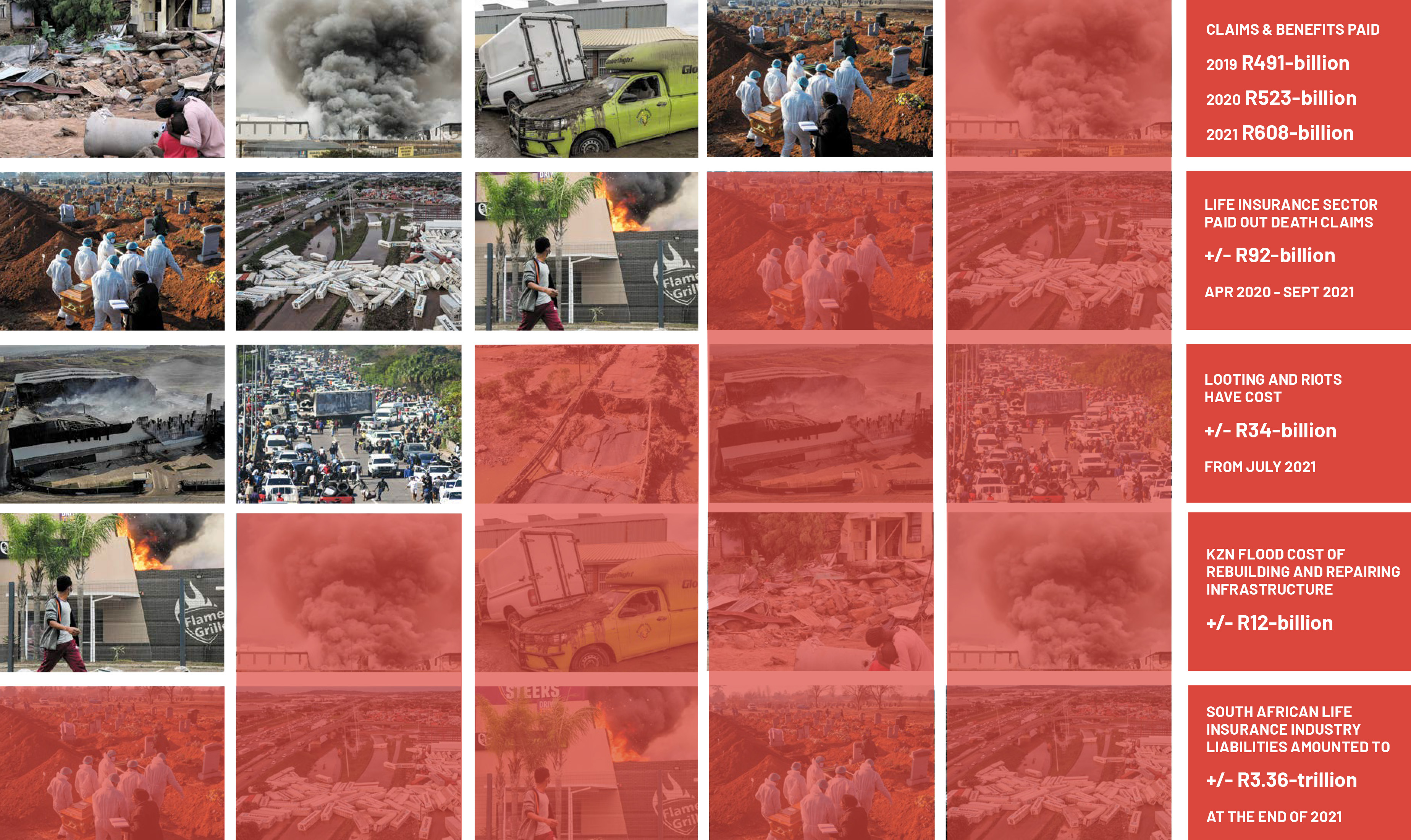

The recent floods in KwaZulu-Natal and the declaration of a National State of Disaster have added to the onslaught of economic shocks South Africa has endured over the past three years, and the insurance industry has had to deal with billions of rands worth of claims.

The first wave to hit the South African long-term and short-term insurance industry was the Covid-19 pandemic, which brought loss of income, death and business interruption claims. The Association for Savings and Investment South Africa (Asisa) says, over the 18 months from April 2020 to September 2021, the life assurance sector paid out about R92-billion in death claims alone.

This was followed by the rioting in July last year, which state insurer Sasria says cost about R34-billion. This year, the floods have claimed more than 440 lives to date, and KZN Premier Sihle Zikalala estimates the cost of rebuilding and repairing infrastructure to be R12-billion. Old Mutual Insure said it had R245-million worth of claims within the first week of flooding.

Insurers are themselves insured via reinsurance. John Kotze, head of Old Mutual’s head of product and protection, says reinsurance has origins in the shipping industry in the late 1600s, when ship owners needed financial protection against their ships sinking. “If there was a local storm, it might impact lots of ships in one region, so if there was a way for insurance risks to be spread across all the ships in the whole world, then that would reduce the regional insurance risks that might arise from time to time. This concept was extended to the life and short-term insurance sectors,” he says.

Fanus Coetzee, head of claims at the country’s largest short-term insurer, Santam, confirms that an increase in disasters will impact insurance and reinsurance pricing over time, although he adds that the main drivers behind increased reinsurance rates in South Africa over the past few years were the Covid-related claims in 2020 and the civil unrest damage in July 2021.

The KZN floods impact

Soul Abraham, head of retail for Old Mutual Insure, says of the R245-million worth of flood-related claims received by 14 April, an estimated R45-million was attributable to homeowner, motor and commercial policies, and more than R200-million is estimated to be for speciality cover, such as plants, factories, specialised equipment as well as shipping and maritime cover.

