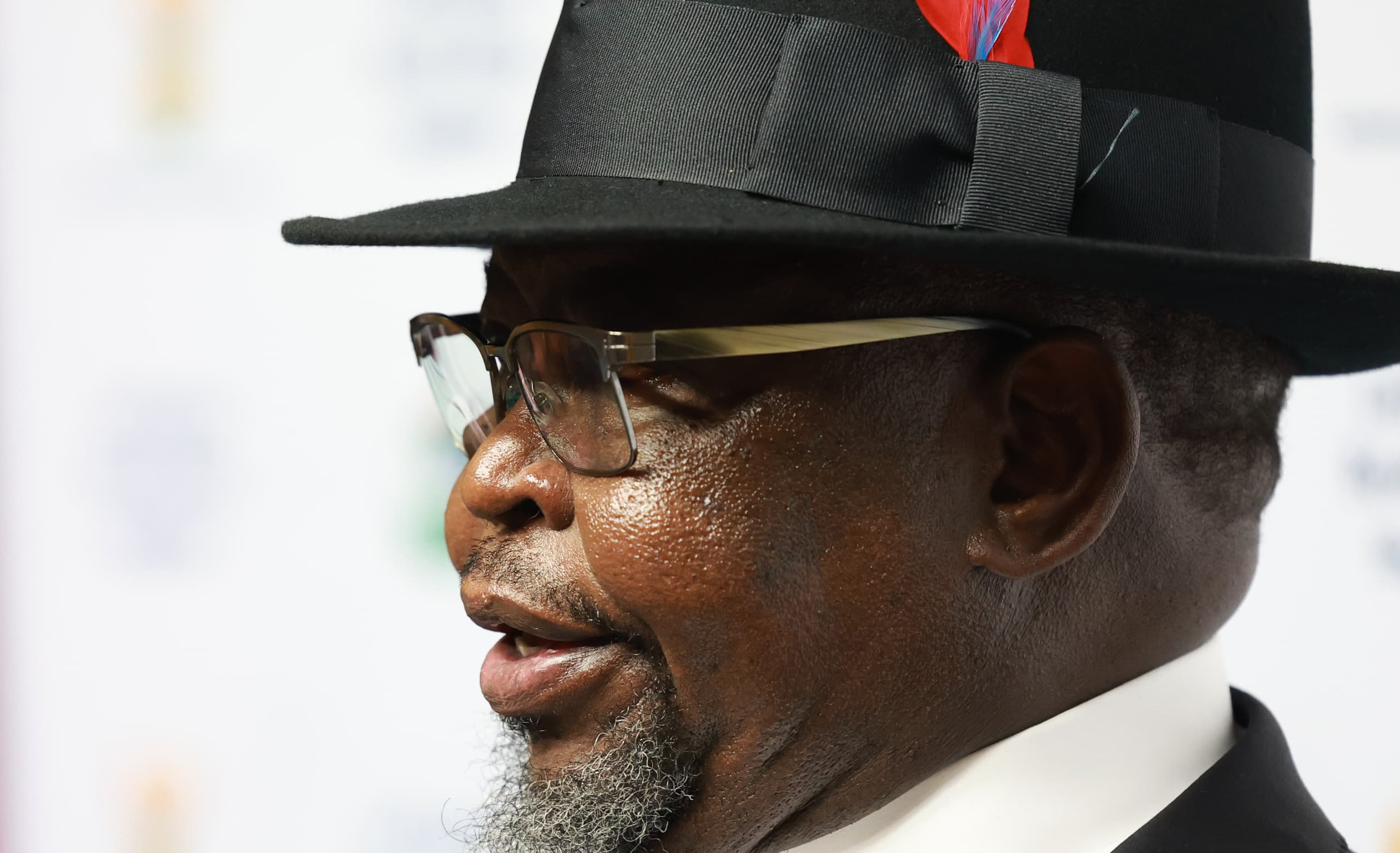

In an unprecedented move, Finance Minister Enoch Godongwana's Budget Speech has been delayed. Chaos ensued on Wednesday when National Assembly Speaker Thoko Didiza announced: “Cabinet, therefore, decided not to come and do a presentation of the budget”, stating a return on Wednesday, 12 March.

