Read Part One here.

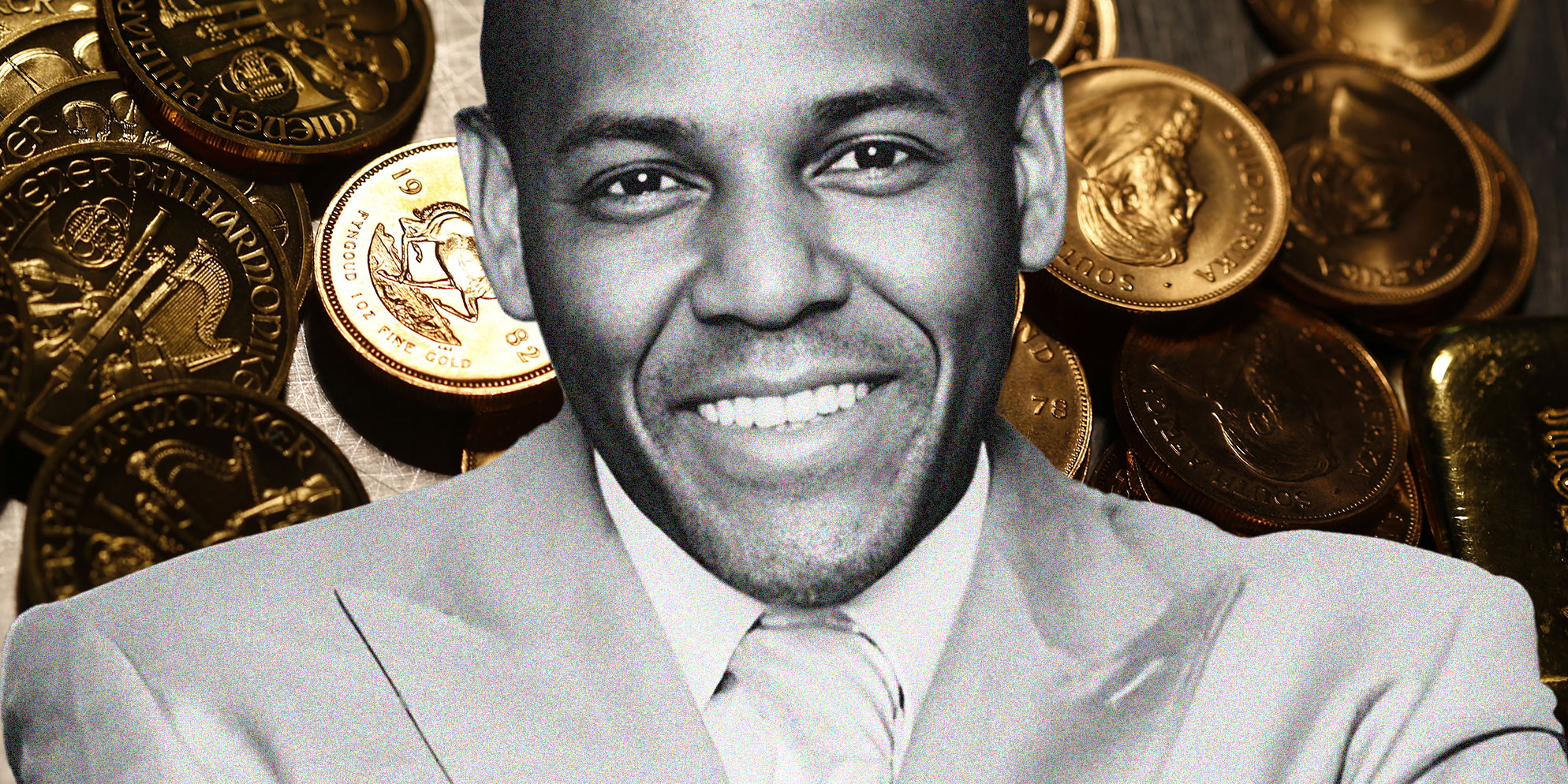

Frank Sadiqi spent some R19-billion buying Krugerrands, but where did all that money come from?

The SA Revenue Service (SARS) has accused him of supplying coins in bulk to the illicit gold supply chain so that they could be illegally smelted as part of a colossal VAT scam. But who made up the rest of that chain?

