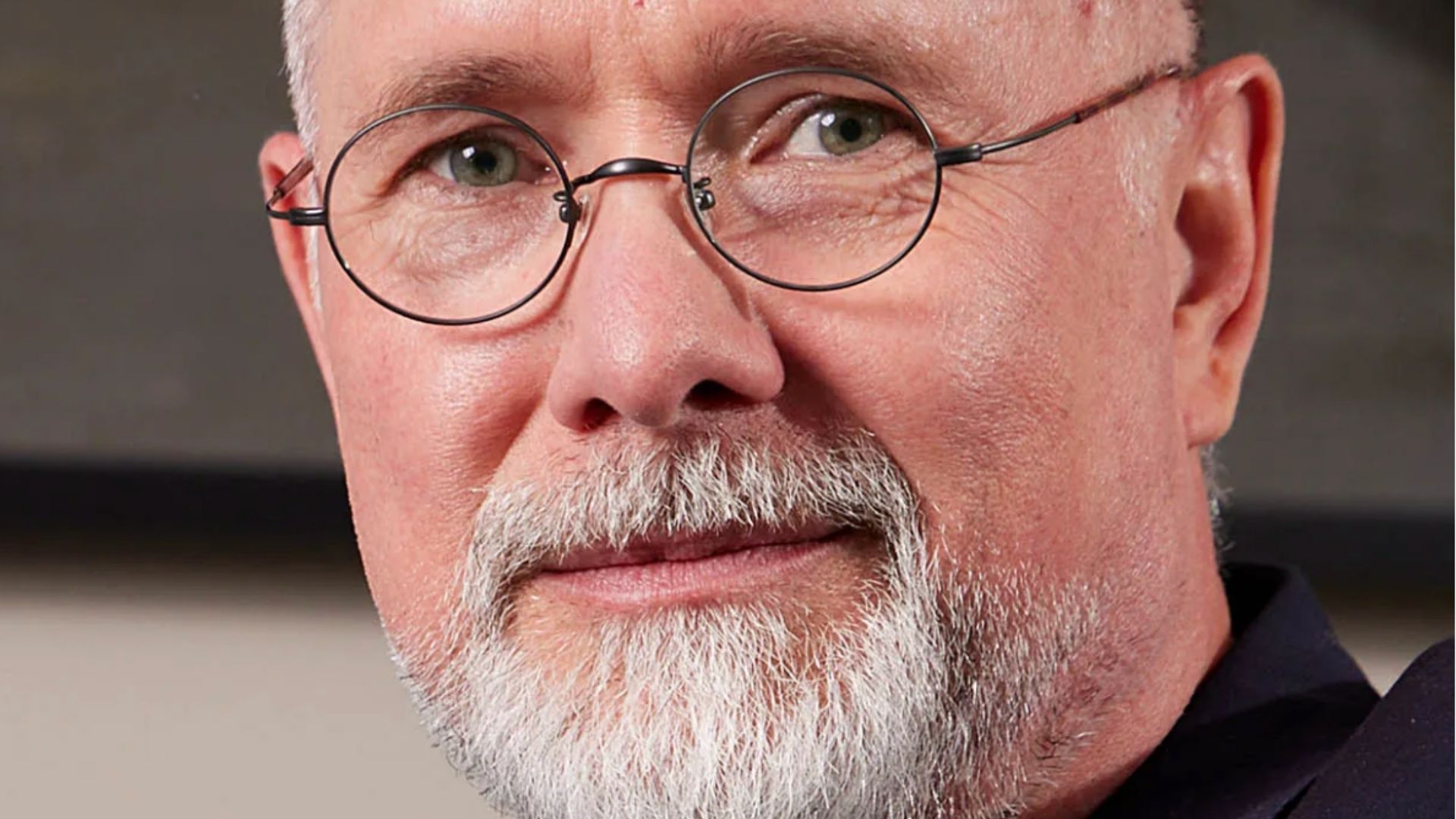

Coen Jonker, chief executive of TymeBank, told Daily Maverick the company is engaged in its fourth capital raise and is looking to raise $125-million, which would push its valuation above $1-billion – unicorn status. A unicorn is typically a high-growth technology startup that attains a valuation north of $1-billion.

About a year ago, the digital banking giant garnered two international investors – Norrsken22 and BlueEarth Capital – as part of its series C capital raise, clinching a total shareholder investment of $77.8-million.

Jonker confirmed there would most likely be another capital raise round in 2026 before the company looked to list in 2028.

TymeBank will list simultaneously on the New York Stock Exchange and the local JSE, with New York as the primary listing and the JSE as a secondary listing. Jonker said the decision to have a primary listing abroad rather than in South Africa was not a reflection on the JSE.

“In the five years since we launched TymeBank, we have seen much more interest in the business from international investors than from South African investors – with the exception of African Rainbow Capital (ARC) and the Ethos AI Fund, which is our second investor.

“Most of our big investors have actually come from international markets. The other thing is, of course, the New York Stock Exchange has the deepest capital markets in the world, so we’ve got a lot of liquidity there,” Jonker explained.

He said Brazil’s Nubank had followed a similar model, launching in Brazil and then expanding to Mexico and Colombia. Nubank hit the 100 million customer mark at the end of May, 11 years after launching and two years after listing on the New York Stock Exchange.

Part of the effect of all the capital raising is that there will inevitably be some dilution of ARC’s stake in TymeBank. When asked if ARC would unbundle TymeBank ahead of the proposed listings, an ARC spokesperson said this was still under deliberation. He confirmed that ARC intended to remain a shareholder in Tymebank and would not exit entirely.

Expansion plans

Looking ahead, TymeBank has already successfully expanded to the Philippines via a joint venture – GoTyme with JG Summit Holdings. GoTyme reached 2.3 million customers in 14 months.

“We want to launch in Vietnam next before launching in Indonesia so that by the time we list, we are in four markets – across Southeast Asia and South Africa,” Jonker said.

The Tyme Group entered the Vietnamese market in 2019 with the acquisition of tech hub, CBA Digital Solutions.

“Our international expansion model is similar to our South African model in that we partner with retailers. So, in the Philippines, we have partnered with the retailer arm of the JG Summit Group, which is Robinsons Retail Holdings, and we will do the same in other markets,” he said.

Jonker told The Asian Banker that the board recently approved TymeBank’s entry into Vietnam, with Indonesia cued for some time before 2025.

TymeBank in South Africa

Coming back to where it all began, Jonker said the aim was to be in the top three banks in the country in terms of return on investment, customer satisfaction and growth.

“We want to be the fastest-growing bank, the best return and the happiest, and most customers,” he told Daily Maverick.

The bank currently has 9.4 million customers, adding between 150,000 and 200,000 a month. DM