The development sent the rand into a tailspin, triggering turmoil in the Government of National Unity. Treasury has since lifted the embargo on the details that would have been presented. The sticking point has been the VAT hike. Here is what we would have reported had the increase gone ahead.

The most significant announcement that was going to be made by Minister of Finance Enoch Godongwana today at the 2025/2026 Budget speech in Cape Town would have been the 2 percentage point increase in Value Added Tax (VAT), effective 1 April 2025, and expected to add R58-billion to the National Treasury’s revenue.

“We propose to raise the VAT rate by 2 percentage points,” said Godongwana, citing the need to increase public sector wage funding and increase infrastructure as key motivation for the increase.

The move, which is mooted to have a positive impact on government revenue, is likely to cause a stir among consumers and unions, affecting small businesses and everyday South Africans the hardest despite government attempts to mitigate cost increases on the most vulnerable.

Why VAT and not Personal Income Tax?

Government revenue is sorely tested given the country’s high debt-to-GDP ratio, expected by government estimates to stabilise at 76.1% of GDP during the 2025/2026 financial year, meaning very little revenue is left over for the government to spend on critical projects and infrastructure.

“Madam Speaker, this decision was not made lightly,” said Godongwana, at pains to make clear that the Treasury is aware of the severity of the decision.

Changes to the Personal Income Tax rate — which is a possible alternative to a VAT increase, were panned by the Treasury.

“We’ve said before that we think that income tax increases aren’t as effective as VAT increases…” said Acting Deputy Director-General Tax and Financial Sector Policy Christopher Axelson today, citing that previous Personal Income Tax increases did not generate expected revenue due to taxpayers changing behaviour — while VAT increases were much less avoidable.

Moreover, extensive changes to Personal Income Tax would probably generate extensive backlash, as South Africa’s income taxpayers are already amongst the highest as a percent of GDP in developing countries.

With just shy of 80% of government revenue generated from taxation, the increase is seen by the Treasury as a critical tool for the government to increase its revenue generation, but the impact on already pressed businesses and consumers is likely to be dire.

However, the VAT increase is unlikely to generate the amount of revenue needed as stated by the government, with an increase to 17% VAT only estimated to add R58-billion.

Consumer and small business impact

Consumers will feel the pinch the most, with essential goods and services such as grocery bills, utility payments and transport costs increasing correspondingly.

The Treasury has attempted to mitigate some of this impact by adding goods to the zero-rated basket, including tinned vegetables, variety meats and dairy blends, as well as exempting the general fuel levy and providing full inflationary relief across the lower two income tax brackets.

While this plays well in terms of protecting the vulnerable on the surface, zero-rating goods and levies does not necessarily exempt them from costs, with concurrent inflationary pressures likely to result across the economy as a whole. Tinned vegetables might not see a VAT increase, but the entire value chain that places them in our homes — from agriculture, canning production, logistics and marketing — will all see higher costs, all of which are likely to be passed on to the consumer.

Small businesses will also feel the increase the hardest as they are not able to absorb increases easily, and increased costs across transport and utilities disproportionately affects them.

A pound of flesh

The VAT increase to 17% is higher than the 1% rumoured in recent weeks and will send a shockwave through the markets as businesses and consumers are forced to adjust their budgets to manage increased costs.

While the additional revenue is required by the Treasury, and planned projects and infrastructure need to be funded, it’s not clear from the minister’s speech that VAT is the correct mechanism to achieve the needed revenue, that those most vulnerable are protected from the downsides of the increase, or that projects and wages funded by the VAT increase will deliver the value required to balance additional pressure placed on consumers.

“The strength of our democracy lies not in avoiding difficult choices, but in making them together… Every rand collected goes directly toward this goal of building a more equitable society,” stated Godongwana.

While the government and the Treasury are able to make the decision, there are no guarantees that a more equitable society is on the horizon. DM.