The process of passing South Africa’s Budget is beginning anew after the planned increase in value-added tax (VAT) was suspended last week through an order of court.

What happened?

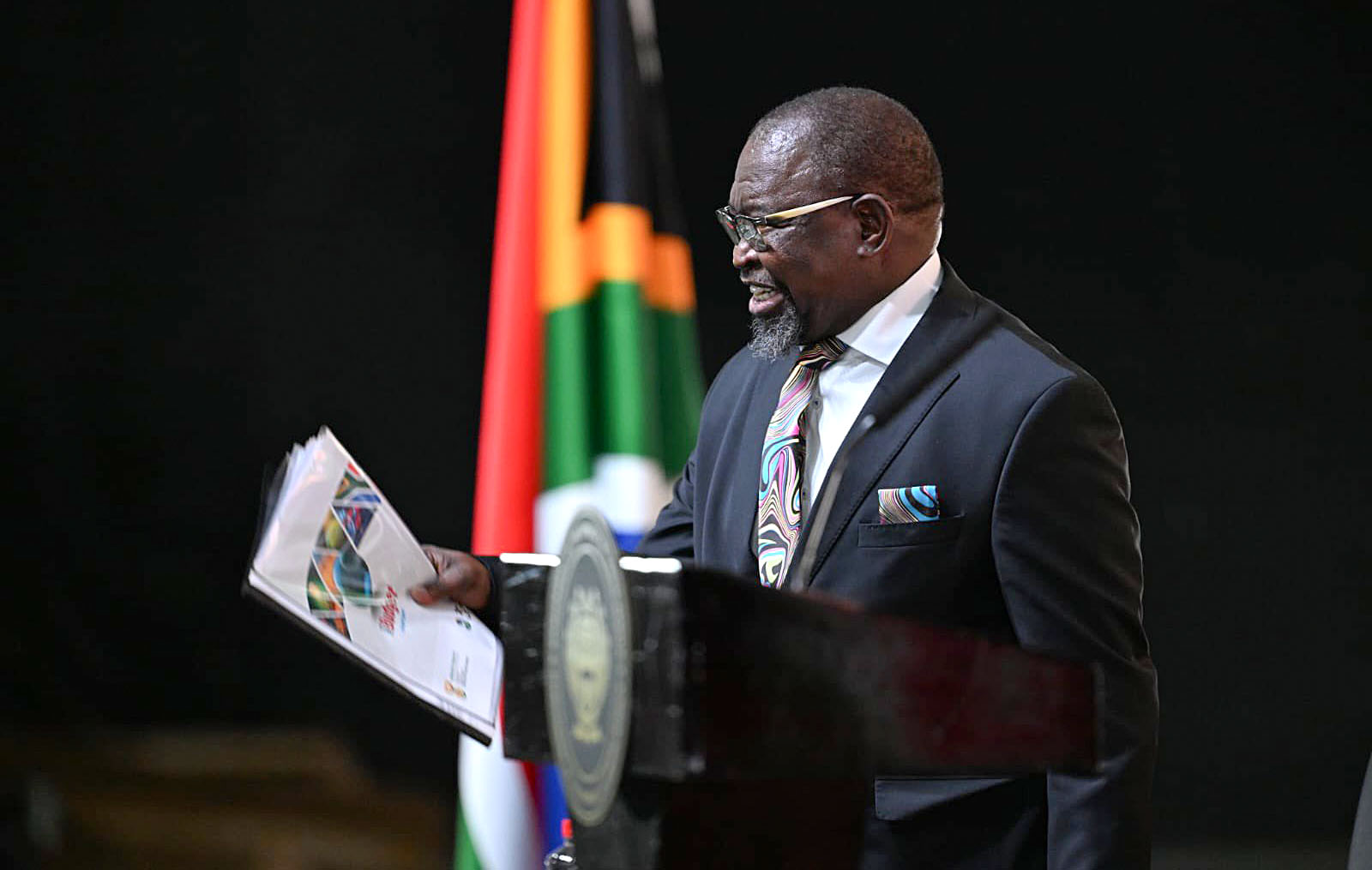

On Sunday, 27 April, the Western Cape Division of the High Court ruled in favour of the DA and the EFF’s application to suspend Finance Minister Enoch Godongwana’s 0.5 percentage point VAT increase, announced in his Budget Speech on 12 March. The contentious VAT increase was due to be implemented on 1 May.

This was after Godongwana withdrew his opposition to the application, saying in an affidavit filed on Sunday morning that he had done so after realising that he had no political support for a VAT increase, and after he received a letter from National Assembly Speaker Thoko Didiza asking him to table alternative revenue proposals by 2 May.

