The South African Revenue Service (SARS) has secured a much-needed boost in funding. Minister of Finance Enoch Godongwana allocated R3.5-billion for the 2025/26 financial year and an additional R4-billion over the medium term. This comes as the government increasingly relies on SARS to close the widening tax gap in a constrained fiscal space.

“The rewards of higher tax compliance and efficiency take time. Once again, the investments we make today in SARS will allow the collector the time to make improvements,” Godongwana said during his budget speech.

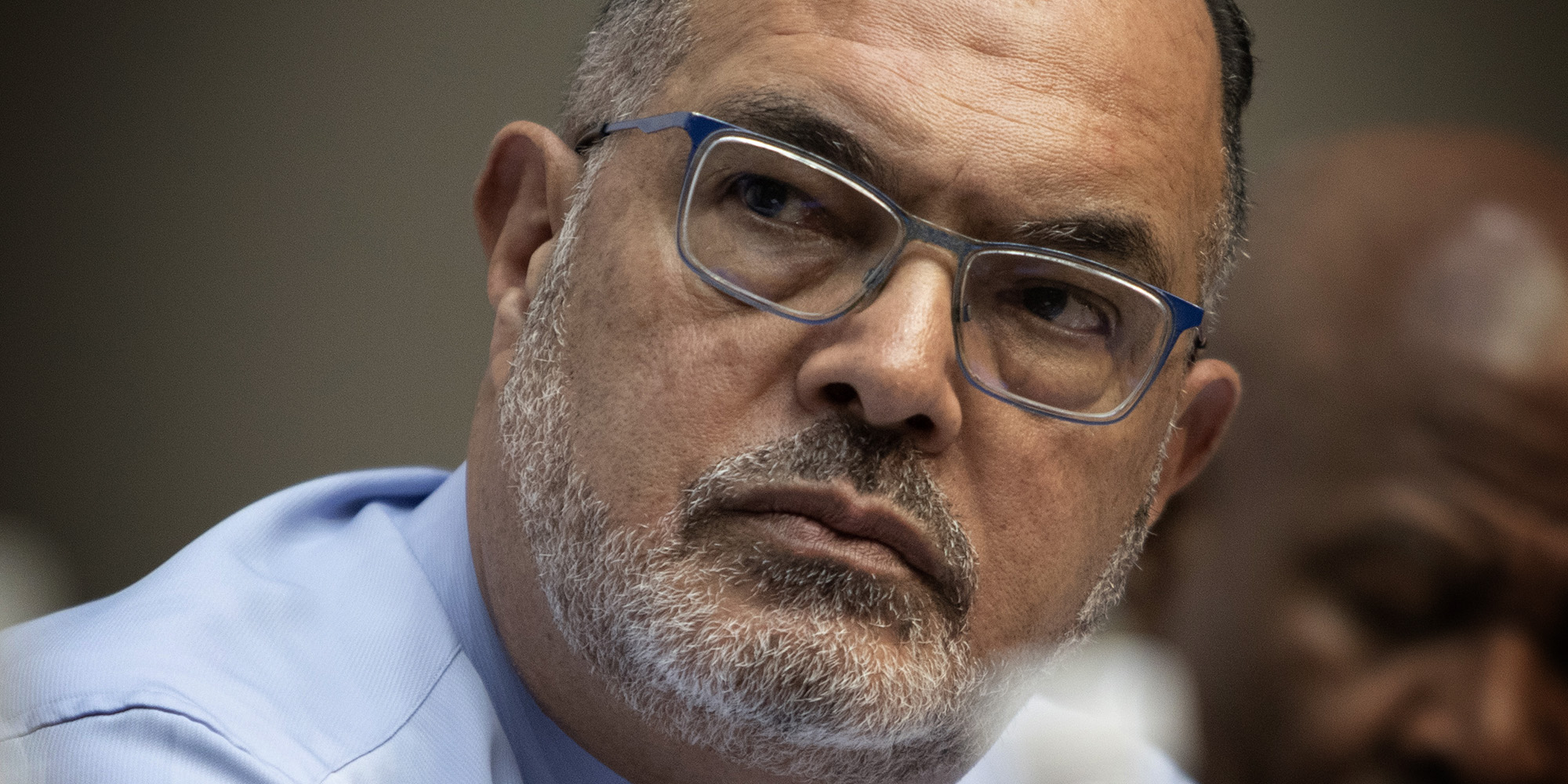

The move signals a renewed commitment to revenue recovery, but it also marks a notable shift in the dynamic between National Treasury and SARS Commissioner Edward Kieswetter. In recent months, Kieswetter has been vocal about his concerns regarding tax collection inefficiencies, even as National Treasury has pushed ahead with a 0.5 percentage point VAT increase – an option he previously downplayed in favour of enhancing SARS’ capacity to recover outstanding debts.

Bridging the tax gap

Kieswetter previously estimated that SARS could recover between R700-billion and R800-billion in outstanding taxes, a sum significantly larger than the VAT increase is expected to generate over the medium term. Despite his concerns, the VAT hike was tabled, and both the commissioner and the minister appeared broadly affable at a post-Budget press briefing.

“I think as far as I’m concerned, both of us understand that is behind us,” said Godongwana. “We are focusing on the job at hand.”

Treasury expects the VAT increase – staggered at a 0.5 percentage point rise in May 2025 and another 0.5 percentage point in April 2026 – to generate R28-billion in additional revenue for 2025/26 alone. However, it remains a politically fraught move, with concerns over its impact on consumers and businesses already facing economic strain.

SARS, meanwhile, has been tasked with ramping up compliance enforcement and modernisation efforts to secure more revenue without overburdening taxpayers. The 2025 Budget explicitly outlines that SARS will leverage artificial intelligence (AI) and data analytics to improve enforcement and plug revenue leakages.

Modernisation and compliance crackdown

The Budget allocation will support several key SARS initiatives, including digital upgrades and automation, with an additional R3-billion over the Medium-Term Expenditure Framework (MTEF) earmarked for modernisation efforts, including AI-driven fraud detection and taxpayer services.

