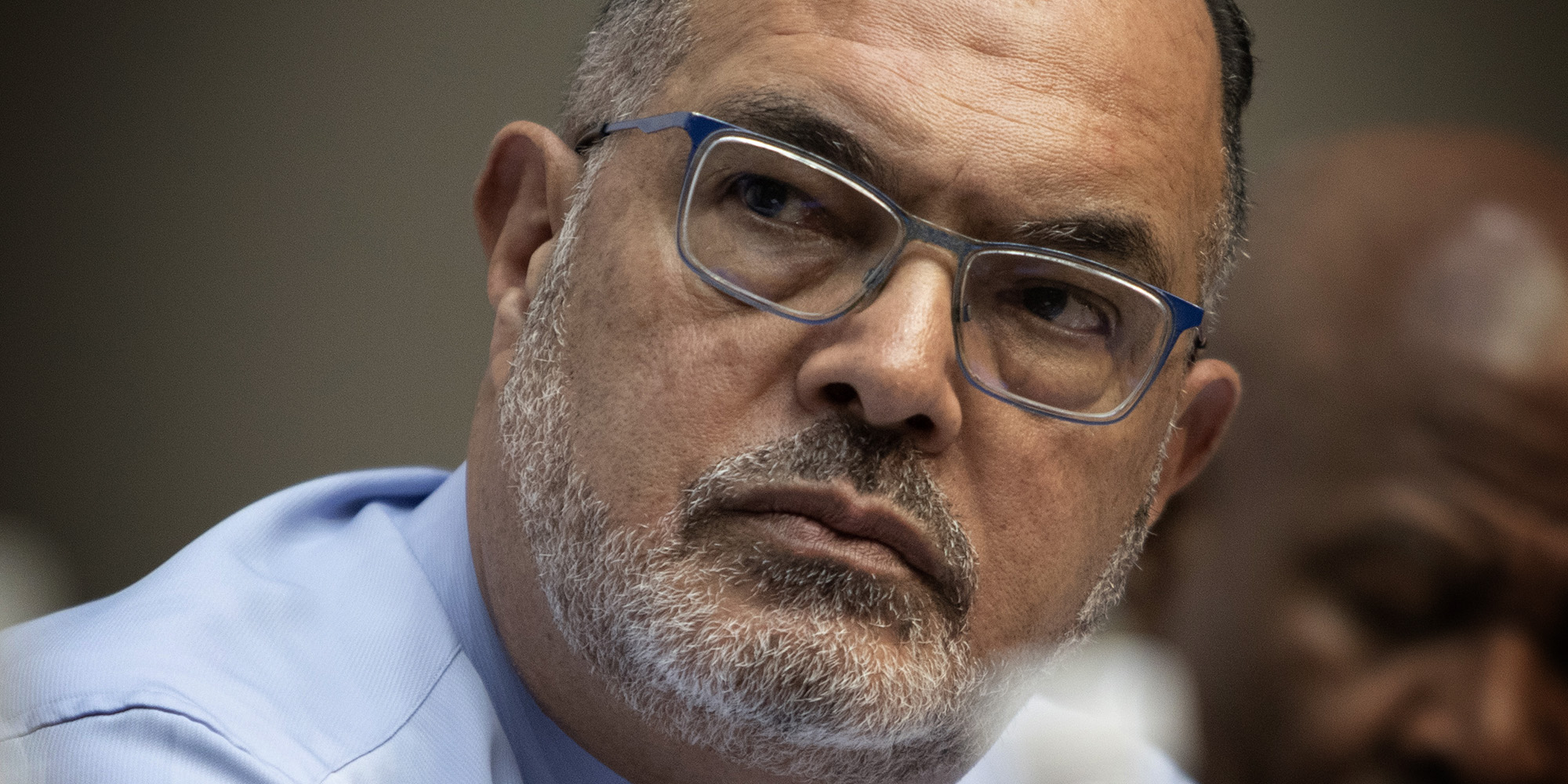

SA Revenue Service (SARS) Commissioner Edward Kieswetter was the hero of the National Budget 2023 for the second year running, bringing in an estimated tax revenue of R1.7-trillion for 2022/23, which is R94-billion higher than previous estimates.

In an interview with Daily Maverick, he said the additional revenue could be attributed to tireless, diligent work by the 12,500 employees under his care, “simply doing what the revenue authority is supposed to do”.

He explained where the money came from. To start with, it was important to understand what a compliance dividend was.

“There is no straightforward correlation between what happens in the economy and what ends up in the tax coffers. When the minister with the Treasury team models the estimate of taxes, they take into account what’s happening in the economy; they don’t necessarily take into account how taxpayers will behave … or the level of tax morality where people feel confident and justified in paying their taxes,” he said.