AmaBhungane can’t access the whole history of Sadiqi’s African Medallion Group, but the voluminous bank statements we do have for him and related parties show that practically all his income, at least up to late 2018, arrived directly or indirectly from Asset Movement Financial Services.

Later known as AMFS Solutions, this notorious “cash-in-transit” company was created by the gold trader Andries Greyvenstein and was linked to alleged money launderer Howie Baker. AmaBhungane has reported on Baker’s links to Zimbabwean tobacco mogul Simon Rudland and the company’s operations here, here and here.

Readers will recall that Baker was, from 2019 onwards, also the owner of Rappa Resources — the gold export refinery targeted by SARS to try to recover the proceeds of what SARS claims was a multibillion-rand gold VAT scam (as we reported in Part One).

South African lawyer Raees Saint, who represents Baker, did not reply to our request for comment but previously told amaBhungane that his clients would not tolerate any insinuation of illegal conduct.

To recap, the basic idea behind the VAT scheme is smelting down VAT-free Krugerrands (which is illegal) and passing them off as “scrap” gold (which does carry VAT) to claim refunds adding up to billions of rands.

For now, it is important to understand that AMFS has been accused, not least by SARS, of effectively being an unregistered bank that just moved money from one place to another, with most of its business allegedly directed personally by Baker through daily email instructions. The Zondo Commission of Inquiry recommended that AMFS be investigated by the Hawks.

As mentioned, Krugerrand harvester AMG received most of its money from AMFS.

Lots of money. In the first year of existence of Sadiqi’s Krugerrand business — late 2017 to late 2018 — we can trace a total of R5-billion paid to the coin dealer from AMFS.

A close analysis of the books for this period, however, shows that the money going to AMG via AMFS came largely from just one place: the Gold Kid micro-refinery.

One would think that Gold Kid, as a refinery, could have no business with a Krugerrand dealer, directly or indirectly, given that the smelting of Krugerrands is illegal. However, as the bank statements show, it appears that Gold Kid was dealing with AMG at an industrial level through AMFS.

Until its demise at the end of 2018, Gold Kid was owned by Greyvenstein, while Baker was at different times also a shareholder and an employee, using a company email address in emails we have copies of.

Gold Kid’s income in turn also came from pretty much one place: the aforementioned Rappa Resources, to which Gold Kid sold 8,662kg of gold in the period covered by our bank statements. A high-level summary of Gold Kid’s income and expenses from 2016 through to the end of 2018, which has been filed in court by SARS, suggests that 90% of sales were to Rappa.

In 2019, Baker and company finally took control of Rappa as well, in a R1-billion deal.

Rappa’s CEO, Gary Bickerton, told us, however, that Baker first approached them with a takeover plan as early as 2015, just as AMFS was founded.

Perhaps tellingly, Bickerton claims that Rudland — the man believed by some to be the force behind Baker — was at the meeting.

Rappa has been locked in a legal battle with SARS for several years about VAT refunds that have been withheld. A separate preservation order SARS obtained against Baker in 2022 means that the receiver of revenue’s curator now technically owns the refinery it is doing battle with.

“Mr Baker was simply a shareholder of Rappa and was never involved in the operation, management or transactions of Rappa. Mr Baker is no longer a shareholder of Rappa and no longer has a relationship with the company,” said Bickerton.

“We place it on record that Rappa pays VAT on all its purchases reflected in tax invoices and claims VAT input credits completely in line with provisions of the VAT Act.

“Rappa is aware of payments to Gold Kid for supplies made to Rappa but cannot comment on what Gold Kid did with payments received from Rappa. Rappa has never dealt with the cash-in-transit group AMFS.”

Read Rappa’s full response here.

As we show next, however, Gold Kid used a large proportion of its receipts from Rappa to buy Krugerrands.

Route One: From Gold Kid to AMG

Greyvenstein’s lawyers, in response to questions, were adamant that Gold Kid never bought Krugerrands from Sadiqi’s African Medallion.

However, as we will show, the evidence points decidedly in the opposite direction.

This suspicion is strengthened by SARS’ figures, which show it has attempted to claw back from Gold Kid around R1-billion in allegedly invalid tax claims from 2016-2020.

Gold Kid, as we’ll see, claimed it bought gold not as Krugerrands from Sadiqi, but as thousands of pieces of small jewellery and scrap gold for which it could claim input tax.