Expanding SARS’ rural presence has also been prioritised, with Treasury endorsing a recommendation to deploy mobile offices and community outreach initiatives aimed at improving tax compliance in underserved areas. Human resource investment is another focal point, with R1.5-billion allocated to hire an additional 2,338 staff members to bolster compliance and service delivery efforts.

Addressing illicit financial flows remains a core element of SARS’ enforcement strategy, with a greater emphasis on high-net-worth individuals and corporate tax evasion.

The 2025 Budget commits further resources to forensic tax investigations, reflecting a push to tighten oversight on complex financial structures and money laundering schemes.

Tax administration reforms are expected to enhance collections, but persistent shortfalls remain a risk. Treasury has acknowledged that a constrained fiscal environment limits the extent to which SARS can be funded beyond its current allocations.

Investor sentiment under management

Beyond tax collection, the government is also trying to strike a balance between revenue generation and investor sentiment. Treasury has committed to maintaining South Africa’s tax competitiveness while ensuring fiscal sustainability, with a review of corporate tax incentives and wealth tax options to prevent capital flight. There is also a renewed push to expand the tax base by targeting non-compliant businesses and individuals, with SARS identifying 156,000 high-activity taxpayers who are either unregistered or have failed to file returns.

Enhancements to customs enforcement are expected to reduce illicit trade and revenue losses, with modernised port-of-entry inspections and expanded AI-driven tracking forming part of this strategy.

The broader tax policy framework remains under scrutiny, particularly given the political sensitivity of VAT increases and the risk of further squeezing middle-income earners. The Parliamentary Standing Committee on Finance has called for the Treasury to explore progressive tax measures, such as luxury levies, rather than relying on consumption taxes that disproportionately impact on lower-income households.

SARS under strain – rebuilding capacity

While the Budget signals confidence in SARS’ ability to improve collections, the underlying fiscal reality remains challenging. The tax gap is unlikely to be bridged through enforcement alone, and Treasury’s reluctance to make further structural tax adjustments suggests that more austerity measures could be on the horizon.

For now, the investment in SARS is a step toward improving compliance and efficiency, but it remains to be seen whether these measures will be enough to offset revenue shortfalls in the face of South Africa’s broader economic difficulties. DM