First published in the Daily Maverick 168 weekly newspaper.

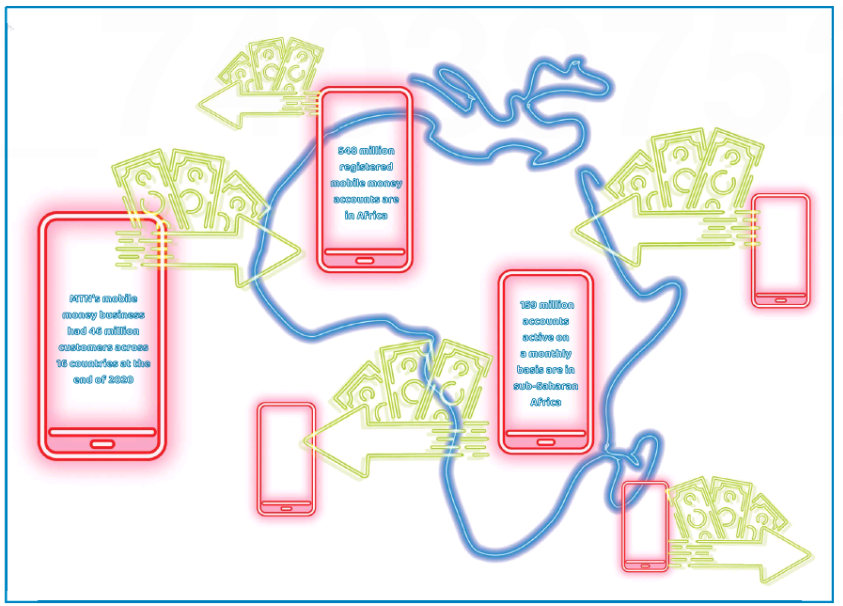

If 2020 and Covid-19 taught us anything, it is that the shift from cash to digital forms of payment is accelerating at a rate not seen before, and is set to continue. Last year, the number of registered mobile money accounts topped 1.2 billion, 548 million of which are in Africa. At the same time, the number of accounts that are active on a monthly basis topped 300 million, 159 million of which are in sub-Saharan Africa.

And while it took nearly a decade for the mobile industry to reach its first 100 million (active) mobile money accounts it took just more than five years to add another 200 million. These are some of the numbers included in the GSMA’s latest “State of the Industry Report on Mobile Money”.

Telecoms providers MTN, Vodacom and Airtel, sitting plumb in the middle of this opportunity, are beginning to reorganise themselves to capitalise further, and investors are paying attention.

“The opportunity in mobile money is massive and the telcos [telecommunications companies] are well positioned to capitalise on it. These are valuable assets,” says Claude van Cuyck, portfolio manager at Denker Capital.

Last year M-Pesa, the continent’s first and most successful mobile money payment service, was acquired by Vodacom and its Kenyan subsidiary Safaricom in a joint venture the companies hope will spur the growth of mobile payments on the continent. It has more than 40 million users and moves more than $24.2-billion a month through the platform, according to Vodacom Group CEO Shameel Joosub.

More recently, London-listed Airtel Africa assigned a $2.65-billion valuation to its mobile money business, Airtel Mobile Commerce, by selling off stakes to The Rise Fund (the impact investing platform of alternative investment firm TPG) and Mastercard. Airtel, which has operations in 14 countries across Africa, is exploring the listing of its mobile money business.

“Globally, the fintech space is highly rated,” says Shmuel Simpson, an investment analyst with 36One Asset Management. “You just have to look at the likes of Paypal, Square or any of the other payment businesses. Once they have scale they are high-margin businesses with good cash flow and limited capex requirements.”

Then, MTN CEO Ralph Mupita told Bloomberg that it was unbundling its fintech business, which was not especially surprising. What was surprising was the valuation: R5-billion, almost half the existing market value of the company.

MTN plans to separate its infrastructure assets from its high-growth platforms, such as data and fintech, to reveal value and attract third-party capital and partnerships into these businesses, says Mupita. This is part of the group’s strategic repositioning, ‘Ambition 25’, announced last month. To support this, about R29.1-billion will be invested in the network, as well as fintech and digital services platforms in 2021, Mupita says.

This revised strategy is part of MTN’s ongoing efforts to reduce debt, simplify its portfolio of assets, for instance by exiting its Middle East investments, and focus on its Pan-Africa business.

Mupita promised to provide investors with more details on this strategy and its implementation at a capital markets day (CMD) planned for early June 2021. The board has also appointed Serigne Dioum the group’s chief digital and fintech officer, who joined the exco on 1 January.

MTN’s mobile money business has grown significantly, from 22 million customers in 2017 to 46 million across 16 countries at the end of 2020. It plans to more than double this to 100 million by 2025.

The fintech business, which includes person-to-person transfers, insurance services, bill payments and airtime top-ups, is small relative to MTN’s core services business, which generated revenue of R170-billion at the end of 2020, and data, which generated R48.7-billion. For its part fintech generated R13.5-billion, but is growing annually at a rate of 24% and has been challenged to deliver 20% of group revenue in the next three to four years, compared with 8% currently.

This could well be feasible.

According to the GSMA, Africa’s mobile money industry has reached a digital tipping point, driven by two key trends. The first is that digital transactions – as opposed to simple cash-in and cash-out transactions – now make up the majority of African mobile money flows, making the mobile money system increasingly integral to the African financial system. The second is that more value is circulating in the mobile money system than exiting. About $13.6-billion was circulating in the system at the end of 2019.

MTN does not have a good track record for staying on the right side of regulators. And right now it does not have a P2P lending licence, which allows an operator to match borrowers and lenders on its online platform, in Nigeria, its fastest-growing mobile money market.

Supporting this is the fact that the market is far from saturated. And while money providers partner with the likes of agribusinesses and co-operatives, the unfortunate reality is that the demand for partnerships with non-profit organisations is also growing – and driving demand. There are 25 million displaced people in Africa and mobile money services are connected to on average 11 humanitarian organisations.

But as the sector grows, so regulators are paying increasing attention to the telcos. It is expected that the regulatory environment will have to change to incorporate the mobile money market.

“Some regulators are encouraging the split between telecoms and fintech,” says Simpson. “They don’t want the telcos to have that much control and would like better interoperability. It is possible that MTN is pre-empting this requirement.”

MTN does not have a good track record for staying on the right side of regulators. And right now it does not have a P2P lending licence, which allows an operator to match borrowers and lenders on its online platform, in Nigeria, its fastest-growing mobile money market.

“They have had issues in Nigeria,” says Van Cuyck. “This is the first time they have tried to do fintech and mobile money without a bank, and the banks have pushed back. It is possible that by unbundling and setting up a separate business, MTN will have an ‘arm's length’ interest in the business economics of this growing and valuable segment while also allowing the banks and other potential shareholders to share in the upside.”

While MTN faces regulatory and macroeconomic challenges in its core markets, it seems that investors like the strategy, kicked off by former CEO Rob Shuter, and amplified by Mupita.

“The company has some optionality on multiple fronts,” says Simpson. “Just the mobile money business and the stake in tower business IHS can potentially account for almost 75% of MTN’s market cap. Unbundling, selling or listing these could realise significant value for the company.”

The share price reflects the investor interest, rising 51% in the year to date to R92.85. DM168

This story first appeared in our weekly Daily Maverick 168 newspaper which is available for free to Pick n Pay Smart Shoppers at these Pick n Pay stores.