In response to questions about the apparent Krugerrand purchases it made, Gold Kid succinctly told us that it “denies having done so” and that as a consequence there “is no need to answer” additional questions.

It did, however, give more extensive answers in affidavits filed in an ongoing court battle with SARS, about which more below.

But here is why Gold Kid’s story does not add up.

Refinery to refinery

AmaBhungane is in possession of a trove of internal emails from AMFS, as well as bank statements for nearly all involved parties.

First, these seem to show that Gold Kid’s vociferous denial that it ever did business with African Medallion rings spectacularly hollow.

AmaBhungane’s analysis of these documents appears to show that the opposite is true, on a massive scale. A SARS letter of findings filed in court shows that the receiver of revenue arrived at a similar conclusion.

On 20 September 2017, around the time African Medallion got a licence from Rand Refinery to sell Krugerrands, Howie Baker sent an email to AMFS’ nominal owner and administrator, Kalandra Viljoen, affectionately known as Lallie.

Baker copied in Lize Muller, Gold Kid’s finance manager.

The email reads:

Dear Lallie,

Please can you do these transfers:

African Medallion (Pty) Ltd

FNB

Branch: 204809

Account: [Number redacted]

Ref: Asset Management

Amount: 9,000,000

Ian Frank Properties

FNB

Account: [Number redacted]

Amount: 9,000,000

Thanks very much.

It just so happens that on the previous evening, Gold Kid had made two payments equalling exactly R5,850,000 into AMFS’ bank account using matching reference numbers.

As soon as Baker’s email came in, AMFS paid forward the combined R5,850,000.

Bank statements for African Medallion show this amount arriving with the reference “Asset Management”, as directed in Baker’s email.

Immediately afterwards, African Medallion received another R1-million from another party and then paid R6,874,000 to Gold Reef City Mint, another Krugerrand dealer.

The chain of payments can be seen here:

If we return to the R5,850,000, Gold Kid’s internal records show that there was an apparent attempt to hide these transactions from SARS.

Evidence shows that Gold Kid claimed it made payment of two invoices to a supplier named Jewellery Dynasty totalling R6.25-million. These used the invoice references JG81 and JG82 — the same invoice references used for the payments that actually went to African Medallion, for which we have seen no invoices.

There are also no payments to Jewellery Dynasty to be found in either Gold Kid or AMFS’ bank accounts. This indicates that Jewellery Dynasty was most likely one of many “invoice factories” used by Gold Kid, as we explain below.

Taking into account what we’ve described above, it seems clear that Gold Kid was doing business with African Medallion despite its denials.

Another transaction reinforces this point and adds another layer of apparent subterfuge.

On 28 September 2017, Baker emailed Viljoen at AMFS:

Dear Lallie,

Please can you do these transfers:

African Medallion (Pty) Ltd

FNB

Branch: 204809

Account: [Number redacted]

Ref: Asset Management

Amount: 9,000,000

Ian Frank Properties

FNB

Account: [Number redacted]

Amount: 9,000,000

Thanks very much.

On the same day, he sent two more missives adding two payments for African Medallion — another R9-million and R647,411.34.

This set off a slightly more complicated chain of transactions, and the evidence suggests that the payment to Ian Frank Properties, a company owned by Sadiqi, was in reality also meant for African Medallion.

The trail went as follows:

On the day of the email, Gold Kid’s account showed six outgoing payments totalling R25,720,000.

At AMFS these payments can be seen arriving with the same reference codes. AMFS then duly made the four payments Baker had requested.

Bank statements for African Medallion show its three direct payments totalling R18,647,411.34 arriving.

In addition, bank statements for Ian Frank Properties also show its R9-million arriving. It, however, immediately makes a payment of R8,834,050 to African Medallion.

Other Sadiqi companies, notably Hamilton Lifestyle, also appear to have functioned as conduits in this way.

So now all four payments ordered by Baker are sitting with African Medallion (minus a small amount retained by Ian Frank Properties).

As soon as all this money was consolidated in the account of African Medallion, the company made a payment of R24,636,307 to Rand Refinery with the reference “KR” — quite likely an abbreviation for Krugerrand.

There is thus an immediate and unbroken chain of payments from Gold Kid to Rand Refinery, the ultimate source of South Africa’s Krugerrands, via African Medallion.

Once again, this makes Gold Kid’s denials implausible.

