tariffs that would trigger a trade war with China and further undermine the global economy.

That would be bad for most commodities with the exception of gold, which thrives on chaos and uncertainty.

Almost two dozen US recipients of the Nobel Prize for economics recently signed a letter saying that Harris’ economic agenda was “vastly superior” to Trump’s.

Sanctions and tariffs are two punitive economic measures that, as US policy instruments, will hinge on the outcome of next week’s election. South Africa’s platinum group metals industry is waiting with bated breath. DM

Mined platinum-rich rock sits inside a freight wagon in a mine shaft during a media tour of the Sibanye-Stillwater Khuseleka platinum mine, operated by Sibanye Gold, outside Rustenburg. (Photo: Waldo Swiegers / Bloomberg via Getty Images)

Mined platinum-rich rock sits inside a freight wagon in a mine shaft during a media tour of the Sibanye-Stillwater Khuseleka platinum mine, operated by Sibanye Gold, outside Rustenburg. (Photo: Waldo Swiegers / Bloomberg via Getty Images)