The collapse of merger talks for the second time in five years between Rebosis Property Fund and Delta Property Fund, which blighted ambitions of creating SA’s largest black-owned real estate group, was largely expected.

Discontent among Rebosis and Delta shareholders had been growing in recent weeks, with some saying the proposed merger, which would have created an entity that owned real estate assets worth about R28-billion, was intended to rescue debt-laden Rebosis.

Some shareholders, who would hold sway in collapsing the proposed merger through an impending vote, preferred Rebosis and Delta to be standalone real estate companies, as the latter’s financial position isn’t as dire as the former’s. But the proposed merger, which has been in the making since August 2019, didn’t even reach the stage of it having to be approved by shareholders through a vote, or transaction advisers releasing financial terms of how it will work.

On the morning of Tuesday 3 March 2020, Rebosis and Delta jointly announced that merger talks had been scrapped, sending Delta’s penny stock 45% higher to 63 cents well into the close of Wednesday’s (4 March) trading session. Arguably, this is an indication that shareholders are happy that merger talks have collapsed considering that Delta shares, which have crashed by 71.4% over the past year, recovered to levels last seen on 6 February 2020.

Meanwhile, Rebosis B-shares, which have fallen by 84.4% over the past year, finished in the red at 33 cents on Wednesday. Rebosis has a dual share structure that caters to shareholders with different risk appetites. Shareholders who own the B-shares are usually the last in line to receive dividends.

Merger promises

The merger was proposed by both companies with the promise of creating an entity that would be able to easily raise capital to fund growth projects — because real estate shareholders in SA like companies with the scale to ride out SA’s stalling economy and the resultant lack of demand for property space by tenants.

The combined entity would have had diverse assets; Delta owns a portfolio of properties worth R11.3-billion, comprising 81 office properties tenanted by government departments, and Rebosis’s R16.3-billion worth portfolio includes shopping centres and more than 30 office properties that are mostly let to government departments and agencies.

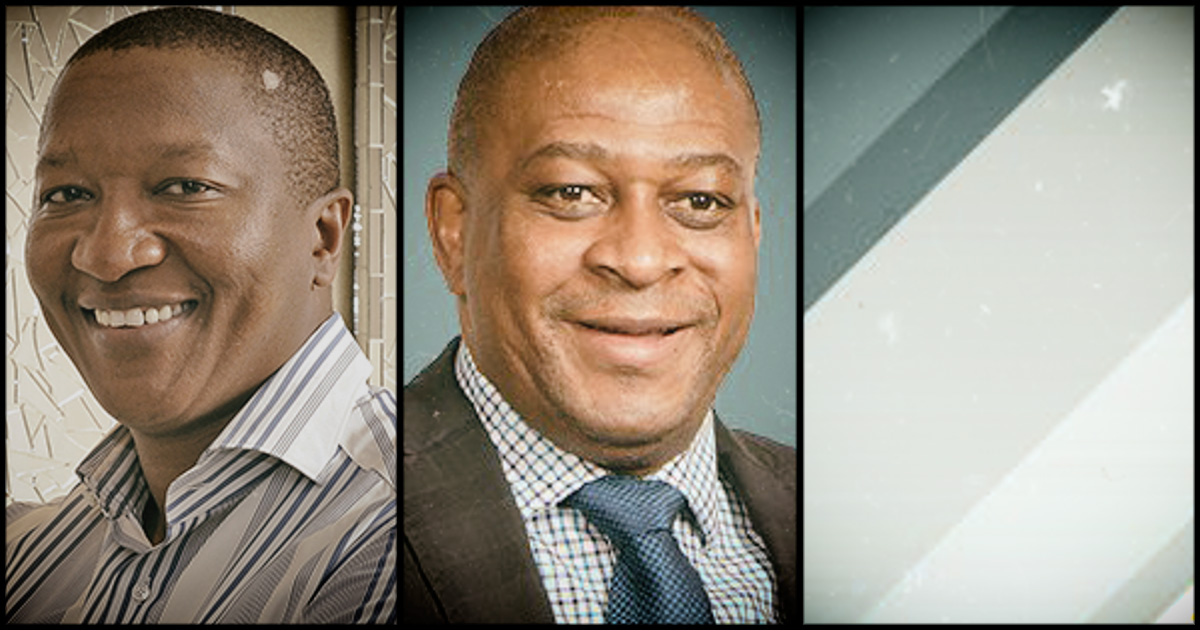

But most of all, a successful merger would see two of SA’s prominent real estate barons, Sisa Ngebulana (founder and CEO of Rebosis) and Sandile Nomvete (co-founder and CEO of Delta), join forces at a time when racial transformation in the sector remains woeful.

Although both parties didn’t proffer reasons for ending the merger talks, it was widely known that it would be difficult for the merger to pass muster with shareholders.

“Given Rebosis’s high debt levels and constrained balance sheet, it would have naturally been difficult for the merger with Delta to be concluded. Market conditions have worsened and shareholders are cautious about the real estate sector since both companies tried to merge for the first time in 2014,” a Johannesburg-based asset manager said.

In 2014, Delta and Rebosis were in a three-way proposed merger with Ascension Properties. However, the three companies called off merger talks after signing a co-operation agreement, saying it was “not opportune”.

Life after merger talks

Rebosis faces a debt burden of R10.1-billion as of August 2019. The value of its real estate assets is R16.3-billion. Its debt position was worsened by its R1.26-billion investment in the UK in 2015 – through shopping centre owner New Frontier Properties – which has since soured due to Brexit as it led to a more than R2-billion impairment in the investment and a R96-million loss in income for the six months to February 2019.

Underscoring Rebosis’s debt burden is a loan-to-value (LTV) ratio, a key metric used in the real estate sector to measure a company’s debt against the value of its assets. Rebosis’ LTV ratio sits at 64.5%, which is the highest in the real estate sector and places the company under enormous risk of missing debt payments if lenders were to immediately call loan repayments. Delta’s LTV ratio is at a much lower 44.3%, which is still high. Shareholders prefer it to be below 40%.

When Ngebulana was recently asked what would become of Rebosis if the merger was not successful, he told Business Maverick:

“We have been approached by a lot of private equity players, which would mean that if concluded, they would buy out Rebosis and will delist it from the JSE. The Rebosis board will consider the offers. But before doing this, we would first do a capital raise to fix the balance sheet [and pay down debt].”

Delta faces the same prospects: to be either bought out or raise capital to give it room to reduce debt and conclude its protracted process to get government departments to conclude new leases at favourable terms. BM

This article is more than 5 years old

Business Maverick

Rebosis and Delta ponder future as bid to create SA’s largest black-owned real estate group collapses

For the second time in five years, real estate titans Sisa Ngebulana of Rebosis Property Fund and Sandile Nomvete of Delta Property Fund have failed to cement a merger. Both companies now face an uncertain future as they wrestle with uncomfortable debt levels and worsening SA economy.