It warned about the looming catastrophe for months and now its worst fears have come to pass – Astral Foods says rolling blackouts have cost it three-quarters of a billion rand in just half a year.

The group released its interim results on Monday, revealing that load shedding has cost it just shy of R750-million in six months.

The group’s share price sank a little over 6% in on-day trade, before recovering slightly to 5.45% by 3.30pm.

In the media announcement, Astral said revenue had increased by 6% to R10-billion; operating profit decreased by 88% to R98-million, and headline earnings per share decreased by 88% to 163c.

It had a net cash outflow of R1.2-billion, with “staggering” costs related to rolling blackouts amounting to R741-million.

The integrated poultry producer said in its interim results for the six months ended 31 March 2023 that it had stated at its year-end results presentation it was expecting market conditions to deteriorate on the back of escalating raw material costs, rolling blackout impacts and the general decay of municipal infrastructure – but that the conditions were “far worse” than it could have anticipated.

Cautionary note

In January 2023, Astral warned that its H1 earnings for the six months ending 31 March 2023 were expected to plunge by “at least” 90% due to rolling blackouts – which were preventing farmers from ventilating their chicken coops, irrigating crops and impeding abattoirs from slaughtering birds — and the rising cost of chicken feed, which is affected by the rand-dollar exchange rate.

Now, the news is far worse:

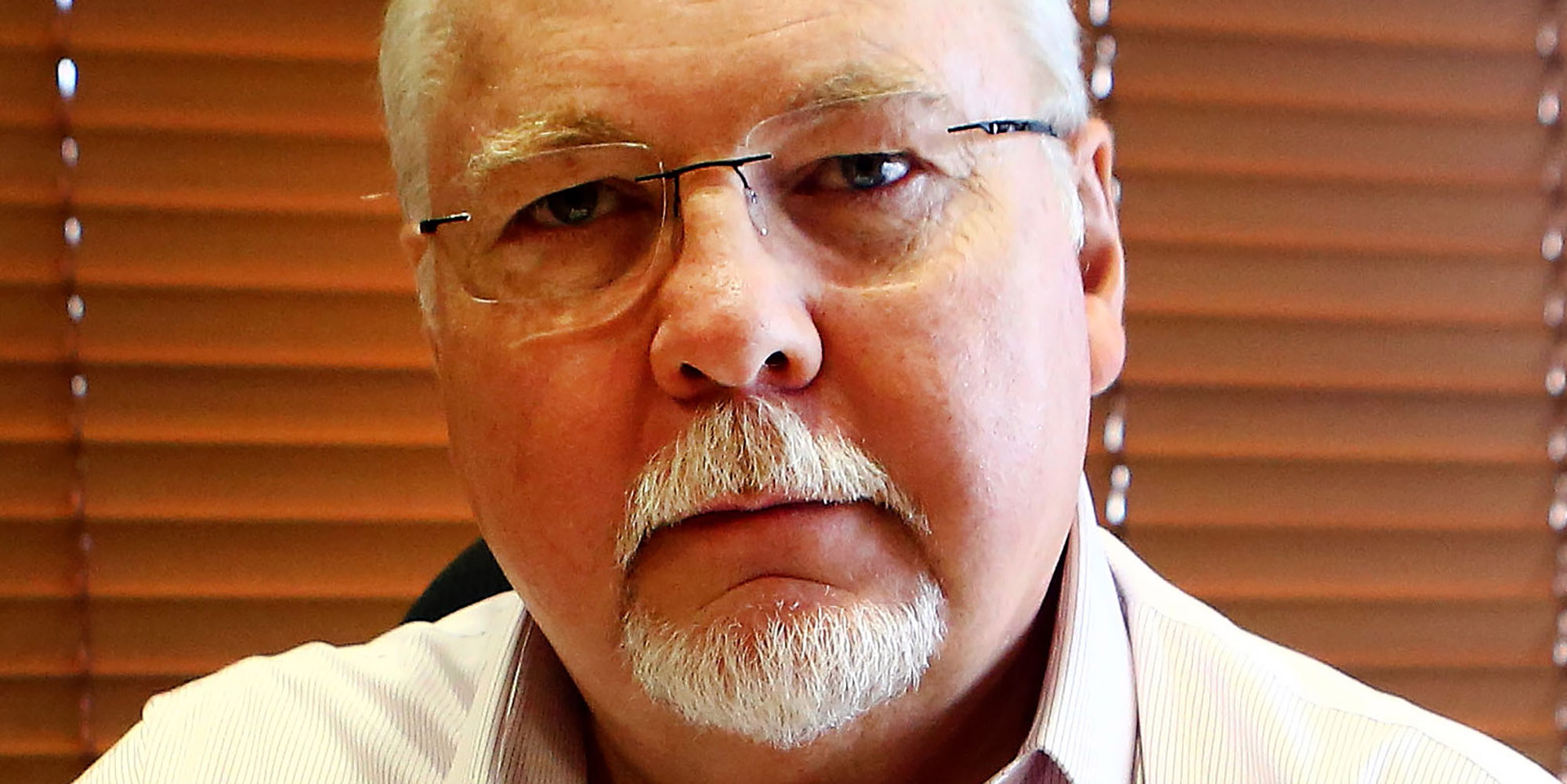

“Daily bouts of load shedding and extended periods at Stage 6 have been experienced, with disrupted water supply and record high poultry feed prices all creating a perfect storm, which has had a severe impact on the group’s financial performance, and which will endure in the near term,” said Astral CEO Chris Schutte.