Joubert Botha, head of tax at KPMG, praised the commissioner’s efforts, saying it was evident the compliance drive was paying off. “The compliance drive includes a closer scrutiny of taxpayers’ tax returns. We can expect ... more scrutiny [in future].”

Revenue management

SARS has developed a revenue management system that looks at potential loopholes in the legislation, following up to ensure tax deductions are bona fide and true to the intention of the law.

For example, Kieswetter said, if a company’s profits were R100 and the tax rate was 28%, the company was liable to pay R28. Theoretically.

“What SARS actually collects is what people or companies disclose. They will use provisions in the law for deductions to minimise that R28 so that you end up with a tax liability of R20. Our [SARS’s] job is to assess the difference between the R28 liability and the R20 finally paid over.”

For the year to January, Kieswetter’s offices worked just short of 1.4 million outstanding debt follow-up cases. This included cases where assessments had been issued and were not disputed but had also not been paid, or taxpayers had not submitted a return so SARS could not carry out an assessment.

“More than R60-billion has been collected just through following up on outstanding debt cases,” he said.

The second big collection area is customs, which brought in R3-billion. Kieswetter said for the year to January, 4,750 audits were carried out, of which 470 related to narcotics, 277 to clothing and textiles, 244 to cigarettes and tobacco and almost 500 to medication.

Customs audits related to impermissible customs duty “slipping away” yielded more than R10-billion.

Visit Daily Maverick's home page for more news, analysis and investigations

Criminal and civil investigations

SARS has 830 active fraud-related investigations, has handed 178 cases to the National Prosecuting Authority, and has got convictions in 92 of 94 completed cases.

“We have over 300 investigations under way that are related to syndicated crimes, and another 413 enquiries. An enquiry is where SARS starts asking for more information because something has raised a red flag or suspicions and evidence is required to launch a formal investigation. We have completed 215 cases for the year to January, and recovered another R4-billion in cash already,” Kieswetter said.

State Capture wheels are moving, albeit slowly, with 46 civil cases and 78 criminal cases yielding an assessment value of R500-million. Illicit trade interventions, including the detainment of 640 consignments and 156 seizures, yielded another R4-billion in revenue.

When it came to personal taxpayers, Kieswetter said SARS had to be alert to attempts to obtain refunds either fraudulently or through impermissible refunds – where someone either understates their income or overstates their expenses so they can be in a net refund position.

He said extensive use of artificial intelligence and algorithms prevented the outflow of fraudulent refunds worth more than R61-billion.

“So when people say SARS has ‘over collected’, the money doesn’t flow in by the doors… Every return has to be assessed. It’s about catching the loopholes and that’s where our compliance work comes in,” Kieswetter said.

Corporate creativity

Regarding companies, Victor Mpunga, the head of research at Old Mutual Private Wealth, said the collection of about R10.5-billion more than expected at the time of the Medium-Term Budget Policy Statement suggested that despite the severe blackouts in December, corporate tax receipts might have held up.

Kieswetter said companies tended to get creative with exotic schemes such as the use of offshore passive entities to avoid paying tax in South Africa.

“I’ve seen it myself. You go to Mauritius [which carries a 15% flat tax rate], and you walk into a corporate complex, where you will find a small 20m² office with 20 company nameplates on the wall. It’s just an address.”

Part of the move to address this is a proposed amendment to the definition of a foreign business establishment in relation to a controlled foreign company.

Based offshore

Roy Naude, partner international tax at KPMG, said one would have thought that such an amendment would have been as a result of the changing way in which companies run their businesses and how the workforce operated after Covid-19.

But it seems to be the result of the outcome of a recent Supreme Court of Appeal case where Coronation was ordered to pay a sizeable tax bill.

“National Treasury is proposing to refine the definition of a foreign business establishment to clarify what it considers to be the important functions of that controlled foreign company.

“One can only wait and see how this will be implemented on matters that are normally considered to be very fact-specific,” Naude said.

Kieswetter also spoke about pricing risk where a parent company is based offshore with a local subsidiary on South African shores. The parent sells the subsidiary a product, where the arm’s length price should be R5,000, but it is sold for R6,000. So, R1,000 that should be taxed locally has now been transferred offshore.

“Focusing on these types of schemes and other aggressive structuring by corporates uncovered R13-billion.”

The total amount of collections that compliance work has yielded for the year to date is R167-billion. DM168

This story first appeared in our weekly DM168 newspaper, which is available countrywide for R25.