The Sekunjalo group has responded with outrage to a Supreme Court of Appeal (SCA) finding that will effectively allow Nedbank to close the accounts of the group. This comes after a full bench of South Africa’s second-highest court of appeal excoriated a finding made by the Equality Court.

The finding constitutes a huge legal setback for the Sekunjalo group and its 44 associate companies, which has been conducting a four-year legal campaign to prevent a host of SA’s top banks from closing its accounts.

The group was initially successful in gaining an interim order against Nebank at the Equality Court preventing the bank from closing several accounts.

The finding of the SCA reverses this decision and sharply criticises the judgment of Judge Mokgoatji Dolamo, saying the court should have dismissed the application in the first place because Sekunjalo had never established a prima facie case of unfair racial discrimination.

In response, the Sekunjalo group said it was “dumbfounded” by the ruling and questioned the race of judges in the case, saying it was “highly unusual” that a panel of five white judges should come to this decision in this “landmark case” about how SA’s banks treat customers differently according to their racial classification.

“Not to impugn the integrity of these judges, but it is highly unusual and especially so given that every other case at the SCA on the day that this matter was heard, had been presided over by a bench fully representative of South Africa. Why not this matter?”

Central to Sekunjalo’s case was the distinction it made between how it had been treated, and how several “white” companies had been treated, including Steinhoff, EOH and Tongaat Hulett, whose bank accounts with Nedbank and other banks remained open.

The judgment contains “some obtuse observations”, Sekunjalo said, including one claiming that Sekunjalo had not conclusively proven that EOH, Tongaat Hulett and Steinhoff – whom it cited as being treated differently – were in fact white-owned.

“Sekunjalo contends that the judges did not apply their minds to this point at all.”

Sekunjalo had not been found to be suspected of any financial misconduct, the Sekunjalo statement said.

“Indeed, Nedbank, in writing, confirmed that Sekunjalo had not been found to have done anything wrong. Thus, there is no need for Sekunjalo to take any corrective action. This was also ignored by the SCA.”

Dismissed with costs

However, in dismissing the application with costs, acting Supreme Court of Appeal judge Raylene Keightley said there were fundamental inadequacies in the respondents’ case.

The respondents – the Sekunjalo group – applied the racial designation of “white” or “white-dominated” to Steinhoff, EOH and Tongaat “without any underlying factual basis to support that designation”.

“In their submissions, the respondents contended that the race profile of a company must be determined by considering factors such as the racial composition of its senior management, its board of directors and its beneficial shareholders.

“However, the affidavits filed in support of the application were devoid of any reference to these factors, let alone an evaluation, based on them, of the alleged ‘white companies’ identified.

“These companies [also] did not pose the same reputational risk as the respondents. This was because, unlike the respondents, they had all been restructured following the adverse findings against them; they had acknowledged their past wrongdoing; those implicated had been dismissed or resigned; new management was in place and other remedial actions had been undertaken.”

