The Treasury said on Tuesday 24 September it had raised $5-billion, a billion more than initially offered, from the sale of a pair of international bonds – one for 10 years, the other for 30 years. The transaction was 2.7 times oversubscribed, meaning almost $11-billion in bids were made, underscoring surprisingly robust investor appetite for South African debt. The Treasury statement added that the issuance was “believed to be the largest ever out of sub-Saharan Africa”.

Even by wider emerging market standards, the transaction is hefty and suggests institutional investors are keen on yields in an age when a fair amount of debt coming out of developing economies has negative yields, meaning you will get less money than what you put in when it matures.

Of course, South African debt comes with a risk premium, but amid all the doom and gloom about rising debt levels, a barely growing economy and plunging levels of business confidence, not to mention policy inertia, investors are hardly demanding the sky.

“The 10-year bond priced at a coupon rate and re-offer yield of 4.85% which represents a spread of 313 basis points above the 10-year US Treasury benchmark bond,” said the Treasury.

“The 30-year bond priced at a coupon rate and re-offer yield of 5.75% which represents a spread of 358.6 basis points above the 30-year US Treasury benchmark bond.”

It said investor demand was widespread, coming from Europe, North America, Asia, South America, Middle East, Africa and other regions. The investor profile was also diverse: “a mixture of fund managers, insurance and pension funds, financial institutions, hedge funds and others”. The additional $1-billion raised “was done to take advantage of good pricing and favourable market conditions while reducing future borrowing need”.

This is clearly good news for South Africa and could – and should – dampen some of the hyperbolic chatter about prospects of an International Monetary Fund (IMF) bailout. Foreign investors are generally shy of lending money to economies with finances in a state of disarray necessitating such action. The transaction comes ahead of a possible risk downgrade by international credit rating agency Moody’s, before the end of the year – which would complete the country’s spiral into junk territory.

Moody’s is the only one of the big three rating agencies maintaining South African debt as investment grade. Moody’s could see this as a signal of confidence in its decision to stick to a rating that many analysts see as questionable, to say the least. Of course, it would be better if the economy was growing at such a pace that the Treasury collected enough domestic revenue to dispense with foreign borrowing. And future generations will be saddled with this debt.

Still, it is a promising sign, and markets should react favourably when they reopen after the Heritage Day public holiday. One just hopes the government does not become complacent, because urgent reforms are still required to fire up the potential of Africa’s most developed economy. BM

This article is more than 6 years old

Business Maverick

Treasury pulls rabbit out of hat with $5bn sale of two international bonds

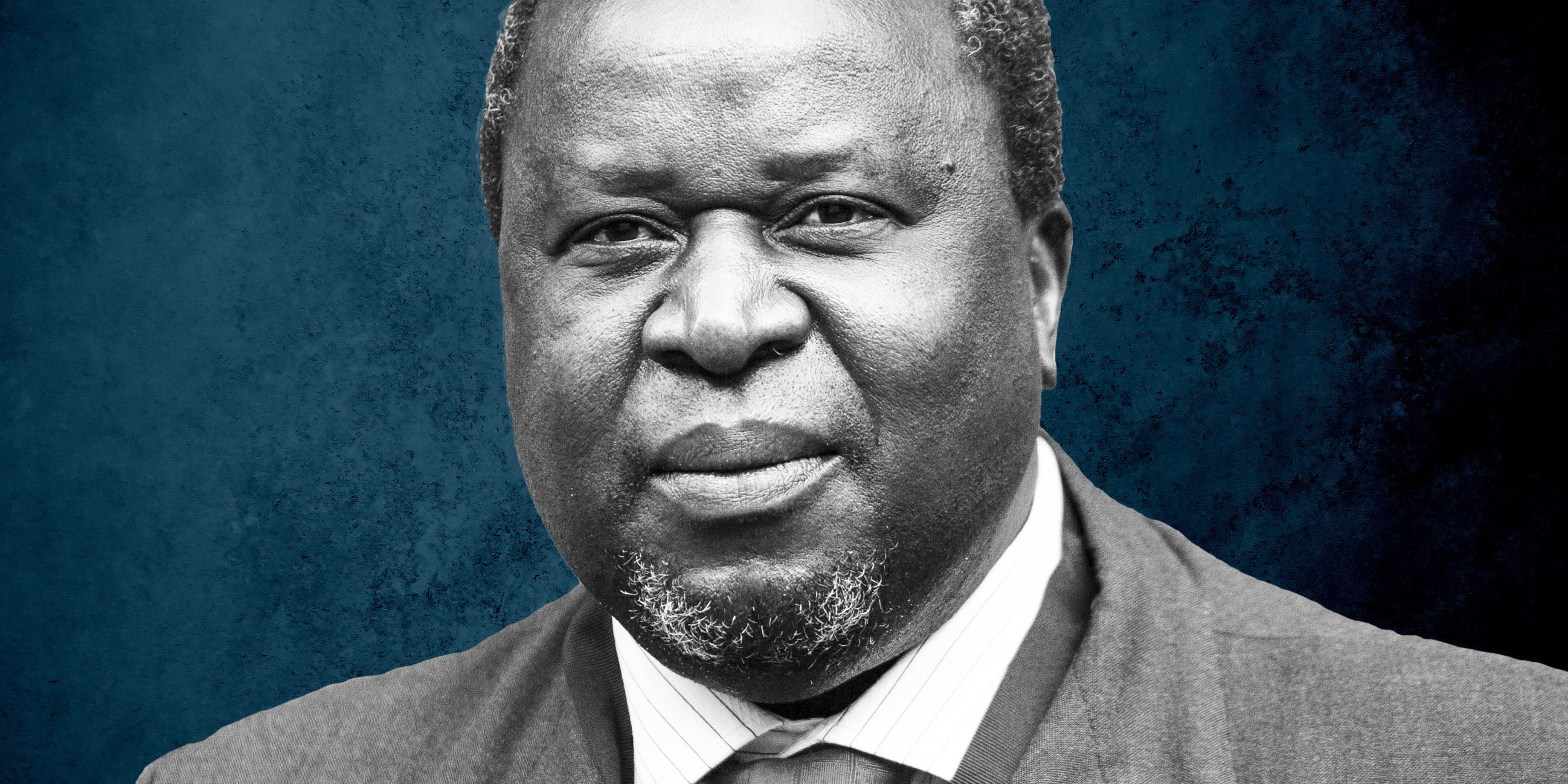

South Africa’s Treasury has issued a pair of international bonds to the tune of $5-billion, the largest such transaction out of sub-Saharan Africa. It’s a vote of investor confidence that Finance Minister Tito Mboweni can do with ahead of his medium-term budget speech in October and a looming Moody’s downgrade.