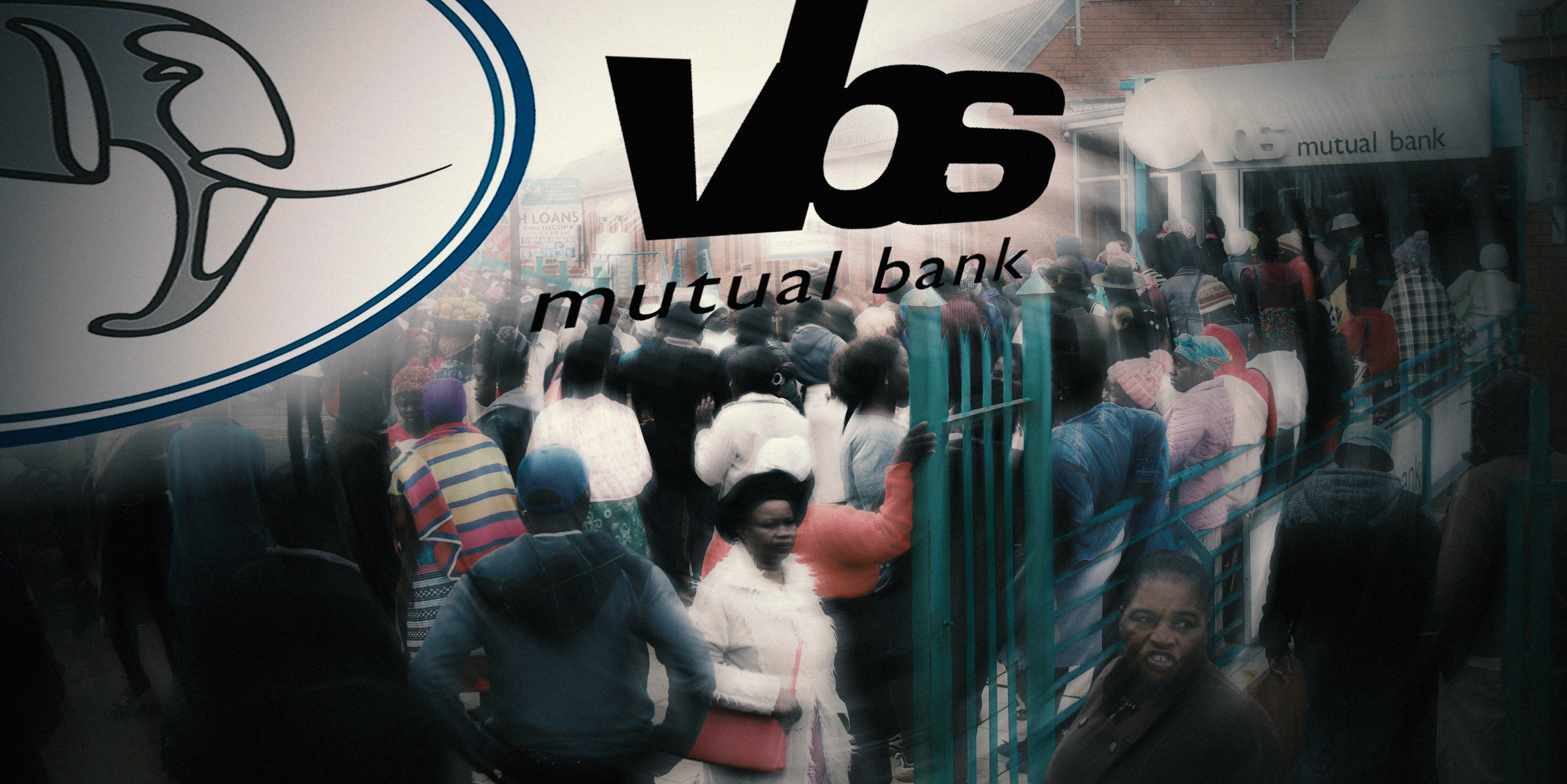

The VBS Mutual Bank liquidation team has so far recovered about 25.6% of depositors and municipalities’ lost money since the bank was stolen into insolvency by its managers, auditors, lawyers and politicians, resulting in its implosion in March 2018.

The average recovery during liquidation processes in South Africa is quite low, often less than 10 cents in the rand, research suggests.

Announcing a second round of dividends to creditors last week, liquidator Anoosh Rooplal said 20 cents in the rand of creditors’ claims will be paid out by the end of January 2025. This is about R458-million, of which R291-million will be paid to 13 municipalities and the balance to businesses, retail depositors and supplier creditors.

Retail depositors include people who had claims of more than R100,000. These were typically people paid out the first R100,000 through the South African Reserve Bank guarantee.

Rooplal was appointed VBS liquidator in November 2018 after his initial probe in his role as curator found the bank was “factually and commercially insolvent and unable to repay its debts against the background of massive frauds and the theft of depositor funds”.

A subsequent investigation by advocate Terry Motau and law firm Werksmans found VBS board chairperson Tshifhiwa Matodzi, treasurer Phophi Mukhodobwane and CFO Philip Truter broke the banking system, kept a second set of books on spreadsheets and allowed the bank to be stolen into insolvency by others while they themselves were on the take. So far, Truter, who is already out on parole after serving three years and six months for corruption, and Matodzi have pleaded guilty. Matodzi is still serving jail time.

Read more: The VBS scandal

The first liquidation dividend of 7c in the rand was paid out in 2022 at a total of about R159-million. About R110-million of the first round of dividends was paid to municipalities.

The second dividend distribution tallies the current payment to VBS creditors to R617-million.

“This is a fantastic outcome given the many challenges the bank faced. When compared to other liquidations, it is not uncommon to have final recoveries of less than 5%. We have left no stone unturned in our recovery efforts and are elated to have distributed approximately R400-million to the municipalities, which is effectively a distribution to the South African taxpayers,” Rooplal said.

He emphasised that the dividend distribution does not affect people who still own open loan accounts with the bank. The liquidation team continues to collect the monthly instalments and has in the past initiated various court cases to recover loans in the event of defaults.

Rooplal said he hopes to recover enough to pay out a third dividend in future. DM

Scorpio

VBS creditors receive 20c in the rand in second dividend payout, liquidator hails ‘fantastic’ recovery rate