Local and international motor vehicle manufacturers that invest in new assets including buildings, plants and machinery, or in improvements to assets to produce battery electric and hydrogen-powered vehicles in South Africa, will be able to deduct 150% of the cost of that investment from their taxable income — from March next year.

The National Treasury confirmed this with Daily Maverick, clarifying: “For example, if a business spends R1-million, they can deduct R1.5-million.”

The tax cost related to this incentive is estimated to be R500-million for 2026/27 and the incentive is applicable in the year the investment assets are brought into use.

The 2024 Taxation Laws Amendment Bill, which allowed for this incentive, was formally tabled on Wednesday, 30 October 2024, and was signed into law last Friday.

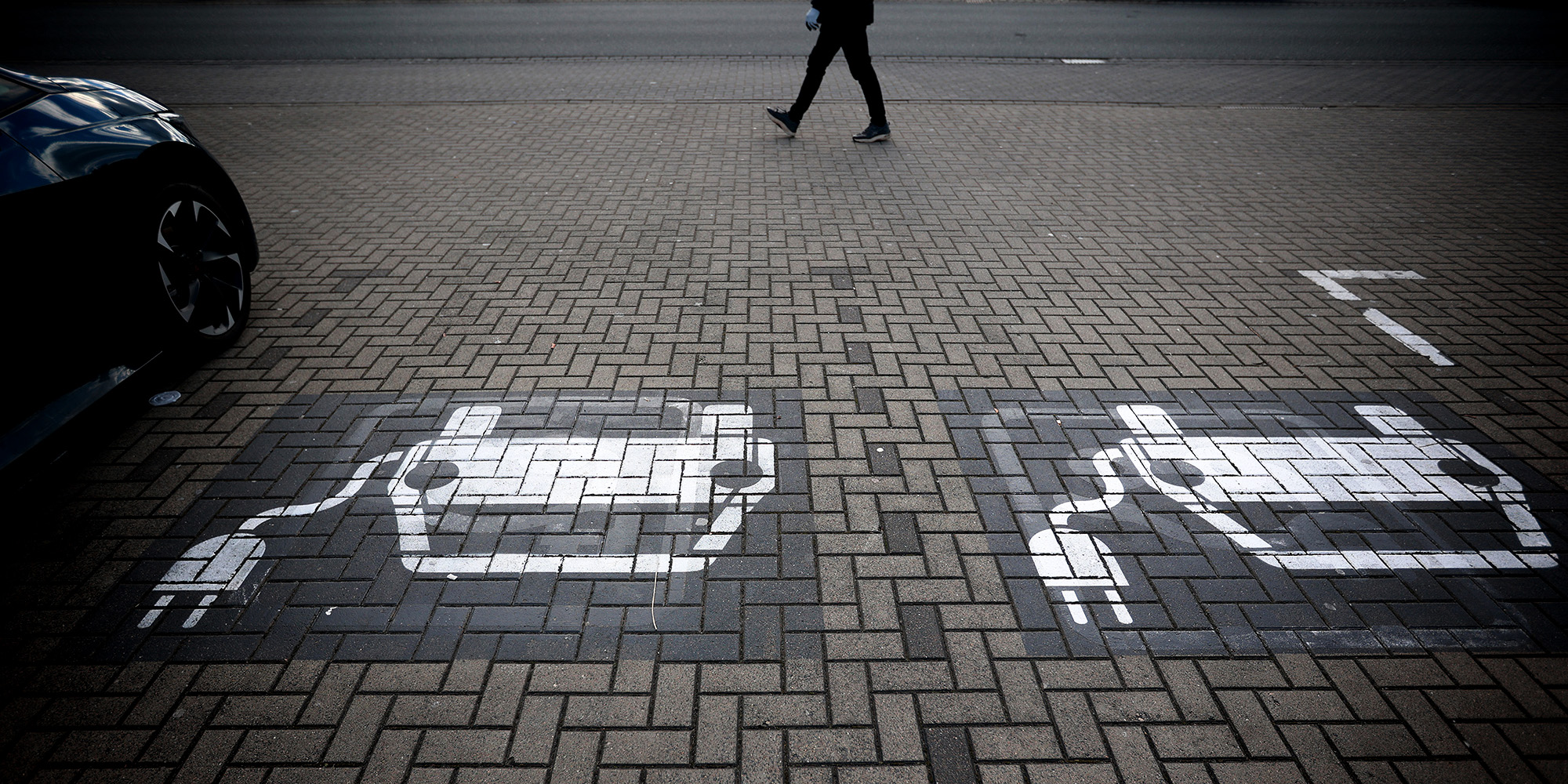

Kickstarting production of cleaner cars

It is the latest development in South Africa’s nascent new energy vehicle sector as the government sets out to develop and attract investment in the local production of emission-free vehicles in line with climate imperatives and a changing automotive market globally.