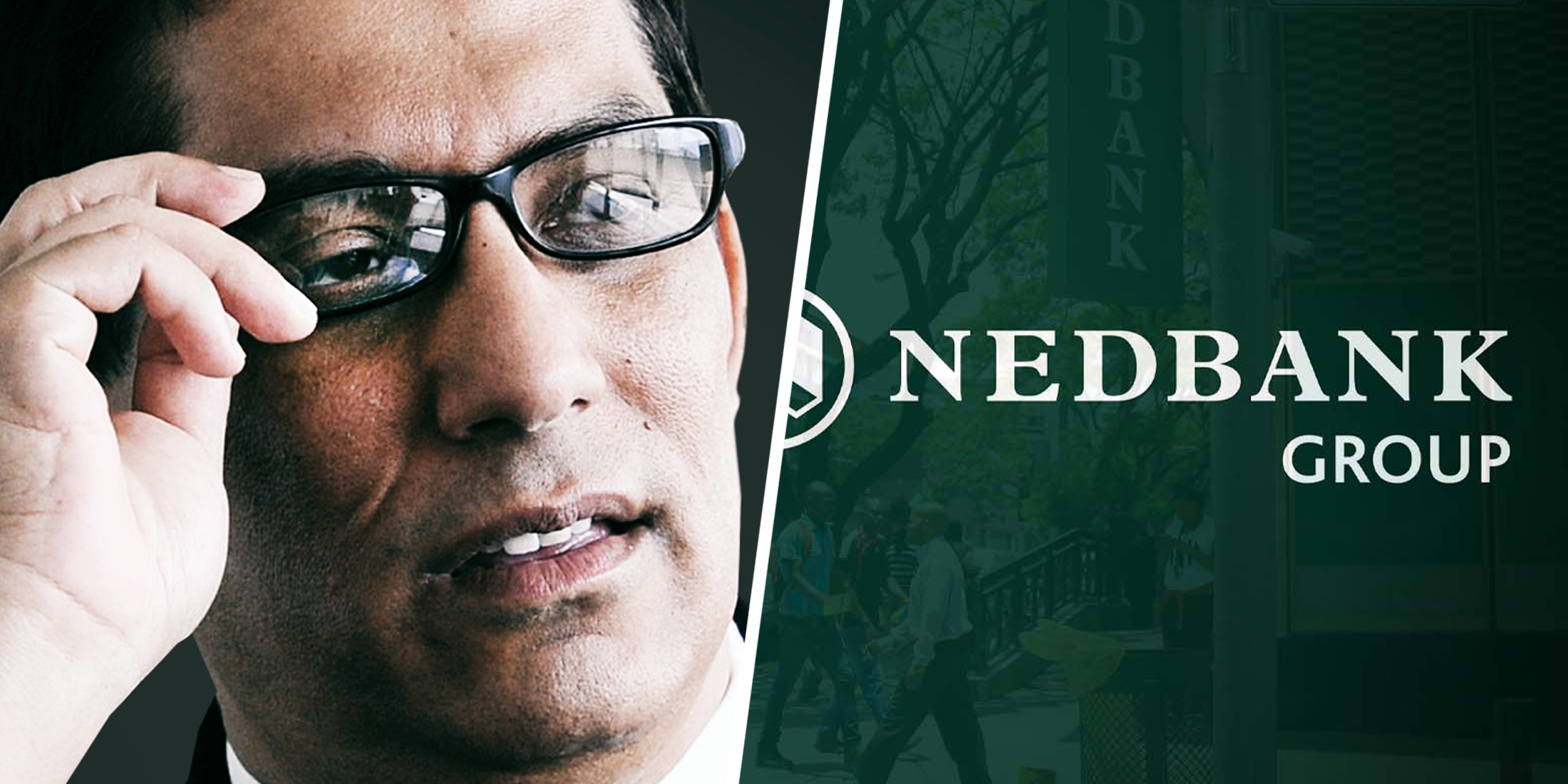

In contrast, its interaction with the respondents demonstrated that they had sought to downplay the seriousness of the Mpati Commission’s adverse findings and comments directed at the Sekunjalo Group and its founder, Dr Iqbal Survé.

“Effectively, the respondents’ case rested on no more than an assumption of racial designation” and the Equality Court had “inexplicably” reversed the onus of proof, the unanimous judgment found.

The Sekunjalo’s group application to the Competition Commission against several other banks has also failed, but it has now announced that it intends to take these cases to the Constitutional Court.

Some of the group’s bank accounts remain open pending that court’s finding.

Absa, FNB, Investec and Mercantile Bank all started the process of closing the accounts in 2020, and, reportedly, a total of 28 banks and representative offices of foreign banks have turned down Sekunjalo’s business, making the banking sector’s boycott very nearly universal.

The companies involved in the battle include JSE-listed African Equity Empowerment Investments, Premier Fishing and AYO Technology Solutions. DM