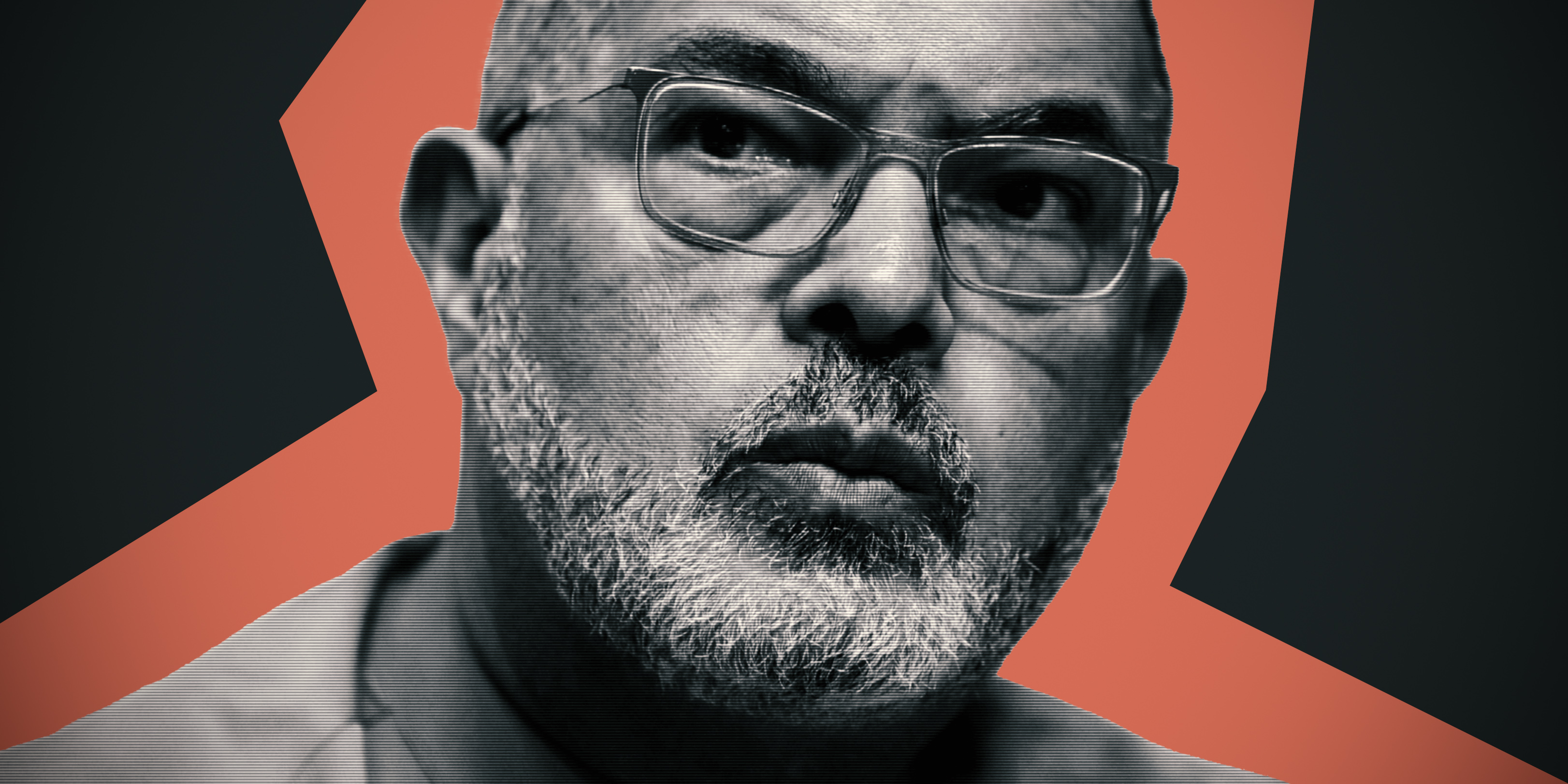

Sars Commissioner Edward Kieswetter told media yesterday that one of Sars’s targets going forward was to recover an additional R20-billion to R50-billion to strengthen the fiscus.

Key growth areas included personal income tax (12.6%), corporate income tax (2.1%) and VAT (2.3%). Sars also recovered R301-billion through compliance efforts.

Sars is taking advantage of technology such as data science, artificial intelligence (AI), and machine-learning algorithms to counter criminality and wilful non-compliance. These systems also ensure that no legitimate refunds are denied, while preventing impermissible and fraudulent refunds.

Commenting on the use of AI, Kieswetter said: “We use data science, AI and machine-learning to detect non-compliance and enforce tax laws with precision. This allows us to identify risk areas and intervene before revenue is lost. Through AI-driven automation, we are simplifying tax compliance. More taxpayers now receive auto assessments, reducing their need to file traditional tax returns.”

