The SA Reserve Bank has left interest rates unchanged for the fourth consecutive meeting of its Monetary Policy Committee (MPC), warning that consumer inflation remains a major risk that might see borrowing costs elevated for a long time.

The MPC held its key repo rate steady at 8.25%, with the interest rate charged by commercial banks remaining at 11.75%.

It was a unanimous decision by five members of the MPC, including David Fowkes, a new member appointed earlier this month to replace Kuben Naidoo (deputy governor), who left the central bank in December last year.

Read more in Daily Maverick: Kuben Naidoo resigns as SA Reserve Bank deputy governor against backdrop of vexed monetary policy

The market had largely expected the Reserve Bank to keep interest rates unchanged, with all 20 economists surveyed by Reuters expecting no changes in the benchmark interest rate.

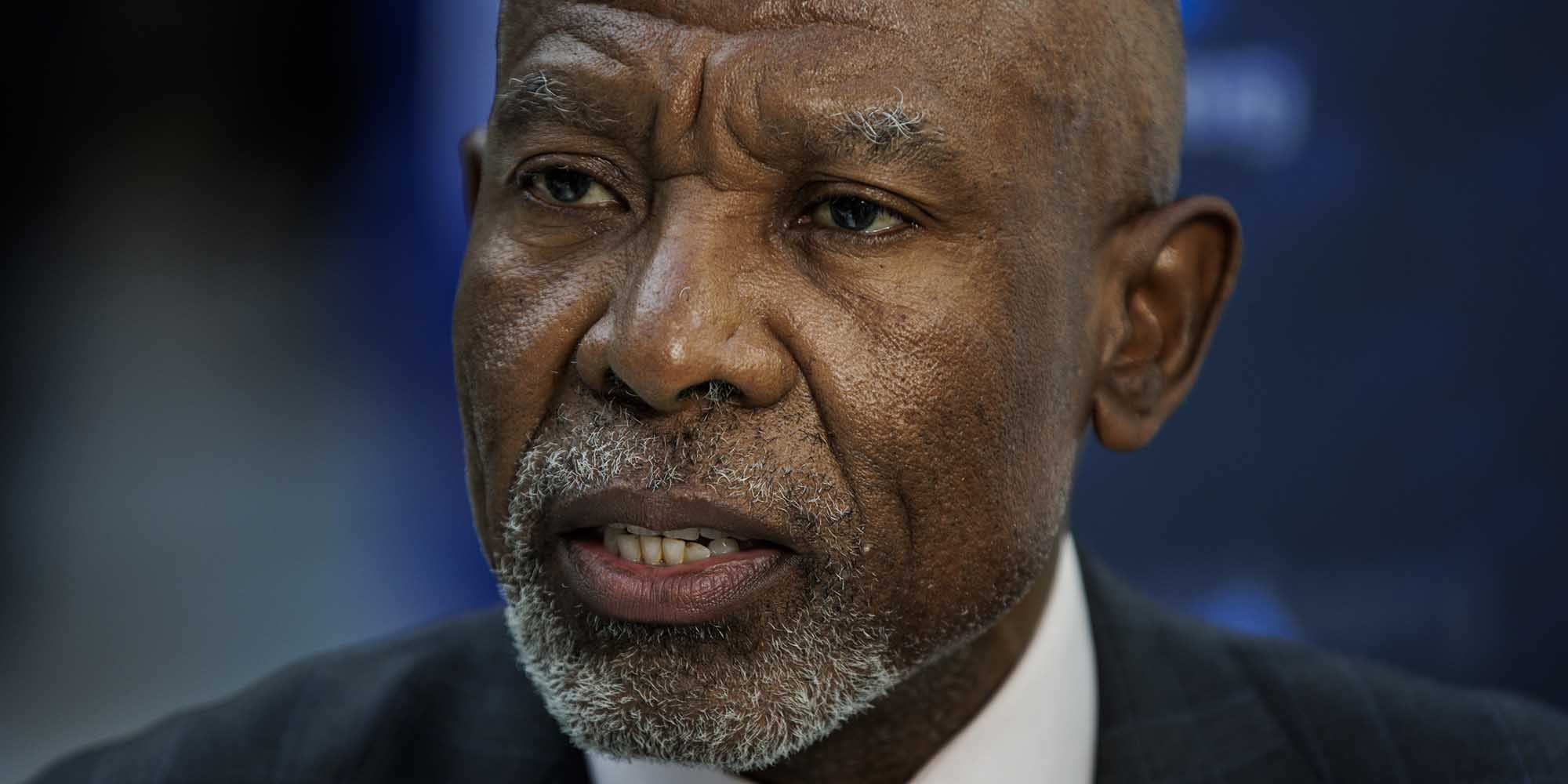

Reserve Bank governor Lesetja Kganyago stressed that a cut in interest rates will depend on whether the headline consumer inflation rate falls within the midpoint of the central bank’s 3% to 6% inflation target range in a “sustained manner”.

This midpoint would be 4.5%.

“Only when we are convinced that inflation has declined to the target and is sustained there, would it be necessary to recalibrate policy appropriately,” said Kganyago during a media briefing on Thursday.

Kganyago believes that there is no “discernible trend” that the inflation rate is declining towards the Reserve Bank’s midpoint target.

Inflation in South Africa has seesawed - from highs of 7.8% in July 2022 to remain above the upper end of the bank’s target for about 13 months.

In 2023, the inflation rate fell to 4.7% in July, which was closer to the Reserve Bank’s midpoint, but this was short-lived as food and fuel price increases drove inflation up to 5.9% in October, moderating to 5.5% in November, and further to 5.1% in December.

Underscoring the unpredictability of inflation is that the Reserve Bank expected the headline inflation rate to reach 5.8% for 2023 as a whole, but reached 6%. The central bank expects the inflation rate for 2024 to ease to 5%, then 4.6% in 2025, and 4.5% in 2026.