Although it is too early to tell what the total claim volume and estimates are likely to be, Abraham says this is “already the biggest natural disaster to have happened to the insurance industry” since the 2017 Knysna fires, which led to damage claims of R7-billion.

Viviene Pearson, chief executive of the South African Insurance Association (Saia), says there are a host of new or emerging insurance risks that have the potential to have dire effects on the sustainability of the industry. According to the Global Risks Report 2021, published by the World Economic Forum, the top four risks that are systemic in nature are extreme weather events, climate action failure, human environmental damage and infectious diseases. Extreme weather has been at the top of this list since 2017. “There is little doubt these four emerging risks will only see an increase in the protection gap, glaringly becoming more evident, and insurance alone is not enough to mitigate these risks. They are catastrophic in nature and, therefore, impossible for the insurance industry to cover single-handedly without the intervention of government,” Pearson points out.

Rudolph Britz, chief actuary at Momentum Insure, says at this stage the insurer is of the view that the flooding is an outlier and something that happens infrequently, but he adds that it is currently a hotly debated topic. “An outlier would not cause an increase in premium levels, but a systemic increase in frequency of flooding may. An increased risk of these events may cause premiums for the specific extensions that cover these to be increased, limitations imposed or removed,” Britz says.

Coetzee warns that properties in regions prone to higher incidences of flooding (and higher trending areas) will be more expensive to insure than those in lower-risk areas. “KZN is one of the areas with the highest incidence of flooding, which already results in higher premiums. To the extent that climate change increases this going forward, premiums are very likely to increase over time,” he says.

The rioting impact

Cedric Masondo, managing director of Sasria, says July’s riots were some of the most expensive in the world, with 80% of claims for damage in KZN and 20% in Gauteng. The riots had widespread implications, with damage to warehouses, buildings, fire damage and, of course, business interruption claims. The biggest insurance claim of R1.5-billion was from the retail sector.

National Treasury allocated an additional R11-billion to Sasria to assist with claims payments and recapitalising the insurer. By November last year, Sasria had announced changes to its offerings. For example, revenue cover is no longer insured under material damage but will be covered under business interruption. Premiums have also increased significantly in some cases, and commercial vehicles in particular have absorbed a 1,736% rate increase from February this year. As an example, the annual Sasria premium for a heavy commercial vehicle insured for R2-million went up from about R376 to R6,900.

Sasria has not indicated any change in premium specifically related to KZN, and Britz says his interpretation is that political instability is not necessarily regionally driven but spread across the entire country.

The Covid impact

Asisa started tracking death claims against individual life, group life (offered by employers), credit life and funeral cover policies at the start of April 2020 to measure the impact of the Covid-19 pandemic on the long-term insurance industry.

Between 1 April 2020 and 30 September 2021, the life insurance industry paid out almost 1.6-million in death claims. Although not every death for which claims were submitted would have been caused by Covid-19, there is no doubt that the pandemic was responsible for many of the deaths, whether directly as a result of a person contracting the virus or because people were reluctant to seek medical attention for other serious conditions, says Hennie de Villiers, deputy chair of Asisa’s life and risk board committee.

The R92-billion in life assurance claims was paid out over a period when the country had massive job losses. According to the National Income Dynamics-Coronavirus Rapid Mobile Survey, as many as 2.8 million South Africans lost their jobs in 2020, while many more who kept their jobs did not draw an income during the first hard lockdown of five months. Government coughed up R60-billion worth of relief via the Covid-19 Temporary Employee/Employer Relief Scheme between March 2020 and July 2021.

Derek Vice, a partner at KPMG claims experience and one of the authors of the KPMG South African Insurance Industry Survey 2021, says, in the context of poor premium growth, mediocre investment performance and significant claims, that the insurance industry moved from a total industry profit of close to R22.1-billion in the 2019 period to a loss of R2.6-billion in 2020. The report shows that the big five – Sanlam, Old Mutual, Liberty, Momentum and Discovery Life – bore the brunt of this overall loss, displaying a drop from R17.8-billion profit in 2019 to a loss of R5.7-billion in 2020, whereas the smaller insurers including Hollard Life, PPS and Absa Life maintained their overall profits, moving from R4.2-billion to R3-billion.

Asisa reports that the South African life insurance industry held assets of R3.71-trillion at the end of 2021, and liabilities amounted to R3.36-trillion. All insurers are required to hold sufficient capital reserves or a solvency capital requirement to cover the possibility of extreme shocks that do happen from time to time.

John Kotze, Old Mutual’s head of product and protection, points out that these solvency reserves allow for extreme claim shocks, including the situation when shocks happen in successive periods.

By the end of 2021, the life assurance industry held free assets of R350.5-billion, which is just under double the capital required by the solvency capital requirements. Despite these reasonably healthy coffers, the cost of life assurance is likely to increase significantly in the years ahead.

“A consistently higher claims experience will leave insurers with little choice but to adjust premiums in line with the higher risk presented by someone who is not vaccinated and therefore more likely to die from Covid-19,” he says.

The Our World in Data website shows that only 30% of the South African population has been fully vaccinated, with 5% partially vaccinated.

De Villiers says that premiums have already increased in the group life insurance space, for example, but employers that have implemented mandatory vaccination policies are starting to benefit from preferential premium rates. DM168

This story first appeared in our weekly Daily Maverick 168 newspaper which is available for R25 at Pick n Pay, Exclusive Books and airport bookstores. For your nearest stockist, please click here.