In his Budget speech in February last year, Finance Minister Enoch Godongwana said: “The Electric Vehicles White Paper outlines our strategy to transition towards broader new energy vehicle production and consumption in South Africa, starting with electric vehicles. It aims to transition the automotive industry from primarily producing internal combustion engine vehicles to a dual platform that includes electric vehicles, by 2035.”

In the same speech, the minister also announced an investment incentive beginning on 1 March 2026. He said the government had budgeted R964-million over the medium term “to support the transition to electric vehicles”.

A Draft Explanatory Memorandum on the Draft Taxation Laws Amendment Bill 2024 notes that “the compelling reasons behind this transition (to new energy vehicles) include the urgent need to address environmental concerns and for countries to meet their national emission reduction commitments stemming from the Paris Agreement. Additionally, some of South Africa’s key export markets like the European Union (EU) and the United Kingdom (UK) have announced their intentions to ban the sale of new ICE (internal combustion engine) vehicles by 2035.”

Since the majority of cars made in South Africa are exported to those countries, the transition is essential if the country is to maintain its “strategic position in the global automotive export industry”.

As GreenCape’s 2024 Electric Vehicles Market Intelligence Report explains, “South Africa is still largely an EV (electronic vehicle) import market with limited local manufacturing of EVs and components locally with the exception of electric two- and three-wheelers”.

Automotive industry a big economic player

The Automotive Business Council has previously noted that South Africa’s automotive industry contributes 5.3% to gross domestic product — 3.2% manufacturing and 2.1% retail, and in 2023 the export of vehicles and automotive components reached a record R270.8-billion, equating to 14.7% of South Africa’s total exports.

The industry accounts for 21.9% of the country’s manufacturing output, and vehicles and components are exported to 148 international markets. In terms of employment, the manufacturing segment of the industry presently employs about 116,000 people across its various tiers of activity.

“Combined with the industry’s strong multiplier effect, it is responsible for approximately 498,000 jobs across the South African economy’s formal sector,” the council notes.

But though vehicle manufacturing makes a strong economic contribution, the transport sector at large is also a major polluter.

According to South Africa’s 9th National Greenhouse Gas Inventory, published in May last year, the second largest source of emissions from fuel combustion activities was the transport sector, which was “largely dominated by emissions from road transportation”.

More specifically, the South African transport sector represents the third highest emissions contributor (57 Mt of CO₂ per annum or 10,8% of national greenhouse gas emissions) to South Africa’s carbon emissions profile, as detailed in South Africa’s Just Energy Transition Investment Plan.

“Of these emissions, road transport is responsible for 91.2%,” the authors wrote.

Transitioning to new energy vehicles will help the country’s efforts to mitigate its emissions — currently the highest on the continent and consistently in the top 20 on the planet.

The Just Energy Transition Investment Plan

The tax incentive dovetails with the Just Energy Transition Investment Plan, with the authors writing in the the funding requirements section of the plan that new energy vehicles — both hydrogen and electric — require R128-billion between 2023 and 2027, with R70-billion going to “new energy vehicle deployment support” and R41-billion earmarked for “industrial development and innovation”.

Asked about the envisioned economic outcomes in terms of job creation, skills development, and local supply chain growth, the National Treasury told Daily Maverick that “the tax incentive serves as a complement” to the Department of Trade, Industry and Competition’s “strategy to transition to new automotive technologies”.

“Because 60% of local motor vehicle production is destined for the export market, the department is currently focusing on a ‘production-led’ strategy. The incentive aims to encourage local production of electric vehicles for export as countries start to impose bans on internal combustion engine vehicles.

“While a tax incentive can contribute to investment decisions that have the potential to boost employment, skills development and local supply chain growth, it is not the only factor. Companies also consider factors such as access to market, availability of skills, infrastructure, etc. so it is difficult to estimate outcomes in advance that will be solely attributable to the tax incentive,” the National Treasury said.

Asked if there were plans to complement this initiative with consumer-focused policies, such as subsidies or tax rebates, to accelerate the adoption of electric and hydrogen vehicles domestically, the National Treasury said that Godongwana “has not made any announcement in this regard”. DM

https://www.youtube.com/watch?v=REeWvTRUpMk