The Monetary Policy Committee (MPC) of the South African Reserve Bank cut its repo rate by 25 basis points on Thursday, bringing it to 7.75% and the prime lending rate to 11.25% – a move triggered by a brightening inflation outlook that could perhaps herald a lower target range.

Following a 25-basis-point cut in September, it all adds up to a 50-basis-point decrease over the past two months, bringing some relief to South African households and consumers in time for the festive season. And economists are forecasting another 50-basis-point reduction in the first half of 2025.

“South Africa’s housing market is poised for a much-needed recovery following the latest interest rate cut,” Standard Bank said in a statement. “The September rate cut sparked positive sentiment, with data from Standard Bank indicating an uptick in home loan applications and new home loan approvals.”

The Reserve Bank is laser-focused on inflation and its aim has been the mid-point of its mandated 3% to 6% target range. In October, consumer inflation slowed to 2.8% year on year, its lowest level in over four years, which raised hopes in some quarters that the Reserve Bank might go for 50 basis points.

But the decision among MPC members was unanimous as the Reserve Bank takes its typically cautious approach.

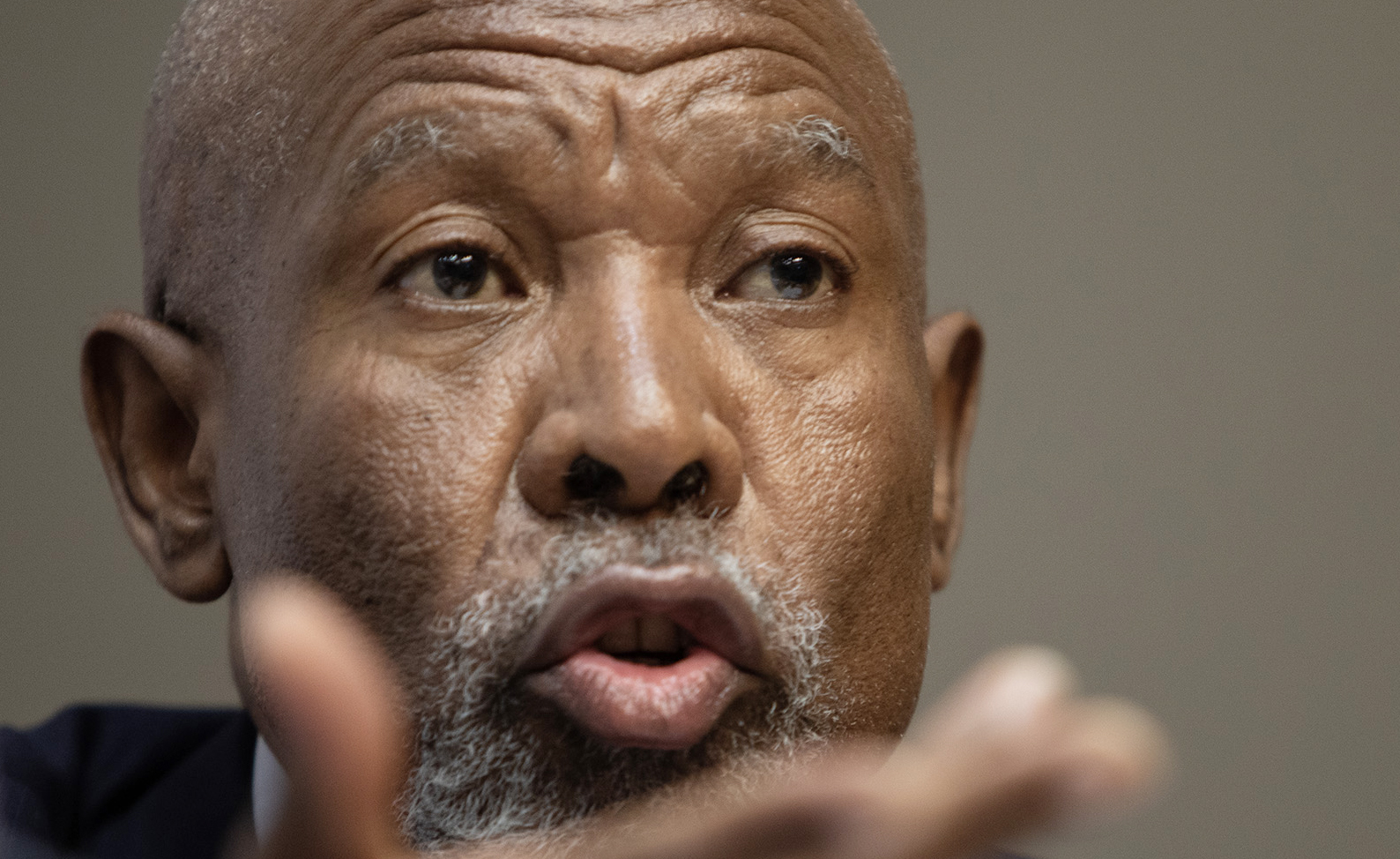

“The environment is uncertain and it calls for caution,” Governor Lesetja Kganyago said during the Q&A which followed his reading of the MPC statement and announcement of the decision.

Inflation outlook is certainly improving

“Goods prices have slowed more than those for services, which mainly reflects the benefits of a stronger exchange rate and a lower oil price, relative to last year. These temporary supply shocks are likely to keep inflation below 4% until mid-2025,” the MPC statement said.

That is important – the Reserve Bank sees inflation in the bottom of its mandated range and well below the 4.5% mark it is more comfortable with, but still regards it as uncomfortably high.

“Thereafter, we see inflation modestly higher relative to our September projections, reaching 4.6% from late 2025, rather than 4.4%. This is primarily because of a higher electricity price assumption.”

Eskom has been keeping the lights on, but it can still spoil the party.

“In the near term, inflation appears well contained. However, the medium-term outlook is highly uncertain, with material upside risks. These include higher prices for food, electricity and water, as well as insurance premiums and wage settlements,” the statement said.

The Reserve Bank is also determined to anchor inflation expectations even lower and the governor said there was a “process” – meaning talks – that were ongoing with the Treasury on the inflation target, which is set by the government.

“We believe it is coming to a conclusion. We can’t quite give you the timeline because the debates become very rigorous. And once that process completes itself, we will say what the target is ... whether it is 3%, 2% or 4%,” he said.

Kganyago recently made an eloquent case for a 3% target and that is clearly the Reserve Bank’s preference.

Read more: Reserve Bank governor Kganyago brings clarity to the costs of getting SA inflation to 4.5%

A lot can happen between now and the MPC’s next scheduled rate announcement on 30 January 2025. The rand exchange rate, oil prices, the incoming Trump administration and what that could mean for US and hence global interest rates, including South Africa’s. There are a lot of moving parts that influence monetary policy.

South African maize futures prices hit record highs this week at more than R6,300 a tonne, a trend that will stoke prices for the staple next year.

But for now, the inflation and interest rate outlook are the brightest they have been for years. That is testimony to the Reserve Bank’s relentless focus on inflation, and that is something to raise a glass to. DM