There are countless examples like these in the statements. In every case, the chain of transactions is preceded by an email from Baker. And in every case, he copies in a representative from Gold Kid — either Greyvenstein’s sister Veronica, who was effectively the CEO, or finance manager Lize Muller.

Two of the Baker emails serve to bring Grevenstein himself more clearly into view.

On 20 November 2017, Baker emailed Viljoen asking for a R5-million payment to African Medallion. Viljoen, however, responded that Gold Kid only had a balance of R4-million at AMFS that day — an amount statements confirm Greyvenstein’s refinery paying over to AMFS the same day.

Baker responds that “Andries” (in context, a clear reference to Greyvenstein) had told him to “expect 5” but tells Viljoen to go ahead with the smaller amount as suggested.

This then follows the same path described for the other transactions above.

On another occasion, Baker ordered R4,050,000 for each of Sadiqi’s other companies, Ian Frank Properties and Hamilton Lifestyle.

Kalandra Viljoen, however, sends him a panicked email referring to a conversation with “A” — she was worried she had accidentally used another client’s money to carry out Baker’s orders:

Dear Howie,

A spoke to me this morning about 25 coming in, so far R14 430 000 has come in. Can you confirm it is yours. (If not, then I will pooop my pants as I just spent some of it on these payments). I will actually cry!!

For what it is worth, Baker assured her that it was Gold Kid’s money.

This incident, however, shows how AMFS functioned as a fairly chaotic hawala system — one that simply inserts a third party into a transaction in an apparent attempt to obscure the source of funds.

This is reinforced by the fact that not one of the many payments to African Medallion, and most clients of AMFS, involved any physical cash at all — somewhat strange for a “cash-in-transit” company.

After its initial denial that it had had dealings with African Medallion, amaBhungane confronted Gold Kid with documented chains of payments like those above, to which it chose not to respond.

The refinery’s lawyers also threatened to pursue amaBhungane for being in “criminal” possession of its private information.

Millions to billions

The emails only cover the first few months of the relationship between Gold Kid and African Medallion, but already add up to orders of more than R250-million directly to African Medallion and R400-million indirectly through Ian Frank Properties. As noted, the pattern of payments via AMFS continued for a long time afterwards, adding up to R5-billion in late 2018, where we lost the trail.

We have matching payments, but no emails.

We cannot say unequivocally that all or most of this R5-billion came from Gold Kid, beyond the fact that our data show a similar pattern.

African Medallion ultimately sold R19-billion in Krugerrands in the course of its operations between 2017 and 2021, but we don’t know how much of the balance came from AMFS either.

Smoke and mirrors

While bank statements seemingly betray the nature of Gold Kid’s relationship with African Medallion, Greyvenstein’s company’s books tell an entirely different “official” story.

An audit and subsequent letter of findings by SARS into Gold Kid last year alleged the use of large-scale invoice factories to provide cover for, among other things, its indirect payments to AMG.

An invoice factory is a company with no real business set up to provide tax invoices for transactions that involve completely different people. These invoices are key to the VAT tax scam because they are what gets submitted to SARS to maintain the fiction that VAT has been paid on, for instance, tax-free Krugerrands.

In submissions to SARS, Gold Kid claimed to have very few suppliers, whom it paid just over R10-billion for gold from 2016 onwards. One allegedly major supplier was Bhekusifiso Scrap, from which Gold Kid supposedly bought R2-billion of that gold.

The problem is that the actual payments to Bhekusifiso that SARS found amount to just 1.47% of the stated figure. Gold Kid’s bank statements are littered with small payments in the tens of thousands to this supposedly huge supplier.

Additionally, records for Howie Baker show that he personally paid R750,000 to Bhekusifiso in September 2014 for a “share subscription”. This belies the claim that Bhekusifiso is independent.

The same applies to other supposed major gold suppliers on Gold Kid’s books. One of them, Encantador, was supposedly paid R1.22-billion for gold. According to SARS, however, it received about 0.15% of this figure.

Another is Jewellery Dynasty, which supposedly sold Gold Kid gold worth R1.87-billion, while SARS said it was paid just 0.65% of that.

Taken as a whole, Gold Kid’s supposed supplier payments bear no resemblance to its real expenditure.

Almost all payments went to AMFS (which appears twice in the list above because it changed its name under new ownership during the period) and, as we have seen, a substantial proportion of that was destined for AMG, which does not appear on the “official” list of suppliers.

