Post-publication update: The first version of this story reflected that Gundo was not a registered credit provider and could, therefore, not offer lawful loan services to T5 Investments. This is incorrect. A “large agreement” (over R250 000) to a company is excluded from the National Credit Act. We have deleted references to Gundo not being a credit provider as the rule is not applicable in this article.

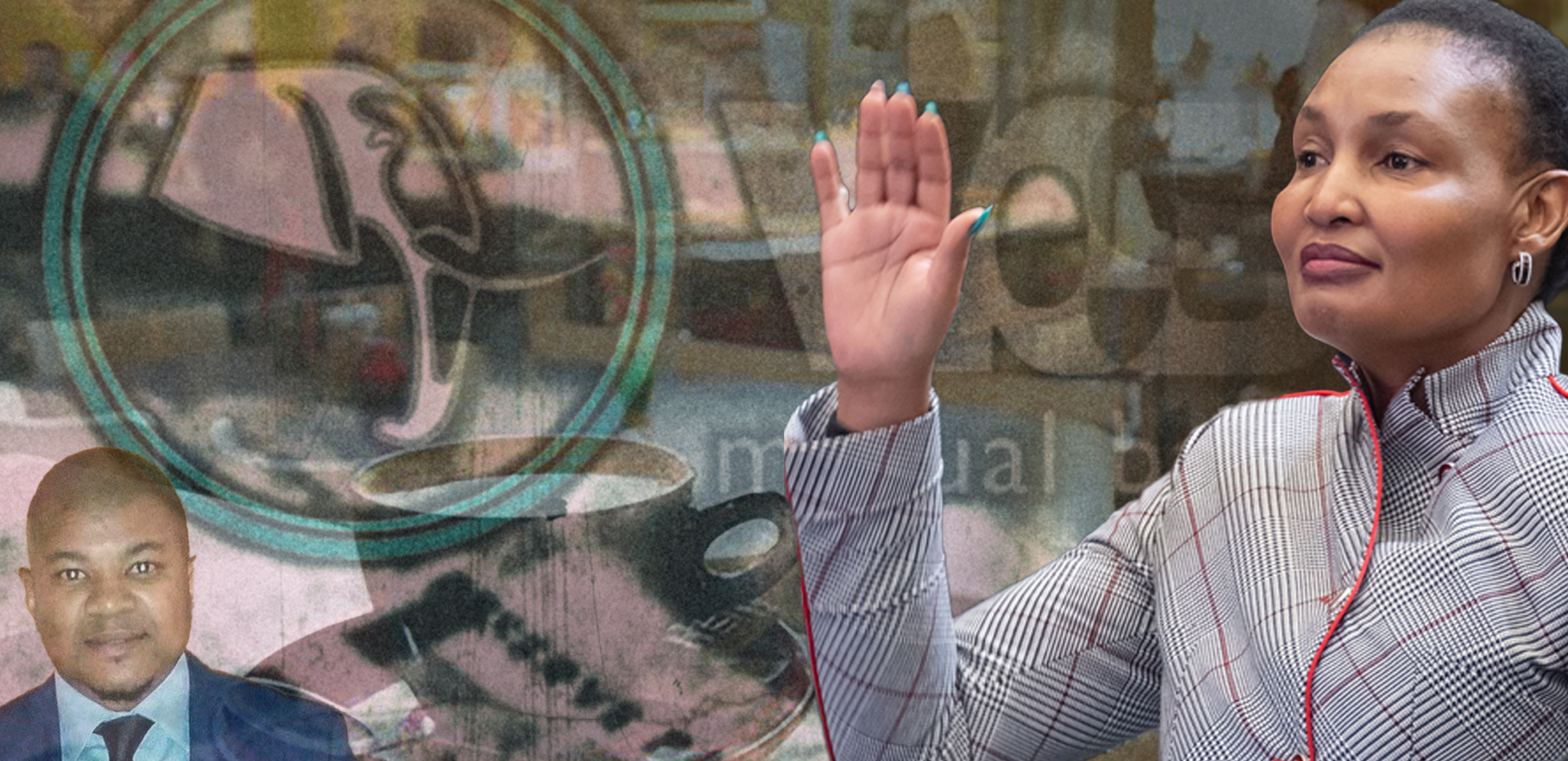

Thembi Simelane took the sole “loan” that corruption accused Ralliom Razwinane claimed to have issued in 2016 from his financial advisory company, Gundo Wealth Solutions’ account held at VBS Mutual Bank.

The only other payouts marked as “loans” in the Gundo account (all made after 2016) total R23,000 and were made to three people, a joint Daily Maverick and News24 investigation has found.

Simelane claims Gundo “loaned” her R575,600 in October 2016 to buy a coffee shop in Sandton. She was the mayor of Polokwane Municipality at the time, and Razwinane was the “commissions agent” who facilitated five unlawful investments of R349-million in VBS, starting days before he made the “loan” to Simelane.

Razwinane received millions in kickbacks from VBS for connecting the bank and the municipality.

There was no cash other than the VBS kickbacks in the Gundo account when it bought the coffee shop for Simelane — cash that is now central to Razwinane’s prosecution.

