Four Monetary Policy Committee (MPC) members preferred an unchanged stance and two preferred a reduction of 25 basis points. MPC members agreed that the restrictive policy was appropriate to stabilise inflation at 4.5%, given the inflation risks.

“Economic performance in the first half of the year was disappointing. The economy contracted slightly in the first quarter, by 0.1%, and recent data, including last week’s mining and manufacturing numbers, have caused us to trim our second quarter growth estimate modestly, to 0.6%.

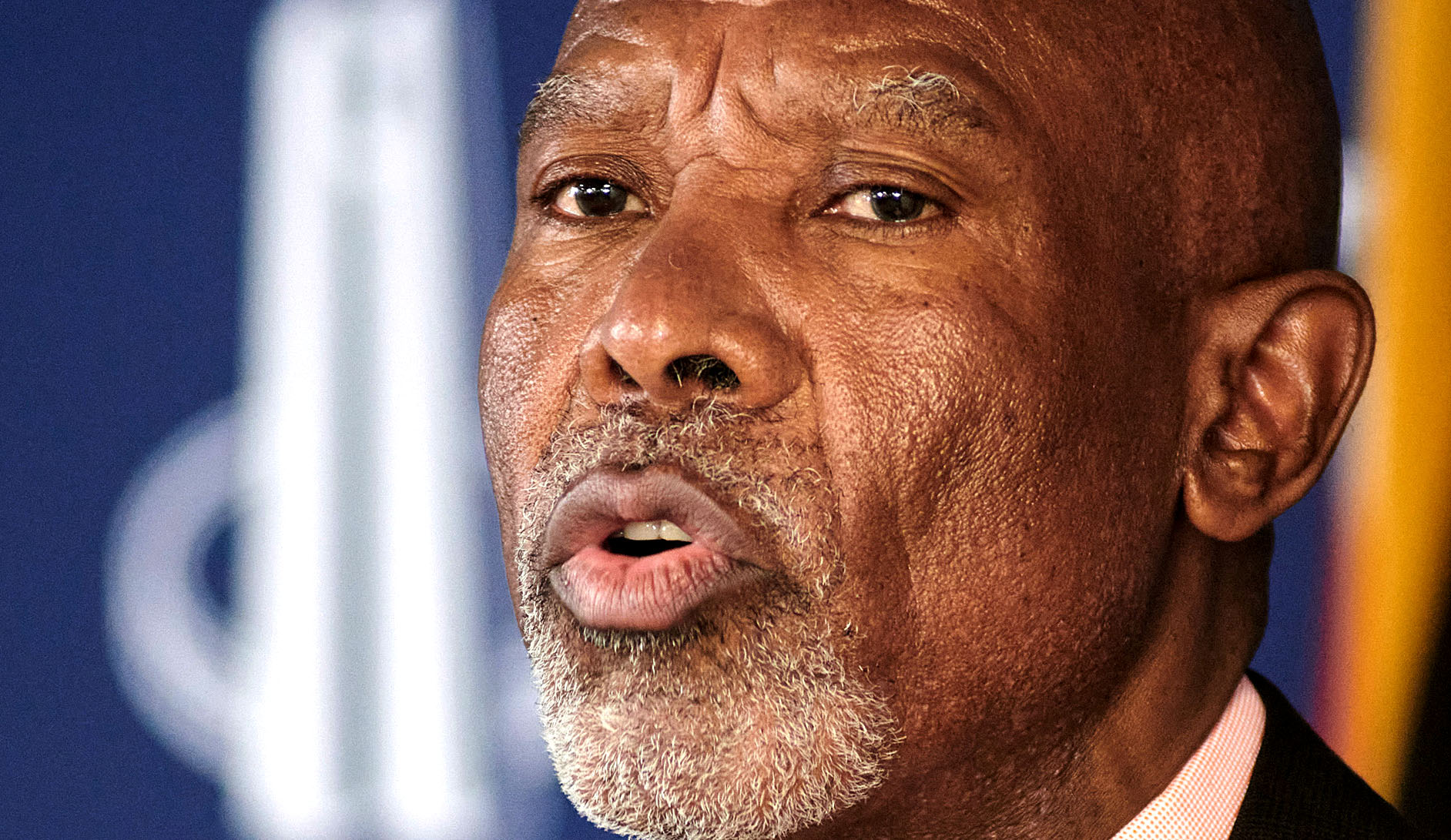

“Over the medium term, we expect somewhat faster growth, supported by a more reliable electricity supply and improving logistics, among other factors,” Kganyago said. However, he tempered this with the proviso that the revised growth projections remained below longer-run historical averages, of about 2%.

Inflation expected to dip

Inflation came in at 5.2% for May, unchanged from April and still at the upper end of the 3% to 6% target range. The Reserve Bank is now expecting headline consumer price inflation for this year to be 4.9%, compared with 5.1% at the previous meeting. Over the next few quarters, headline inflation is expected to dip below the 4.5% midpoint, mainly because of fuel and food prices. This outlook is supported by the stronger rand.

“Over the medium term, we continue to see inflation stabilising at 4.5%. While the forecast has improved, the balance of risks is assessed to the upside,” said Kganyago.

Reaction from economists points to widespread expectations that the Reserve Bank will embark on an easing cycle with an interest rate cut in September.

David Omojomolo, Africa economist at Capital Economics, said he had expected rate cuts to begin early in 2025 but now expected a 25bp cut to 8% in September. While Standard Bank shares this view, First National Bank believes the first rate cut is more likely in November this year.

Vivienne Taberer, investment director at Ninety One, says the market is now pricing in a cycle of slightly less than 100 basis point cuts over the next 15 months.

“Our analysis of over 70 global interest rate cycles over the past 20-plus years has taught us two things: Firstly, markets generally underestimate hiking cycles and, secondly, they underestimate the speed and magnitude of the cutting cycle. We do not expect the South African cutting cycle to buck this trend,” she said.

Cost-of-living crisis for consumers

Kganyago also noted concern about administered prices. “We have had to mark up electricity inflation for this forecast round, even as other categories shifted lower. Services price inflation also remains uncomfortably above the mid-point,” he said. This is a view that has already been widely noted.

Koketso Mano, senior economist at FNB, says food pressures are likely to intensify in the second half of the year on the back of adverse weather conditions and as higher soft-commodity prices reach retail shelves.

The TransUnion Consumer Pulse survey for the second quarter of this year yielded similar insights, with 77% of consumers saying one of their biggest concerns was inflation for everyday goods such as groceries and fuel. Fifty-five percent were worried about interest rates and 52% were concerned about jobs. DM