The draft order was made by agreement between the parties, including the DA, the Speaker and the finance minister.

In the order on Sunday evening, Western Cape Judge President Nolwazi Mabindla-Boqwana and judges Kate Savage and Andre le Grange suspended Godongwana’s 12 March announcement adjusting the VAT rate, “pending the passing of legislation regulating the VAT rate” or the final determination of the Part B of the court application, whichever comes first.

Further, the judges ordered that the resolutions of both Houses of Parliament adopted on 2 April, to accept the report of Parliament’s finance committees on the fiscal framework, be set aside.

“This enables the minister of finance to table the national Budget afresh,” said parliamentary spokesperson Moloto Mothapo in a statement on Tuesday.

Why was a court order needed?

The Finance Ministry announced the shock reversal of the VAT increase in a statement issued minutes after midnight on Thursday, 24 April.

But for such a reversal to be “legally effective and enforceable”, Mothapo said it required a legal rescission of the resolution of both Houses taken on 2 April, by either passing a Rates and Money Amounts Bill in Parliament and its assent by the President before 1 May, or through a court order.

“Since the withdrawal of the VAT increase, the Minister tabled the Rates and Monetary Amounts and Amendment of Revenue Laws Bill to give legal effect to the decision to maintain the VAT rate at 15%. However, given the tight legislative timeframes, it was not practically possible for the Bill to be processed by both Houses of Parliament and signed into law before 1 May 2025,” he said.

“In addition, because the matter was already the subject of litigation, a court order became the only available mechanism to make the withdrawal legally enforceable and to remove the uncertainty. The court order thus ensured legal certainty and prevented the previously announced VAT increase from automatically taking effect on 1 May.”

Read more: After the Bell: Decoding the truth after SA’s Budget 2025 Rashomon

Godongwana has also withdrawn the Division of Revenue Bill, which outlines how funds will be divided between the national, provincial and local governments, and the Appropriation Bill, which allocates money to specific priorities like salaries and goods and services, after he had written to Didiza indicating that he would withdraw the Bills.

As there is no Appropriation Bill before Parliament, according to Mothapo, there are no Budget votes currently scheduled.

“A new Appropriation Bill and revised Budget instruments will need to be introduced (through the Budget Speech), after which the Budget votes will be scheduled afresh in accordance with the legislative framework and parliamentary procedures,” he explained.

The Finance Ministry said Godongwana expected to introduce a revised version of the Appropriation Bill and Division of Revenue Bill within the next few weeks.

Does Parliament admit that its processes to pass the fiscal framework were flawed?

No. While Parliament entered into an out-of-court settlement agreement regarding the VAT increase and the process of adopting the fiscal framework, Mothapo said Parliament “did not admit to any procedural defect”.

He said the processes followed by both Houses of Parliament in adopting the framework “strictly complied” with both the Constitution and the Money Bills and Related Matters Act.

Read more: Sars: How to deal with the VAT-on, VAT-off as a business

“Parliament had a strong case before the court. The decision to settle was driven by the recognition that subsequent developments — including the minister’s withdrawal of the Division of Revenue Bill and the Appropriation Bill, and the introduction of a new Bill maintaining the VAT rate at 15% — had overtaken the original framework. This made a negotiated resolution necessary and in the national interest,” said Mothapo.

When will Godongwana table a new Budget?

It’s unclear, but Mothapo said Parliament was “actively engaging with the executive to finalise an appropriate date for the tabling of the revised national Budget.

Read more: VAT debacle shines a light on a fragile coalition – and R75bn question remains

“It is expected that the minister will table the new Budget instruments within the next few weeks,” he said.

In terms of the Money Bills and Related Matters Act, Parliament must consider and adopt the Budget within four months after the start of the financial year. Given that the 2025/26 financial year began on 1 April, Mothapo clarified that the Budget must be finalised before 31 July.

How will the government cover the R75bn shortfall in revenue?

In a statement on Sunday, the National Treasury said the withdrawal of the VAT increase “creates a medium-term revenue shortfall of approximately R75-billion, necessitating decreased government expenditure with likely impacts on service delivery”.

Now that VAT has been scrapped, the National Treasury has to find R75-billion to plug the hole in the kitty over the medium term.

Read more: ‘Only game in town’: Treasury must now slash the fat with no hike for the VAT

Political parties inside and outside the Government of National Unity have made recommendations on how to generate the required revenue.

At a press conference on Friday, the DA said it would be pushing for a review of government spending.

“The DA will now be pushing very hard for the necessary spending review,” DA Federal Council chairperson Helen Zille told reporters.

“We want to cut waste, and we want to cut corrupt and fruitless expenditure, and that is what our spending review seeks to achieve,” she said. DM