To “loan” more than half a million rand to Simelane, Gundo dipped R400,000 deep into its overdraft at the bank. Razwinane parted with 39% of the money the Gundo account received that year. Only 11% of the account’s income was paid to other entities. The rest, plus a large portion of Gundo’s overdraft, funded regular payments to Gundo’s Nedbank and FNB accounts, or part payments towards his properties, the analysis found.

To “loan” more than half a million rand to Simelane, Gundo dipped R400,000 deep into its overdraft at the bank. Razwinane parted with 39% of the money the Gundo account received that year. Only 11% of the account’s income was paid to other entities. The rest, plus a large portion of Gundo’s overdraft, funded regular payments to Gundo’s Nedbank and FNB accounts, or part payments towards his properties, the analysis found.

Read more: EXCLUSIVE: Justice minister took half a million rand ‘loan’ from accused VBS investment broker in 2016

A person with inside knowledge of Gundo’s business deals suggests that Simelane’s receipt of the sole “loan” Gundo made in 2016 and the amount of cash Razwinane paid towards her business is questionable, as the company was never in the money-lending business.

This casts significant doubt over Simelane’s attempts at explaining how she became a beneficiary of VBS loot.

Razwinane is on trial for 13 counts of corruption linked to the VBS loot in his Gundo account. The kickbacks to Gundo, of which a portion eventually ended up with Simelane, are the subject of two counts of corruption.

When Simelane bought Silvana’s Coffee Shop, she had oversight of Polokwane Municipality’s R3.5-billion budget. As mayor, she was the accounting officer — she had ultimate responsibility for the municipality’s financial management and governance.

When Simelane bought Silvana’s Coffee Shop, she had oversight of Polokwane Municipality’s R3.5-billion budget. As mayor, she was the accounting officer — she had ultimate responsibility for the municipality’s financial management and governance.

Eight years later, Simelane — now justice minister — has denied any impropriety. She said there was no conflict of interest when she used Gundo, which was contracted to her municipality, as her personal “loan” provider. She further denied any conflict of interest between her being a potential VBS suspect and the political head of the National Prosecuting Authority, which is responsible for the sprawling VBS prosecutions.

The minister is due to appear in Parliament on Friday to answer questions related to the “loan”.

Razwinane did not reply to questions sent to him by the authors of this article.

The secrets of Gundo Wealth Solutions’ VBS account

Razwinane received millions of rand in kickbacks, loans and a huge overdraft in exchange for cajoling municipalities and state-owned enterprises to unlawfully invest in VBS Mutual Bank. When the bank imploded and was put into curatorship in March 2018, Razwinane had benefited to the tune of about R24-million, an investigation by advocate Terry Motau and law firm Werksmans found.

Razwinane’s company Gundo opened a VBS bank account in September 2016. Between then and March 2018, Gundo received R16.8-million in VBS loot. Razwinane regularly used the overdraft, at first capped at R600,000, internal documents show.

VBS bank managers viewed Razwinane as particularly important to their money-making endeavours and allowed the overdraft to stretch to more than R900,000 by the time the bank imploded.

The total expenditure from Gundo’s VBS account was almost R18-million. Razwinane sent the bulk of it to his account and the Gundo account, held at Nedbank and FNB, respectively.

Read more in Daily Maverick: VBS scandal archive

The money flowing in and out of Gundo’s VBS account in 2016 reveals the company received R1.47-million in four payments — all of it kickbacks from VBS.

Prosecutors tied three of these directly to Polokwane Municipality’s first and second investments in VBS and described the transactions as corrupt. The fourth transaction was a “bridging loan” of R375,401 for a property.

In his plea affidavit, the disgraced former chairperson of VBS Bank, Tshifhiwa Matodzi, explained how VBS dished out “loans” to people whose loyalty and favourable actions Matodzi wanted tied to the bank.

Many of these “loans” were never repaid. From Gundo’s bank statements, it seems neither did Razwinane. The “loan” to Gundo seems to have been, in effect, akin to a bribe.

The money flowing out of Gundo is even more startling, particularly measured against Simelane’s version of events and what is expected of a company providing “loans” to government officials and the public.

In 2016, R2.07-million flowed out of Gundo, including the R575,600 — about 39% of the inflows — paid towards the purchase of Silvana’s Coffee Shop.

Razwinane deposited the bulk of the cash, R960,000, in Gundo’s Nedbank and FNB accounts, and made a part-payment of R300,000 for a property in Eagle Canyon.

The balance of the total outflows includes R10,000 “legal fees” and a total of R163,000 sent to two people seemingly influential in Limpopo and KwaZulu-Natal local government structures. This tallies to about 11% of the total income in Gundo’s VBS accounts for 2016.

That year, not only did Razwinane pay the biggest chunk of his VBS loot, other than to himself, for Simelane’s coffee shop, it seems he did not offer any other entity or person a “loan”.

The word “loan” in relation to any other person only appears four times in the Gundo VBS bank statements among nearly 300 transactions.

The first was a payment of R5,000 described as “Sethole loan” on 6 May 2017.

The same person received another R5,000 on 27 January 2018. A day later, Gundo paid R3,000 marked as “Ngobeni loan” and on 9 February 2018, a R10,000 payment simply described as “Loan” flowed out of the Gundo account.

This financial analysis suggests that the R575,600 transaction for Simelane’s coffee shop was a complete outlier in the Gundo VBS bank statements. DM