Revenue growth has risen to R10-billion (from R9.4-billion in March 2022), which is a 5.7% increase for the period under review, under an “extremely trying” operational environment in which higher feed prices, soaring raw material costs and poultry selling prices were adjusted to try to recover some of the group’s large cost burdens.

Operating profit was down 88% to R98-million (from R785-million year on year), including the R741-million it incurred due to blackouts, which cannot be recovered from the market.

The group’s operating margin remained barely positive at 1%.

Revenue for the poultry division increased by 3% to R8.2-billion (March 2022: R7.9-billion), driven by broiler selling prices which were increased in an effort to recover the rapidly escalating costs in poultry feed (up 28.9% due to record-high local coarse grain prices), and costs such as diesel.

Broiler sales volumes decreased as demand for Astral’s poultry products slowed, with lower sales into the quick-service restaurant sector. Broiler sales volumes were down by 10.6% (or 28,177 tons).

It also processed almost 17% fewer broilers, averaging 4.9 million birds a week compared with an average of 5.8 million birds in the prior period.

Total broiler weight slaughtered was down by 1.5% for the period, as heavier birds were processed due to the impact of the blackouts. It had also been forced to cut back production by 24.9 million broilers which were sold as either live birds or through reduced broiler placements, to manage the backlog in the slaughter programme.

Despite efforts to raise prices, they recovered significantly less than what was required to recover the higher input costs for feed, diesel, energy, wages and overtime, with feed costs being the biggest contributor.

Competition Commission

Taking aim at the Competition Commission’s Essential Food Pricing Monitoring Report for 2021 to 2022, in which it trained its sights on the feed-to-poultry value chain, Schutte said: “Recent media reports reflect that the South African Competition Commission has slammed price hikes on essential foods, labelling them as ‘opportunistic’ and ‘unjustified’.”

The Competition Commission was quoted as saying it now plans to investigate the prices of a range of foods – at both retail and wholesale levels – and will take a ‘deep dive’ into the poultry chain.

“Any idea that poultry selling price increases were unjustifiable or opportunistic is plainly ludicrous and unfounded, which shows the lack of understanding that exists on the fundamental impact that load shedding and input cost inflation has had on business operations in South Africa.

“Perhaps their time and analysis will be better spent on understanding producer margins which reflect an industry in distress, rather than focusing on selling prices.”

Schutte blamed the government’s inaction and failures for driving food inflation.

“On top of load shedding and water supply disruptions, the weaker local currency, the fallout of the continuing conflict in Ukraine, higher global energy costs, global weather phenomena and the escalating costs to manage the risk of highly pathogenic bird flu, have all taken their toll on the local poultry sector.”

Revenue for the feed division increased by 37.4% to R6.4-billion (up YoY from R4.7-billion) due to higher selling prices as a result of significant increases in raw material costs.

External feed sales decreased by 6% as the pig and table egg production sectors came under tremendous pressure on higher feed costs and lower selling prices. The operating profit for the division increased by 28.5% to R381-million.

Load shedding costs

Astral’s chief financial officer, Dries Ferreira, said the group is being forced to reallocate at least R400-million in expansion capital towards backup solutions to supply electricity and water to their operations.

“A net cash outflow amounting to R1.2-billion for the period is reported and includes R741-million in load shedding costs and R705-million in expanded working capital requirements. As a result of the current cash position and a continuing challenging trading and operational environment, no interim dividend was declared.”

The latest Standard Bank Livestock Report shows that, on average, chicken prices have risen by 11% YoY, which is significantly higher than consumer price inflation.

Bird flu

The sector is also facing another looming catastrophe as the highly contagious bird flu has hit the Western Cape, threatening egg supplies in the province. Avian influenza (HPAI) is the worst global outbreak of bird flu on record.

Earlier this month, South Africa’s largest egg producer, Quantum Foods, advised shareholders that HPAI was detected at its Lemoenkloof layer farm outside Paarl in the second half of April.

At the time of the HPAI outbreak, the farm housed about 420,000 layer hens, all of which had to be culled. Quantum, owner of the Nulaid brand, has estimated that the direct loss resulting from this outbreak of bird flu is about R34-million (which includes the cost of the layer hens, feed and eggs that had to be destroyed).

The outbreak is believed to have spread to five farms in the province.

Government’s role

Astral’s Schutte made no bones about his contempt for the government’s role in the calamitous state of affairs for food security and the economy:

“The macro-economic crisis in the country, fuelled by incompetent state-run enterprises, has led to economic stagflation, hampering any prospects for job creation, with disposable income of the consumer under severe pressure as the cost-of-living crisis deepens and a recession looms large.

“The dramatic demise of Eskom in the generation and distribution of electricity, of Water Affairs and the failing water supply networks, together with the disastrous state of Transnet, has destroyed the capacity of the agricultural sector to function efficiently, which is fast becoming globally cost uncompetitive.”

He said they were expecting raw material input costs to reduce and poultry efficiencies to return to normal from July onwards, but benefits that could be derived from lower global grain prices are at risk from the declining local currency and further escalations in the diesel bill.

Stage 6 load shedding was costing Astral about R45-million a month.

“Astral will focus on rebuilding its balance sheet over the new reporting period in 2024, which, as in the past, has provided resilience to the cyclical nature of the poultry sector.

“It is time for the government to respond to the concerns raised by the business community and hardships reflected in the livelihoods of all citizens, instead of sitting asleep at the wheel, floundering around decisions and not implementing real solutions while the country implodes.” BM