Economic outlook

The Reserve Bank still sees currency weakness, a weak economy (exacerbated by Eskom rolling blackouts and the Transnet logistics crisis), and elevated food and fuel prices as drivers of inflation.

The Reserve Bank has increased the repo rate by nearly 5 percentage points since November 2021, resulting in the interest rate charged by commercial banks going from a low 7% during Covid lockdowns to 11.75%.

By increasing interest rates, the Reserve Bank is hoping to curb the consumer demand for goods (due to affordability problems) in the economy. When demand drops, then prices of goods would also decline, resulting in the overall inflation rate reducing.

For 2023 as a whole, the bank expects the economy to grow by 0.6%, revised down from its November expectation of 0.8%. It expects the economy to grow by 1.2% in 2024 and 1.3% in 2025.

Interest rate cut on the horizon

Angelika Goliger, EY Africa’s chief economist, said the outlook for global interest rates in 2024 will be predominantly influenced by the decisions made by the US central bank.

With signs that inflation in the US is decreasing, Goliger expects the US central bank to start cutting interest rates from May, with a cut of 1% for 2024.

She expects the SA Reserve Bank to adopt “a more cautious approach” than the US central bank, with the former only expected to cut interest rates in the second half of 2024. Goliger expects cuts of 0.5% and 0.75% this year.

FNB Chief Economist Mamello Matikinca-Ngwenya agreed with Goliger, saying she also expects the Reserve Bank to deliver the first interest rate cut in the second half.

“However, we think the MPC will be cautious as event risk remains high, [for example] the upcoming elections and any worsening in risk sentiment as well as exchange rate pressure that is associated with that event…

“That said, the MPC still requires more evidence that inflation will anchor at the 4.5% target within the policy horizon.

“Unfortunately, heightened geopolitical tensions, biosecurity, as well as adverse weather patterns, complicate the disinflation trend,” said Matikinca-Ngwenya. DM