Specific focus areas in the year ahead will include:

- Targeting high-risk industries;

- Investigating international tax evasion;

- Addressing base erosion and profit-shifting;

- Focusing on high-wealth individuals;

- Examining cryptocurrency as a wealth-driving asset; and

- Combating VAT fraud and other tax-related crimes.

“I am pleased that the R447.7-billion returned into the hands of taxpayers is good for the economy,” said Kieswetter, adding that he remains “deeply concerned about the ever-present threat of refund fraud and abuse of the system”.

Over the past year, Sars prevented the outflow of R146.7-billion of impermissible refunds.

The preliminary revenue collection represents a substantial tax-to-GDP ratio of 24.8%, reflecting the country’s fiscal health and efficiency in revenue generation. Moreover, the tax-buoyancy ratio for the fiscal year 2024/25 was estimated at 1.20, indicating the robust response of tax revenue relative to economic growth.

What this means for you

A tax-buoyancy ratio of 1.20 means that Sars is collecting tax revenue at a faster rate than the economy is growing. This has a few key implications:

- Potential for improved public services – If the government manages this revenue well, it could mean better funding for healthcare, education, infrastructure and social services.

- Tighter enforcement on tax compliance – Sars’s ability to collect more revenue could mean stricter enforcement against tax dodgers, potentially affecting businesses and individuals that haven’t been fully compliant.

- Possible tax relief in the future – If revenue collection remains strong, the government might have room to avoid raising taxes or even provide relief to lower-income earners.

Personal income tax

Net personal income tax grew 12.6% to R81.8-billion, which Kieswetter attributed to above-inflation growth in the finance and community sectors’ Pay-As-You-Earn (PAYE), as well as the gains from two-pot withdrawals. The two-pot directives were valued at R12.9-billion for the year-to-date, or R7.9-billion more than the projected estimate of R5-billion. There was also a noticeable improvement in PAYE tax compliance, as indicated by the Voluntary Compliance Index, which rose by 0.38 percentage points to 75.48%. This uptick in compliance efforts is shaping taxpayer behaviour.

Corporate tax

On the corporate side, net companies’ income tax (CIT) grew 2.1% to R6.5-billion, driven by CIT provisional tax collections of R323.3-billion. The growth was largely driven by the finance sector, which was buoyed by improved profits, while the mining sector continued to contract.

Investigations plug R74bn VAT leaks

Proactive syndicated-crimes investigation, investigative audit and tax verifications helped Sars stop a potential R74-billion worth of VAT leakages. At the end of March 2025, VAT refunds amounting to R365.5-billion had been disbursed, with mining (mainly owing to higher exports and local expenses), finance and manufacturing emerging as the top three refunded sectors.

“It is pleasing that of all the (VAT) refunds, R127.4-billion was directed to SMMEs, which is pivotal in driving job creation,” said Kieswetter.

The Sars Compliance Programme interventions generated R301.5-billion in compliance revenue, marking a 15.8% year-on-year increase. A portion of this revenue could be attributed to cash-collection initiatives, amounting to R154.8-billion. Strategies to prevent revenue leakage contributed another R146.7-billion. Efforts and outcomes from Sars’s administrative activities included:

- R94-billion from resolving over 7 million outstanding debt cases - supported by debt propensity ML models;

- R103-billion from tax verifications where the risks were flagged through our AI-driven risk profiling models powered with Big Data, debt equalisation and refund fraud risk management ML models - executing 7 million verifications cases;

- R59-billion from executing 230,000 tax and customs compliance audits;

- R30-billion from syndicated crime - conducting 198 complex investigations (made up of 165 Illicit, 33 State Capture);

- R15-billion from general compliance work - 870,000 compliance follow-up; and

- 20 million service-related interactions at our branches, via the phone or through our digital self-service platforms assisting taxpayers and traders to comply.

Graphic by Neesa Moodley using Napkin AI

Graphic by Neesa Moodley using Napkin AI

Looking ahead, Sars plans to use the R7.5-billion allocated to it over the medium-term to reduce its debt-cash collection and pursue the more than 5 million outstanding returns. Equally important, Sars will continue to strengthen its efforts to deal firmly with the illicit economy, trade-based money laundering and illicit financial flows including illicit cigarettes, second-hand gold, crypto currency, trade mispricing and undervaluation fraud, among others. Over the same period, Sars will also expand the modernisation of its systems in both tax and customs.

“In the build-up to this revenue announcement, I made a clarion call to action to the whole Sars family, regardless of whether they were in core operations, enabling, or support functions,” said Kieswetter, adding that “they all went out and made calls, and looked for the inches that contributed to this glorious result.” DM

Graphic by Neesa Moodley using Napkin AI

Graphic by Neesa Moodley using Napkin AI