In response to questions, Gold Kid provided an explanation for the discrepancies: the payments to the “suppliers” were made via AMFS. What is more, Gold Kid claimed, these suppliers would have been giving AMFS instructions as to where to pay their money, so Gold Kid had no hand in it.

This seems not only disingenuous but also logically impossible.

Disingenuous because the payments to, among others, African Medallion were made on the express instruction of Baker (with Gold Kid’s representatives copied in), not on the instruction of the supposed suppliers.

Logically impossible because the scale of payments to African Medallion and other more damning recipients (which we will get to) have to be seen in the context of the grand total of R10-billion in payments Gold Kid made in the relevant period — 2016 through 2020.

Even if the alleged suppliers were making instructions to AMFS that we do not have sight of, these could never be as large as claimed simply because more than half of Gold Kid’s outward payments are already accounted for by Baker’s instructions.

Confronted with this observation, Gold Kid still chose silence.

It has, however, mounted a far more vociferous defence in an ongoing court battle with SARS stemming from the receiver of revenue obtaining a provisional preservation order against Greyvenstein in his personal capacity in February last year.

Battle royale

SARS’ claim against Greyvenstein is roughly R1-billion, with the express threat of adding a 200% penalty to bring the total to R3-billion.

The technical basis of SARS’ claim is that the suppliers that supposedly sold Gold Kid its gold never actually supplied it and were never paid, which means that VAT was also never paid as claimed.

The main evidence SARS is using relates to the kinds of payments to entities like African Medallion that we saw above, which coincide with alleged payments to the suppliers Gold Kid claims to have, but for which there is no record.

“If regard is had to the detailed letter of audit findings and the analysis of Gold Kid’s bank statements it reflects, in certain instances, that Gold Kid only paid a fraction of the invoice amount to its suppliers,” said SARS.

Greyvenstein has not responded to any of this in great detail, but in an affidavit called SARS’ findings a “half-baked conspiracy theory” and the conclusions it has drawn about Gold Kid buying massive amounts of Krugerrands “simply a theoretical conclusion”.

He claims that, on the contrary, “Gold Kid has meticulously recorded all transactions in its administrative systems, and I will in due course deal extensively with these recordals and demonstrate that every single transaction took place.

“When in due course I deal with the substantive issues with regards to the letter of audit findings, assessment and the present application, I will provide extensive documentary evidence of the trades.”

At the same time, however, Greyvenstein has promised to take the legal battle down a path that will possibly delay the need to present this alleged ironclad evidence for years.

First, he launched an interlocutory application to put SARS’ case against him on ice, saying he wanted to challenge the constitutionality of the parts of the Tax Administration Act SARS was using to hold him liable for Gold Kid’s tax debt.

This challenge was drawn up in May last year, but it is unclear whether it ever got filed. Meanwhile, SARS’ case to lay claim to all of Greyvenstein’s assets has been repeatedly postponed, most recently last month.

It is, however, not SARS and Gold Kid’s first rodeo. The receiver of revenue tried to hold the refinery accountable for allegedly fake gold purchases in the past but could not muster the evidence it needed. Following two commissions of inquiry and several investigative audits of industry roleplayers, SARS claims that “this time around it is able to do so”.

While the evidence above seems to show that Gold Kid was a major force in the illegal introduction of Krugerrands into the gold supply chain, following the money up the chain takes things much further.

The evidence suggests that much of the money spent to buy gold and make other huge transfers out of Gold Kid’s accounts didn’t come from gold sales.

Round and around

Instead, and as we will show later in this series, Gold Kid was seemingly both the source and destination of billions flowing through what looks like a sprawling money laundering network that carried out at least two tasks.

One was providing Gold Kid with cash to buy gold which it could sell as part of the VAT scam.

The other was the laundering of funds for a variety of parties, not least Baker and his presumed boss, Rudland.

One central node in all of this was a company in Dubai called Aulion Global Trading — another joint creation of Baker and Greyvenstein which they registered in 2015 and which Baker liquidated in 2020.

While Gold Kid and AMFS were key cogs in an epic machine built around Aulion, they were also far from alone, as we will see in Part Four of this series.

In our next instalment, however, we take a slight detour to the East Rand of Johannesburg to see how the VAT scam is evolving to evade the authorities’ best efforts to quash it. DM