Consumers thinking they have been let off the hook because personal income taxes have not been increased are in for a rude surprise.

The decision not to adjust personal income tax and rebates for inflation (a decision that has been in place since 2023), means that in real terms, you end up paying more tax over the long-term due to bracket creep.

Bracket creep occurs when an increase in salaries pushes you into a higher tax bracket. For ordinary taxpayers, this could mean feeling like you are earning more on paper but actually having less spending power. For the government, it’s a subtle way to boost revenue without explicitly increasing tax rates.

There will also be no changes with medical tax credits, which remain at R364 per month for the first two beneficiaries, and R246 for the remaining beneficiaries.

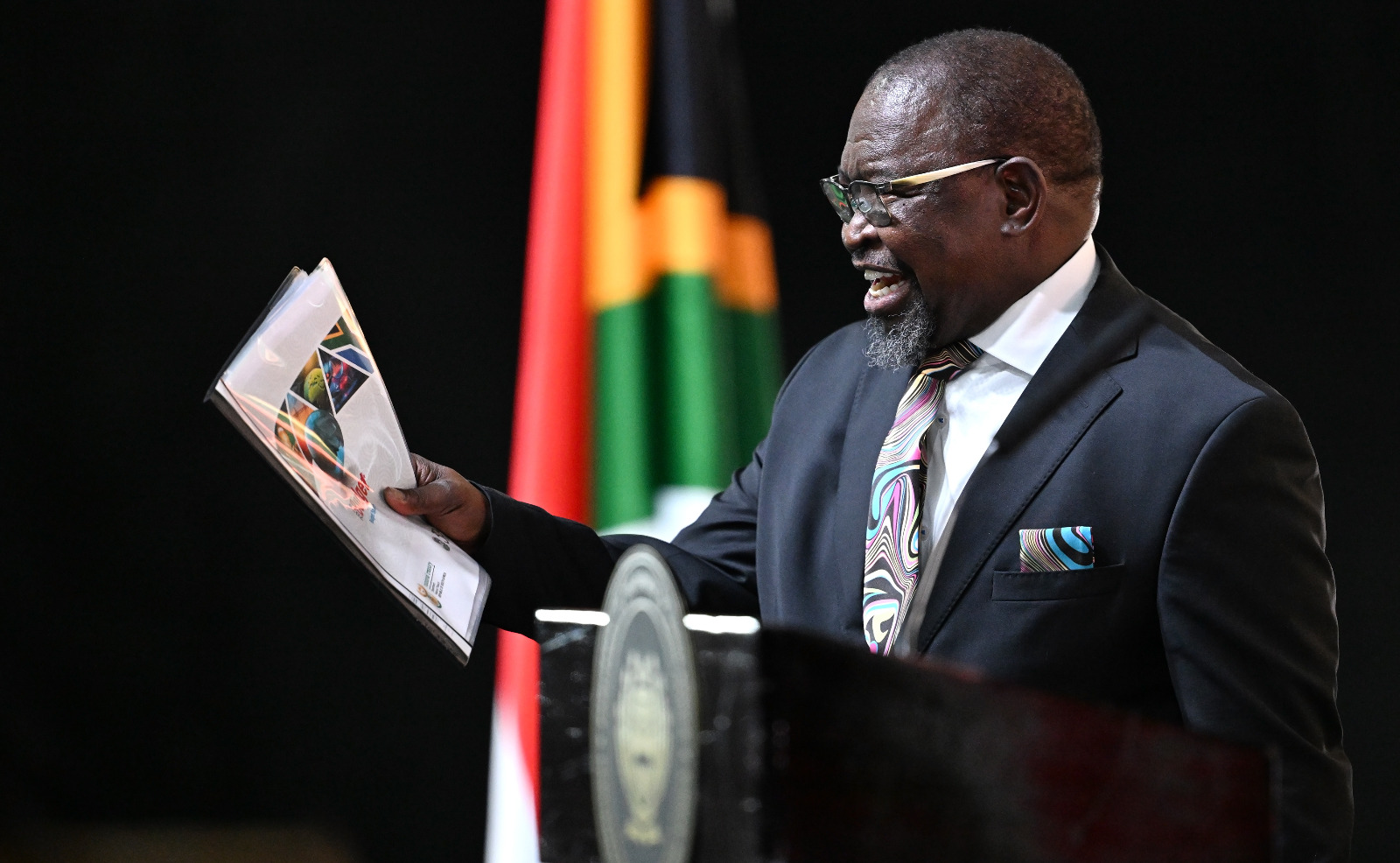

In his speech, Finance Minister Enoch Godongwana announced that “the revenue proposed through the tax measures announced in this budget will contribute largely to us providing R232.6-billion in additional funding to key programmes over the medium term. This amounts to R102-billion in 2025/26, and R68-billion 2026/27.”

Join Daily Maverick’s webinar: The Budget Finally Lands: What you need to know

South Africa’s tax-to-GDP ratio is expected to reach 25.4% by 2027/28, with gross tax revenue collections increasing by 8.7% in 2025/26, 7.8% in 2026/27, and 6.6% in 2027/28.

The Budget Review points out that higher personal income taxes would reduce the incentive to work and save, with potentially larger impacts on the economy.

“Over the past decade, several measures have been implemented to raise personal income taxes. While these have increased the tax burden on individuals, the tax rate increases generated less revenue than expected. South Africa’s personal income tax collection measured as a contribution to GDP, and the top tax rate, are far higher than those of most developing countries.”

Transfer duty

Although the monetary thresholds for transfer duties will be adjusted by 10% from 1 April 2025 to compensate for inflation, transfer duty tax rates will remain unchanged.

Increased revenue expectations

In his budget speech today, the minister announced an increase in the revenue estimate to R1.846-trillion, from R1.841-trillion announced in last year’s Medium-Term Budget Policy Statement (MTBPS).

Commenting on this, SARS Commissioner Edward Kieswetter said overall employment and consumption taxes had and were expected to perform strongly towards the end of the 2024/25 financial year, while import taxes and fuel levies were expected to underperform. Corporate taxes had grown positively, except for mining corporate taxes that continued to underperform due to declining volumes and prices coupled with challenges in the networked logistics sector.

Fuel levy

According to SARS, the fuel levy had also adversely influenced revenue collection. In the 2024 budget, fuel levy collection was estimated at R95.8-billion, and this was revised downward in the MTBPS to R82.4-billion, purely based on lower than estimated consumption. Fuel consumption as at February 2025 was 21 billion litres compared with 24 billion in the prior year, due to increased energy availability. The settlement of significant refunds of prior years had further reduced the fuel levy. It was now projected to end at only R80.6-billion, or R15.2-billion lower than originally estimated.

Kieswetter said: “SARS revenue collection accounts for 90% of government expenditure. This requires SARS to do all that is possible within its mandate to ensure that all revenue due to the fiscus is collected to support the government’s development goals, despite the sluggish economy. Efficient and effective collection of all revenue will help to maintain overall fiscal stability. Pursuit of domestic resource mobilisation is key to our country’s development and protecting its future.” DM